Wells Fargo 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

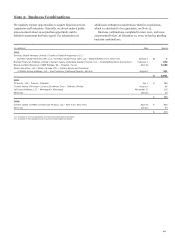

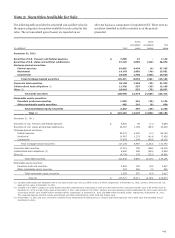

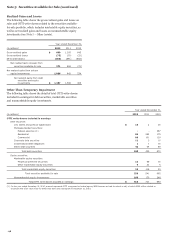

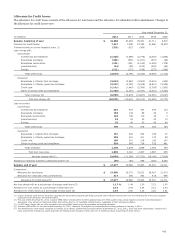

Note 5: Securities Available for Sale

The following table provides the amortized cost and fair value for

the major categories of securities available for sale carried at fair

value. The net unrealized gains (losses) are reported on an

after-tax basis as a component of cumulative OCI. There were no

securities classified as held to maturity as of the periods

presented.

Gross Gross

unrealized unrealized Fair

(in millions) Cost gains losses value

December 31, 2012

Securities of U.S. Treasury and federal agencies $ 7,099 47 - 7,146

Securities of U.S. states and political subdivisions 37,120 2,000 (444) 38,676

Mortgage-backed securities:

Federal agencies 92,855 4,434 (4) 97,285

Residential 14,178 1,802 (49) 15,931

Commercial 18,438 1,798 (268) 19,968

Total mortgage-backed securities 125,471 8,034 (321) 133,184

Corporate debt securities 20,120 1,282 (69) 21,333

Collateralized debt obligations (1) 12,726 557 (95) 13,188

Other (2) 18,410 553 (76) 18,887

Total debt securities 220,946 12,473 (1,005) 232,414

Marketable equity securities:

Perpetual preferred securities 1,935 281 (40) 2,176

Other marketable equity securities 402 216 (9) 609

Total marketable equity securities 2,337 497 (49) 2,785

Total (3) $ 223,283 12,970 (1,054) 235,199

December 31, 2011

Securities of U.S. Treasury and federal agencies $ 6,920 59 (11) 6,968

Securities of U.S. states and political subdivisions 32,307 1,169 (883) 32,593

Mortgage-backed securities:

Federal agencies 92,279 4,485 (10) 96,754

Residential 16,997 1,253 (414) 17,836

Commercial 17,829 1,249 (928) 18,150

Total mortgage-backed securities 127,105 6,987 (1,352) 132,740

Corporate debt securities 17,921 769 (286) 18,404

Collateralized debt obligations (1) 8,650 298 (349) 8,599

Other (2) 19,739 378 (225) 19,892

Total debt securities 212,642 9,660 (3,106) 219,196

Marketable equity securities:

Perpetual preferred securities 2,396 185 (54) 2,527

Other marketable equity securities 533 366 (9) 890

Total marketable equity securities 2,929 551 (63) 3,417

Total (3) $ 215,571 10,211 (3,169) 222,613

(1) Includes collateralized loan obligations with a cost basis and fair value of $12.2 billion and $12.5 billion, respectively, at December 31, 2012, and $8.1 billion for both cost

basis and fair value, at December 31, 2011.

(2) Included in the “Other” category are asset-backed securities collateralized by auto leases or loans and cash reserves with a cost basis and fair value of $5.9 billion each at

December 31, 2012, and $6.7 billion each at December 31, 2011. Also included in the "Other" category are asset-backed securities collateralized by home equity loans with

a cost basis and fair value of $695 million and $918 million, respectively, at December 31, 2012, and $846 million and $932 million, respectively, at December 31, 2011.

The remaining balances primarily include asset-backed securities collateralized by credit cards and student loans.

(3) At December 31, 2012 and 2011, we held no securities of any single issuer (excluding the U.S. Treasury and federal agencies) with a book value that exceeded 10% of

stockholders’ equity.

143