Wells Fargo 2012 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

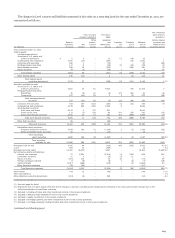

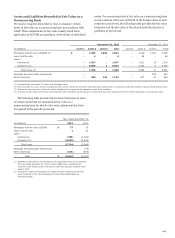

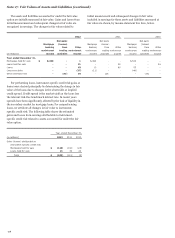

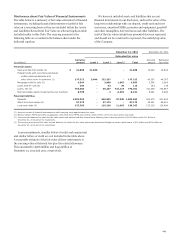

Disclosures about Fair Value of Financial Instruments

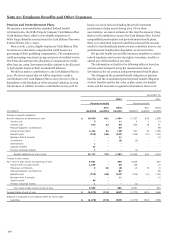

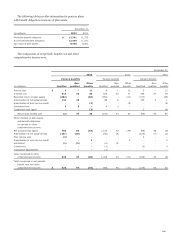

The table below is a summary of fair value estimates for financial

instruments, excluding financial instruments recorded at fair

value on a recurring basis as they are included within the Assets

and Liabilities Recorded at Fair Value on a Recurring Basis table

included earlier in this Note. The carrying amounts in the

following table are recorded in the balance sheet under the

indicated captions.

We have not included assets and liabilities that are not

financial instruments in our disclosure, such as the value of the

long-term relationships with our deposit, credit card and trust

customers, amortized MSRs, premises and equipment, goodwill

and other intangibles, deferred taxes and other liabilities. The

total of the fair value calculations presented does not represent,

and should not be construed to represent, the underlying value

of the Company.

December 31, 2012 December 31, 2011

Estimated fair value

(in millions)

Carrying

amount Level 1 Level 2 Level 3 Total

Carrying

amount

Estimated

fair value

Financial assets

Cash and due from banks (1) $ 21,860 21,860 - - 21,860 19,440 19,440

Federal funds sold, securities purchased

under resale agreements and

other short-term investments (1) 137,313 5,046 132,267 - 137,313 44,367 44,367

Mortgages held for sale (2) 4,844 - 3,808 1,045 4,853 3,566 3,566

Loans held for sale (2) 104 - 83 29 112 162 176

Loans, net (3) 763,968 - 56,237 716,114 772,351 731,308 723,867

Nonmarketable equity investments (cost method) 6,799 - 2 8,229 8,231 8,061 8,490

Financial liabilities

Deposits 1,002,835 - 946,922 57,020 1,003,942 920,070 921,803

Short-term borrowings (1) 57,175 - 57,175 - 57,175 49,091 49,091

Long-term debt (4) 127,366 - 119,220 11,063 130,283 125,238 126,484

(1) Amounts consist of financial instruments in which carrying value approximates fair value.

(2) Balance reflects MHFS and LHFS, as applicable, other than those MHFS and LHFS for which election of the fair value option was made.

(3) Loans exclude balances for which the fair value option was elected and also exclude lease financing with a carrying amount of $12.4 billion and $13.1 billion at

December 31, 2012 and 2011, respectively.

(4) The carrying amount and fair value exclude balances for which the fair value option was elected and obligations under capital leases of $12 million and $116 million at

December 31, 2012 and 2011, respectively.

Loan commitments, standby letters of credit and commercial

and similar letters of credit are not included in the table above.

A reasonable estimate of the fair value of these instruments is

the carrying value of deferred fees plus the related allowance.

This amounted to $586 million and $495 million at

December 31, 2012 and 2011, respectively.

219