Wells Fargo 2012 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 18: Preferred Stock

We are authorized to issue 20 million shares of preferred stock

and 4 million shares of preference stock, both without par value.

Preferred shares outstanding rank senior to common shares

both as to dividends and liquidation preference but have no

general voting rights. We have not issued any preference shares

under this authorization. If issued, preference shares would be

limited to one vote per share. Our total issued and outstanding

preferred stock includes Dividend Equalization Preferred (DEP)

shares and Series I, J, K, L, N and O which are presented in the

following two tables, and Employee Stock Ownership Plan

(ESOP) Cumulative Convertible Preferred Stock, which is

presented in the second table below and the table on the

following page.

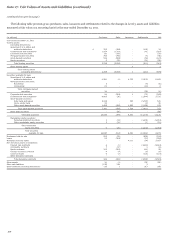

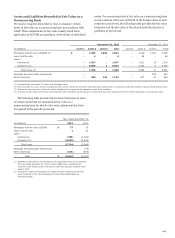

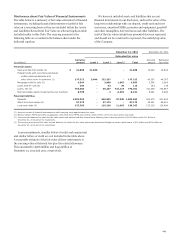

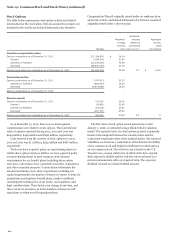

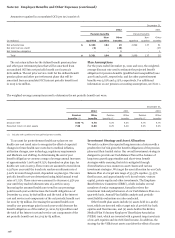

December 31,

2012 2011

Liquidation Shares Liquidation Shares

preference authorized preference authorized

per share and designated per share and designated

DEP Shares

Dividend Equalization Preferred Shares $ 10 97,000 $ 10 97,000

Series G

7.25% Class A Preferred Stock 15,000 50,000 15,000 50,000

Series H

Floating Class A Preferred Stock 20,000 50,000 20,000 50,000

Series I

Floating Class A Preferred Stock 100,000 25,010 100,000 25,010

Series J

8.00% Non-Cumulative Perpetual Class A Preferred Stock 1,000 2,300,000 1,000 2,300,000

Series K

7.98% Fixed-to-Floating Non-Cumulative Perpetual Class A Preferred Stock 1,000 3,500,000 1,000 3,500,000

Series L

7.50% Non-Cumulative Perpetual Convertible Class A Preferred Stock 1,000 4,025,000 1,000 4,025,000

Series N

5.20% Non-Cumulative Perpetual Class A Preferred Stock 25,000 30,000 - -

Series O

5.125% Non-Cumulative Perpetual Class A Preferred Stock 25,000 27,600 - -

Total 10,104,610 10,047,010

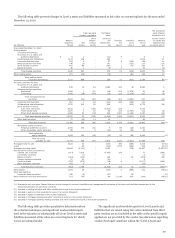

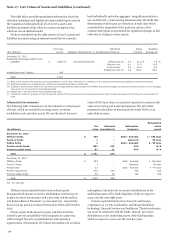

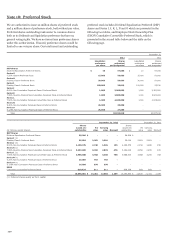

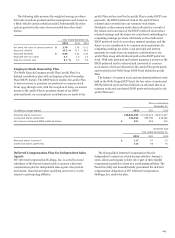

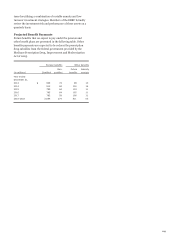

December 31, 2012 December 31, 2011

Shares Shares

issued and Par Carrying issued and Par Carrying

(in millions, except shares) outstanding value value Discount outstanding value value Discount

DEP Shares

Dividend Equalization Preferred Shares 96,546 $ - - - 96,546 $ - - -

Series I (1)

Floating Class A Preferred Stock 25,010 2,501 2,501 - 25,010 2,501 2,501 -

Series J (1)

8.00% Non-Cumulative Perpetual Class A Preferred Stock 2,150,375 2,150 1,995 155 2,150,375 2,150 1,995 155

Series K (1)

7.98% Fixed-to-Floating Non-Cumulative Perpetual Class A Preferred Stock 3,352,000 3,352 2,876 476 3,352,000 3,352 2,876 476

Series L (1)

7.50% Non-Cumulative Perpetual Convertible Class A Preferred Stock 3,968,000 3,968 3,200 768 3,968,000 3,968 3,200 768

Series N (1)

5.20% Non-Cumulative Perpetual Class A Preferred Stock 30,000 750 750 - - - - -

Series O (1)

5.125% Non-Cumulative Per

p

etual Class A Preferred Stock 26,000 650 650 - - - - -

ESOP

Cumulative Convertible Preferred Stock 910,934 911 911 - 858,759 859 859 -

Total 10,558,865 $ 14,282 12,883 1,399 10,450,690 $ 12,830 11,431 1,399

(1) Preferred shares qualify as Tier 1 capital.

220