Wells Fargo 2012 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

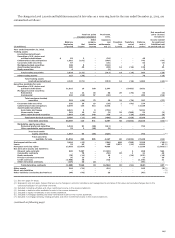

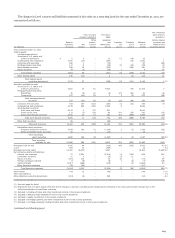

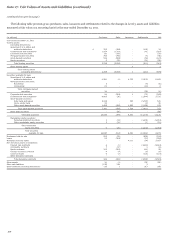

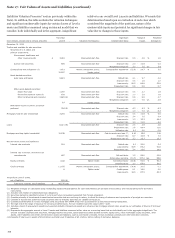

Note 17: Fair Values of Assets and Liabilities (continued)

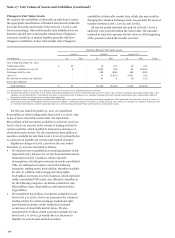

Changes in Fair Value Levels

We monitor the availability of observable market data to assess

the appropriate classification of financial instruments within the

fair value hierarchy and transfer between Level 1, Level 2, and

Level 3 accordingly. Observable market data includes but is not

limited to quoted prices and market transactions. Changes in

economic conditions or market liquidity generally will drive

changes in availability of observable market data. Changes in

availability of observable market data, which also may result in

changing the valuation technique used, are generally the cause of

transfers between Level 1, Level 2, and Level 3.

All current period transfers into and out of Level 1, Level 2,

and Level 3 are provided within the below table. The amounts

reported as transfers represent the fair value as of the beginning

of the quarter in which the transfer occurred.

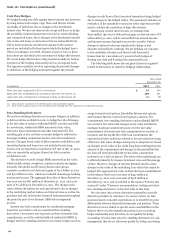

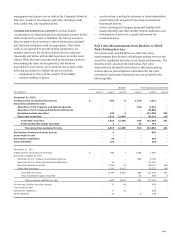

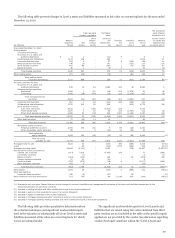

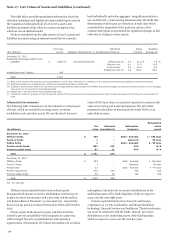

Transfers Between Fair Value Levels

Level 1 Level 2 Level 3 (1)

(in millions) In Out In Out In Out Total

Year ended December 31, 2012

Trading securities $ 23 - 16 (37) 14 (16) -

Securities available for sale (2) 8 - 9,832 (68) 60 (9,832) -

Mortgages held for sale - - 298 (488) 488 (298) -

Loans (3) - - 41 (5,851) 5,851 (41) -

Net derivative assets and liabilities - - 51 8 (8) (51) -

Short sale liabilities - - - - - - -

Total transfers $ 31 - 10,238 (6,436) 6,405 (10,238) -

(1) All transfers in and out of Level 3 are disclosed within the recurring level 3 rollforward table in this Note.

(2) Includes $9.4 billion of securities of U.S. states and political subdivisions that we transferred from Level 3 to Level 2 as a result of increased observable market data in the

valuation of such instruments. This transfer was done in conjunction with a change in our valuation technique from an internal model based upon unobservable inputs to

third party vendor pricing based upon market observable data.

(3) Consists of reverse mortgage loans securitized with GNMA which were accounted for as secured borrowing transactions. We transferred the loans from Level 2 to Level 3 in

third quarter 2012 due to decreased market activity and visibility to significant trades of the same or similar products. As a result, we changed our valuation technique from

an internal model based on market observable data to an internal discounted cash flow model based on unobservable inputs.

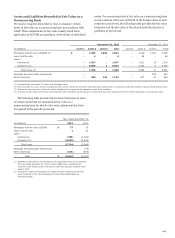

For the year ended December 31, 2011, we transferred

$709 million of other trading assets from Level 2 to Level 1 due

to use of more observable market data. We transferred

$801 million of debt securities available for sale from Level 3 to

Level 2 due to an increase in the volume of trading activity for

certain securities, which resulted in increased occurrences of

observable market prices. We also transferred $502 million of

securities available for sale from Level 2 to Level 3 primarily due

to a decrease in liquidity for certain asset-backed securities.

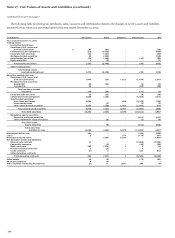

Significant changes to Level 3 assets for the year ended

December 31, 2010 are described as follows:

x We adopted new consolidation accounting guidance which

impacted Level 3 balances for certain financial instruments.

Reductions in Level 3 balances, which represent

derecognition of existing investments in newly consolidated

VIEs, are reflected as transfers out for the following

categories: trading assets, $276 million; securities available

for sale, $1.9 billion; and mortgage servicing rights,

$118 million. Increases in Level 3 balances, which represent

newly consolidated VIE assets, are reflected as transfers in

for the following categories: securities available for sale,

$829 million; loans, $366 million; and long-term debt,

$359 million.

x We transferred $4.9 billion of securities available for sale

from Level 3 to Level 2 due to an increase in the volume of

trading activity for certain mortgage-backed and other

asset-backed securities, which resulted in increased

occurrences of observable market prices. We also

transferred $1.7 billion of debt securities available for sale

from Level 2 to Level 3, primarily due to a decrease in

liquidity for certain asset-backed securities.

206