Wells Fargo 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We manage our credit risk by establishing what we believe

are sound credit policies for underwriting new business, while

monitoring and reviewing the performance of our existing loan

portfolios. We employ various credit risk management and

monitoring activities to mitigate risks associated with multiple

risk factors affecting loans we hold, could acquire or originate

including:

x Loan concentrations and related credit quality

x Counterparty credit risk

x Economic and market conditions

x Legislative or regulatory mandates

x Changes in interest rates

x Merger and acquisition activities

x Reputation risk

Our credit risk management oversight process is governed

centrally, but provides for decentralized management and

accountability by our lines of business. Our overall credit

process includes comprehensive credit policies, disciplined

credit underwriting, frequent and detailed risk measurement

and modeling, extensive credit training programs, and a

continual loan review and audit process.

A key to our credit risk management is adherence to a well

controlled underwriting process, which we believe is

appropriate for the needs of our customers as well as investors

who purchase the loans or securities collateralized by the loans.

Non-Strategic and Liquidating Loan Portfolios

We

continually evaluate and modify our credit policies to address

appropriate levels of risk. We may designate certain portfolios

and loan products as non-strategic or liquidating to cease their

continued origination as we actively work to limit losses and

reduce our exposures.

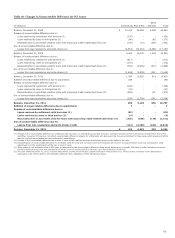

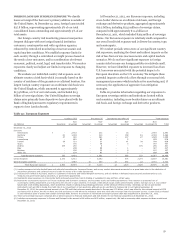

Table 17 identifies our non-strategic and liquidating loan

portfolios. They consist primarily of the Pick-a-Pay mortgage

portfolio and PCI loans acquired from Wachovia, certain

portfolios from legacy Wells Fargo Home Equity and Wells

Fargo Financial, and our education finance government

guaranteed loan portfolio. The total balance of our non-

strategic and liquidating loan portfolios has decreased 50%

since the merger with Wachovia at December 31, 2008, and

decreased 16% from the end of 2011.

The home equity portfolio of loans generated through third

party channels is designated as liquidating. Additional

information regarding this portfolio, as well as the liquidating

PCI and Pick-a-Pay loan portfolios, is provided in the

discussion of loan portfolios that follows.

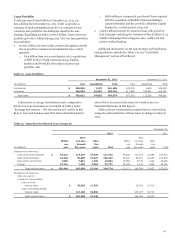

Table 17: Non-Strategic and Liquidating Loan Portfolios

Outstanding balance

December 31,

(in millions) 2012 2011 2010 2009 2008

Commercial:

Legacy Wachovia commercial and industrial, CRE and foreign PCI loans (1) $ 3,170 5,695 7,935 12,988 18,704

Total commercial 3,170 5,695 7,935 12,988 18,704

Consumer:

Pick-a-Pay mortgage (1) 58,274 65,652 74,815 85,238 95,315

Liquidating home equity 4,647 5,710 6,904 8,429 10,309

Legacy Wells Fargo Financial indirect auto 830 2,455 6,002 11,253 18,221

Legacy Wells Fargo Financial debt consolidation 14,519 16,542 19,020 22,364 25,299

Education Finance - government guaranteed 12,465 15,376 17,510 21,150 20,465

Legacy Wachovia other PCI loans (1) 657 896 1,118 1,688 2,478

Total consumer 91,392 106,631 125,369 150,122 172,087

Total non-strategic and liquidating loan portfolios $ 94,562 112,326 133,304 163,110 190,791

(1) Net of purchase accounting adjustments related to PCI loans.

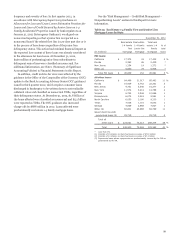

PURCHASED CREDIT-IMPAIRED (PCI) LOANS Loans acquired

with evidence of credit deterioration since their origination and

where it is probable that we will not collect all contractually

required principal and interest payments are PCI loans. PCI

loans are recorded at fair value at the date of acquisition, and the

historical allowance for credit losses related to these loans is not

carried over. Such loans are considered to be accruing due to the

existence of the accretable yield and not based on consideration

given to contractual interest payments. Substantially all of our

PCI loans were acquired in the Wachovia acquisition on

December 31, 2008.

A nonaccretable difference is established for PCI loans to

absorb losses expected on those loans at the date of acquisition.

Amounts absorbed by the nonaccretable difference do not affect

the income statement or the allowance for credit losses.

Substantially all commercial and industrial, CRE and foreign

PCI loans are accounted for as individual loans. Conversely,

Pick-a-Pay and other consumer PCI loans have been aggregated

into pools based on common risk characteristics. Each pool is

accounted for as a single asset with a single composite interest

rate and an aggregate expectation of cash flows.

Resolutions of loans may include sales to third parties,

receipt of payments in settlement with the borrower, or

foreclosure of the collateral. Our policy is to remove an

individual PCI loan from a pool based on comparing the amount

received from its resolution with its contractual amount. Any

51