Wells Fargo 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.such loans are no longer classified as nonaccrual even though

they may be contractually past due because we expect to fully

collect the new carrying values of such loans (that is, the new

cost basis arising out of purchase accounting).

When we place a loan on nonaccrual status, we reverse the

accrued unpaid interest receivable against interest income and

amortization of any net deferred fees is suspended. If the

ultimate collectability of the recorded loan balance is in doubt on

a nonaccrual loan, the cost recovery method is used and cash

collected is applied to first reduce the carrying value of the loan.

Otherwise, interest income may be recognized to the extent cash

is received. Generally, we return a loan to accrual status when all

delinquent interest and principal become current under the

terms of the loan agreement and collectability of remaining

principal and interest is no longer doubtful.

For modified loans, we re-underwrite at the time of a

restructuring to determine if there is sufficient evidence of

sustained repayment capacity based on the borrower’s financial

strength, including documented income, debt to income ratios

and other factors. If the borrower has demonstrated

performance under the previous terms and the underwriting

process shows the capacity to continue to perform under the

restructured terms, the loan will generally remain in accruing

status. When a loan classified as a TDR performs in accordance

with its modified terms, the loan either continues to accrue

interest (for performing loans) or will return to accrual status

after the borrower demonstrates a sustained period of

performance (generally six consecutive months of payments, or

equivalent, inclusive of consecutive payments made prior to the

modification). Loans will be placed on nonaccrual status and a

corresponding charge-off is recorded if we believe it is probable

that principal and interest contractually due under the modified

terms of the agreement will not be collectible.

Our loans are considered past due when contractually

required principal or interest payments have not been made on

the due dates.

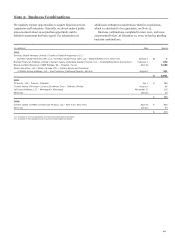

LOAN CHARGE-OFF POLICIES For commercial loans, we

generally fully charge off or charge down to net realizable value

(fair value of collateral, less estimated costs to sell) for loans

secured by collateral when:

x management judges the loan to be uncollectible;

x repayment is deemed to be protracted beyond reasonable

time frames;

x the loan has been classified as a loss by either our internal

loan review process or our banking regulatory agencies;

x the customer has filed bankruptcy and the loss becomes

evident owing to a lack of assets; or

x the loan is 180 days past due unless both well-secured and

in the process of collection.

For consumer loans, we fully charge off or charge down to net

realizable value when deemed uncollectible due to bankruptcy or

other factors, or no later than reaching a defined number of days

past due, as follows:

x 1-4 family first and junior lien mortgages – We generally

charge down to net realizable value when the loan is

180 days past due.

x Auto loans – We generally fully charge off when the loan is

120 days past due.

x Credit card loans – We generally fully charge off when the

loan is 180 days past due.

x Unsecured loans (closed end) – We generally charge off

when the loan is 120 days past due.

x Unsecured loans (open end) – We generally charge off when

the loan is 180 days past due.

x Other secured loans – We generally fully or partially charge

down to net realizable value when the loan is 120 days past

due.

We implemented the guidance in the Office of the Comptroller

of the Currency (OCC) update to Bank Accounting Advisory

Series (OCC guidance) issued in third quarter 2012, which

requires consumer loans discharged in bankruptcy to be written

down to net realizable value and classified as nonaccrual

troubled debt restructurings (TDRs), regardless of their

delinquency status.

IMPAIRED LOANS We consider a loan to be impaired when,

based on current information and events, we determine that we

will not be able to collect all amounts due according to the loan

contract, including scheduled interest payments. This evaluation

is generally based on delinquency information, an assessment of

the borrower’s financial condition and the adequacy of collateral,

if any. Our impaired loans predominantly include loans on

nonaccrual status for commercial and industrial, commercial

real estate (CRE), foreign loans and any loans modified in a

TDR, on both accrual and nonaccrual status.

When we identify a loan as impaired, we measure the

impairment based on the present value of expected future cash

flows, discounted at the loan’s effective interest rate. When

collateral is the sole source of repayment for the loan, we may

measure impairment based on the fair value of the collateral. If

foreclosure is probable, we use the current fair value of the

collateral less estimated selling costs, instead of discounted cash

flows.

If we determine that the value of an impaired loan is less than

the recorded investment in the loan (net of previous charge-offs,

deferred loan fees or costs and unamortized premium or

discount), we recognize impairment. When the value of an

impaired loan is calculated by discounting expected cash flows,

interest income is recognized using the loan’s effective interest

rate over the remaining life of the loan.

TROUBLED DEBT RESTRUCTURINGS (TDRs) In situations

where, for economic or legal reasons related to a borrower’s

financial difficulties, we grant a concession for other than an

insignificant period of time to the borrower that we would not

otherwise consider, the related loan is classified as a TDR. These

modified terms may include rate reductions, principal

forgiveness, term extensions, payment forbearance and other

actions intended to minimize our economic loss and to avoid

foreclosure or repossession of the collateral. For modifications

where we forgive principal, the entire amount of such principal

forgiveness is immediately charged off. Loans classified as TDRs,

133