Wells Fargo 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

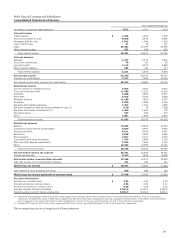

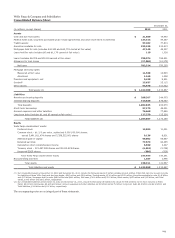

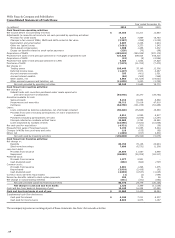

Wells Fargo & Company and Subsidiaries

Consolidated Balance Sheet

December 31,

(in millions, except shares) 2012 2011

Assets

Cash and due from banks $ 21,860 19,440

Federal funds sold, securities purchased under resale agreements and other short-term investments 137,313 44,367

Trading assets 57,482 77,814

Securities available for sale 235,199 222,613

Mortgages held for sale (includes $42,305 and $44,791 carried at fair value) 47,149 48,357

Loans held for sale (includes $6 and $1,176 carried at fair value) 110 1,338

Loans (includes $6,206 and $5,916 carried at fair value) 799,574 769,631

Allowance for loan losses (17,060) (19,372)

Net loans 782,514 750,259

Mortgage servicing rights:

Measured at fair value 11,538 12,603

Amortized 1,160 1,408

Premises and equipment, net 9,428 9,531

Goodwill 25,637 25,115

Other assets 93,578 101,022

Total assets (1) $ 1,422,968 1,313,867

Liabilities

Noninterest-bearing deposits $ 288,207 244,003

Interest-bearing deposits 714,628 676,067

Total deposits 1,002,835 920,070

Short-term borrowings 57,175 49,091

Accrued expenses and other liabilities 76,668 77,665

Long-term debt (includes $1 and $0 carried at fair value) 127,379 125,354

Total liabilities (2) 1,264,057 1,172,180

Equity

Wells Fargo stockholders' equity:

Preferred stock 12,883 11,431

Common stock – $1-2/3 par value, authorized 9,000,000,000 shares;

issued 5,481,811,474 shares and 5,358,522,061 shares 9,136 8,931

Additional paid-in capital 59,802 55,957

Retained earnings 77,679 64,385

Cumulative other comprehensive income 5,650 3,207

Treasury stock – 215,497,298 shares and 95,910,425 shares (6,610) (2,744)

Unearned ESOP shares (986) (926)

Total Wells Fargo stockholders' equity 157,554 140,241

Noncontrolling interests 1,357 1,446

Total equity 158,911 141,687

Total liabilities and equity $ 1,422,968 1,313,867

(1) Our consolidated assets at December 31, 2012 and December 31, 2011, include the following assets of certain variable interest entities (VIEs) that can only be used to settle

the liabilities of those VIEs: Cash and due from banks, $260 million and $321 million; Trading assets, $114 million and $293 million; Securities available for sale, $2.8 billion

and $3.3 billion; Mortgages held for sale, $469 million and $444 million; Net loans, $10.6 billion and $12.0 billion; Other assets, $457 million and $1.9 billion, and Total

assets, $14.6 billion and $18.2 billion, respectively.

(2) Our consolidated liabilities at December 31, 2012 and December 31, 2011, include the following VIE liabilities for which the VIE creditors do not have recourse to Wells

Fargo: Short-term borrowings, $0 and $24 million; Accrued expenses and other liabilities, $134 million and $175 million; Long-term debt, $3.5 billion and $4.9 billion; and

Total liabilities, $3.6 billion and $5.1 billion, respectively.

The accompanying notes are an integral part of these statements.

123