Wells Fargo 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

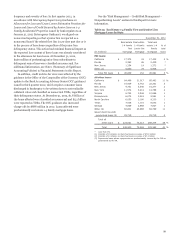

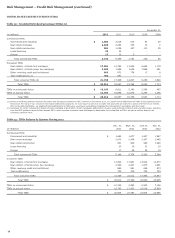

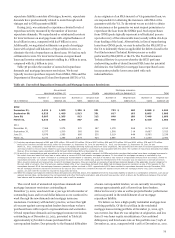

Table 32 and Table 33 provide information regarding the

recorded investment of loans modified in TDRs. The allowance

for loan losses for TDRs was $5.0 billion and $5.2 billion at

December 31, 2012 and 2011, respectively. See Note 6 (Loans

and Allowance for Credit Losses) to Financial Statements in this

Report for additional information regarding TDRs. In those

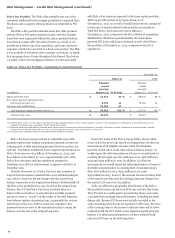

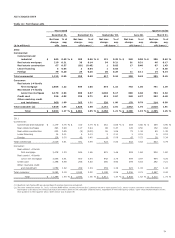

situations where principal is forgiven, the entire amount of such

principal forgiveness is immediately charged off to the extent not

done so prior to the modification. We sometimes delay the

timing on the repayment of a portion of principal (principal

forbearance) and charge off the amount of forbearance if that

amount is not considered fully collectible.

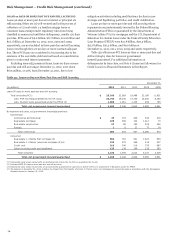

Our nonaccrual policies are generally the same for all loan

types when a restructuring is involved. We re-underwrite loans

at the time of restructuring to determine whether there is

sufficient evidence of sustained repayment capacity based on the

borrower’s documented income, debt to income ratios, and other

factors. Loans lacking sufficient evidence of sustained repayment

capacity at the time of modification are charged down to the fair

value of the collateral, if applicable. For an accruing loan that

has been modified, if the borrower has demonstrated

performance under the previous terms and the underwriting

process shows the capacity to continue to perform under the

restructured terms, the loan will generally remain in accruing

status. Otherwise, the loan will be placed in nonaccrual status

until the borrower demonstrates a sustained period of

performance, generally six consecutive months of payments, or

equivalent, inclusive of consecutive payments made prior to

modification. Loans will also be placed on nonaccrual, and a

corresponding charge-off is recorded to the loan balance, if we

believe that principal and interest contractually due under the

modified agreement will not be collectible.

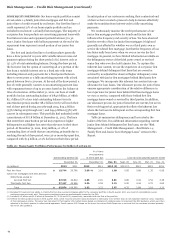

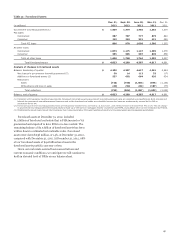

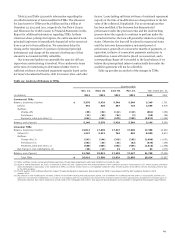

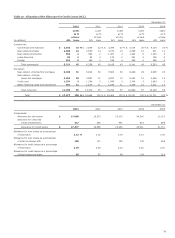

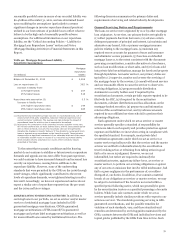

Table 34 provides an analysis of the changes in TDRs.

Table 34: Analysis of Changes in TDRs

Quarter ended

Dec. 31, Sept. 30, June 30, Mar. 31, Year ended Dec. 31,

(in millions) 2012 2012 2012 2012 2012 2011

Commercial TDRs

Balance, beginning of period $ 5,378 5,429 5,548 5,349 5,349 1,751

Inflows 542 620 687 710 2,559 5,379

Outflows

Charge-offs (66) (84) (112) (119) (381) (252)

Foreclosure (14) (20) (24) (2) (60) (64)

Payments, sales and other (1) (694) (567) (670) (390) (2,321) (1,465)

Balance, end of period 5,146 5,378 5,429 5,548 5,146 5,349

Consumer TDRs

Balance, beginning of period 22,012 17,495 17,447 17,308 17,308 14,929

Inflows (2) 1,247 5,212 762 829 8,050 5,673

Outflows

Charge-offs (3) (542) (244) (319) (295) (1,400) (1,091)

Foreclosure (3) (333) (35) (25) (33) (426) (144)

Payments, sales and other (1) (588) (404) (392) (434) (1,818) (1,788)

Net change in trial modifications (4) (28) (12) 22 72 54 (271)

Balance, end of period 21,768 22,012 17,495 17,447 21,768 17,308

Total TDRs $ 26,914 27,390 22,924 22,995 26,914 22,657

(1) Other outflows include normal amortization/accretion of loan basis adjustments and loans transferred to held-for-sale.

(2) Quarter ended September 30, 2012, includes $4.3 billion of loans, resulting from the implementation of OCC guidance issued in third quarter 2012, which requires consumer

loans discharged in bankruptcy to be classified as TDRs, as well as written down to net realizable collateral value. Fourth quarter 2012 inflows remain elevated primarily due

to the OCC guidance.

(3) Fourth quarter 2012 outflows reflect the impact of loans discharged in bankruptcy being reported as TDRs in accordance with the OCC guidance starting in third

quarter 2012.

(4) Net change in trial modifications includes: inflows of new TDRs entering the trial payment period, net of outflows for modifications that either (i) successfully perform and

enter into a permanent modification, or (ii) did not successfully perform according to the terms of the trial period plan and are subsequently charged-off, foreclosed upon or

otherwise resolved. Our recent experience is that most of the mortgages that enter a trial payment period program are successful in completing the program requirements.

69