Wells Fargo 2012 Annual Report Download - page 227

Download and view the complete annual report

Please find page 227 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

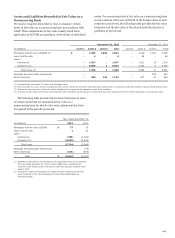

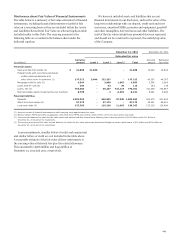

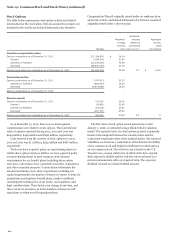

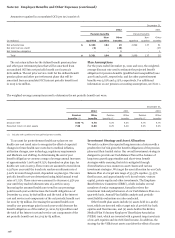

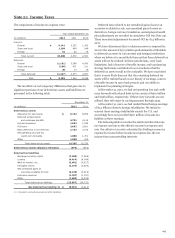

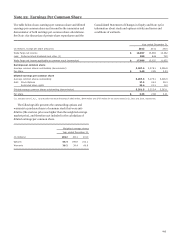

The following table presents the weighted-average per share

fair value of options granted and the assumptions used, based on

a Black-Scholes option valuation model. Substantially all of the

options granted in the years shown resulted from the reload

feature.

Year ended December 31,

2012 2011 2010

Per share fair value of options granted $ 2.79 3.78 6.11

Expected volatility 29.2 % 32.7 44.3

Expected dividends $ 0.68 0.32 0.20

Expected term (in years) 0.7 1.0 1.3

Risk-free interest rate 0.1 % 0.2 0.6

Employee Stock Ownership Plan

The Wells Fargo & Company 401(k) Plan (401(k) Plan) is a

defined contribution plan with an Employee Stock Ownership

Plan (ESOP) feature. The ESOP feature enables the 401(k) Plan

to borrow money to purchase our preferred or common stock.

From 1994 through 2012, with the exception of 2009, we loaned

money to the 401(k) Plan to purchase shares of our ESOP

preferred stock. As our employer contributions are made to the

401(k) Plan and are used by the 401(k) Plan to make ESOP loan

payments, the ESOP preferred stock in the 401(k) Plan is

released and converted into our common stock shares.

Dividends on the common stock shares allocated as a result of

the release and conversion of the ESOP preferred stock reduce

retained earnings and the shares are considered outstanding for

computing earnings per share. Dividends on the unallocated

ESOP preferred stock do not reduce retained earnings, and the

shares are not considered to be common stock equivalents for

computing earnings per share. Loan principal and interest

payments are made from our employer contributions to the

401(k) Plan, along with dividends paid on the ESOP preferred

stock. With each principal and interest payment, a portion of the

ESOP preferred stock is released and converted to common

stock shares, which are allocated to the 401(k) Plan participants

and invested in the Wells Fargo ESOP Fund within the 401(k)

Plan.

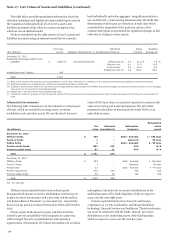

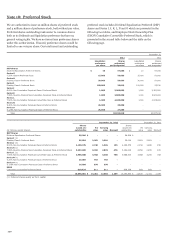

The balance of common stock and unreleased preferred stock

held in the Wells Fargo ESOP Fund, the fair value of unreleased

ESOP preferred stock and the dividends on allocated shares of

common stock and unreleased ESOP preferred stock paid to the

401(k) Plan were:

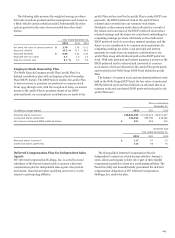

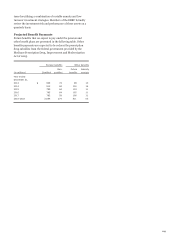

Shares outstanding

December 31,

(in millions, except shares) 2012 2011 2010

Allocated shares (common) 136,821,035 131,046,406 118,901,327

Unreleased shares (preferred) 910,934 858,759 618,382

Fair value of unreleased ESOP preferred shares $ 911 859 618

Dividends paid

Year ended December 31,

2012 2011 2010

Allocated shares (common) $ 117 60 23

Unreleased shares (preferred) 115 95 76

Deferred Compensation Plan for Independent Sales

Agents

WF Deferred Compensation Holdings, Inc. is a wholly-owned

subsidiary of the Parent formed solely to sponsor a deferred

compensation plan for independent sales agents who provide

investment, financial and other qualifying services for or with

respect to participating affiliates.

The Nonqualified Deferred Compensation Plan for

Independent Contractors, which became effective January 1,

2002, allows participants to defer all or part of their eligible

compensation payable to them by a participating affiliate. The

Parent has fully and unconditionally guaranteed the deferred

compensation obligations of WF Deferred Compensation

Holdings, Inc. under the plan.

225