Wells Fargo 2012 Annual Report Download - page 247

Download and view the complete annual report

Please find page 247 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

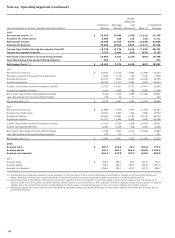

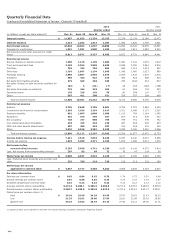

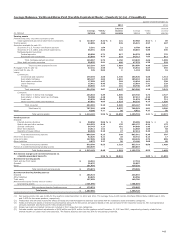

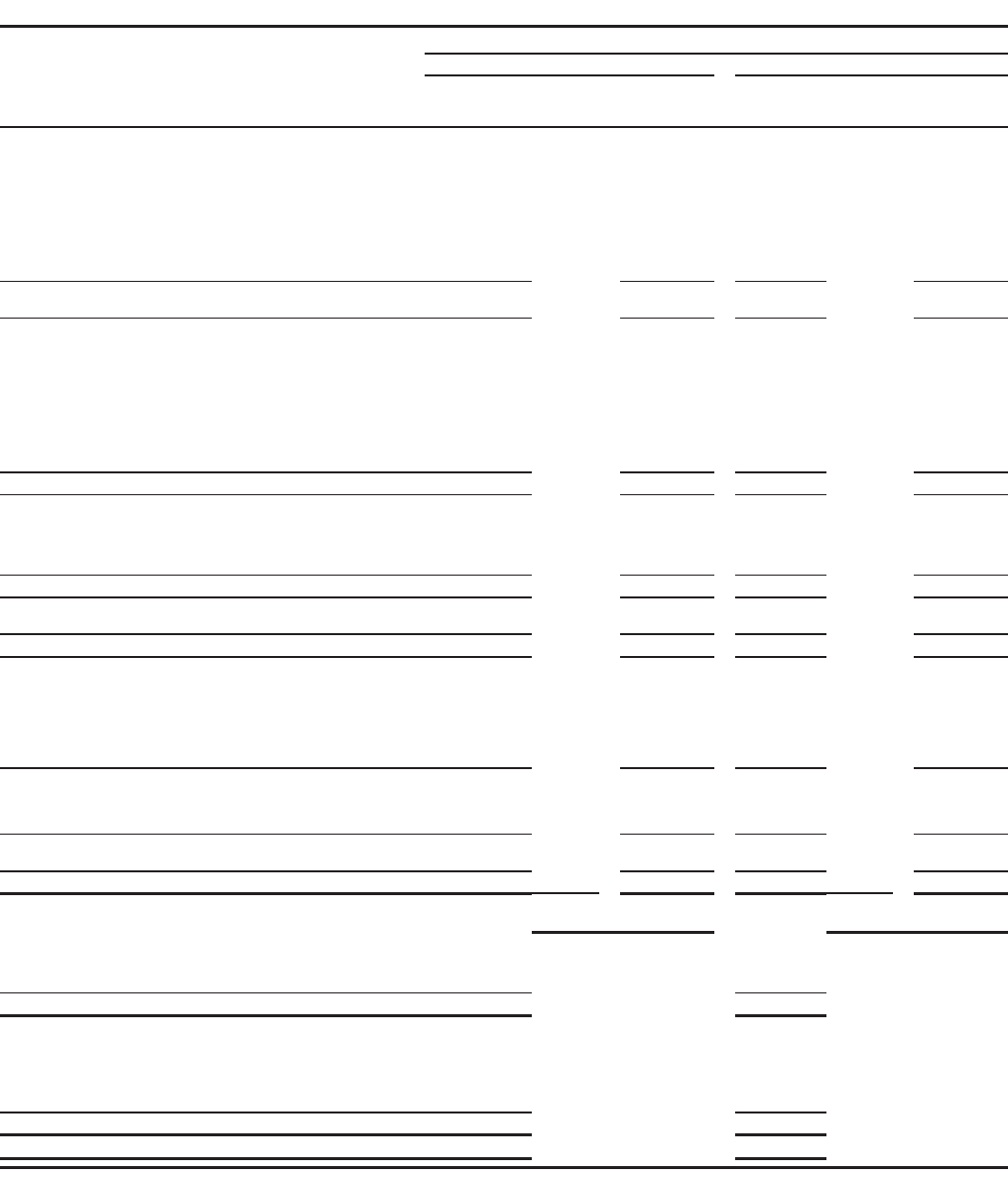

Average Balances, Yields and Rates Paid (Taxable-Equivalent Basis) - Quarterly (1) (2) - (Unaudited)

Quarter ended December 31,

2012 2011

Interest Interest

Average Yields/ income/ Average Yields/ income/

(in millions) balance rates expense balance rates expense

Earning assets

Federal funds sold, securities purchased under

resale agreements and other short-term investments $ 117,047 0.41 % $ 121 67,968 0.52 % $ 89

Trading assets 42,005 3.28 345 45,521 3.57 407

Securities available for sale (3):

Securities of U.S. Treasury and federal agencies 5,281 1.64 22 8,708 0.99 22

Securities of U.S. states and political subdivisions 36,391 4.64 422 28,015 4.80 336

Mortgage-backed securities:

Federal agencies 90,898 2.71 617 84,332 3.68 776

Residential and commercial 32,669 6.53 533 34,717 7.05 612

Total mortgage-backed securities 123,567 3.72 1,150 119,049 4.66 1,388

Other debt and equity securities 50,025 3.91 490 47,278 4.38 518

Total securities available for sale 215,264 3.87 2,084 203,050 4.46 2,264

Mortgages held for sale (4) 47,241 3.50 413 44,842 4.07 456

Loans held for sale (4) 135 9.03 3 1,118 5.84 16

Loans:

Commercial:

Commercial and industrial 179,493 3.85 1,736 166,920 4.08 1,713

Real estate mortgage 105,107 4.02 1,061 105,219 4.26 1,130

Real estate construction 17,502 4.97 218 19,624 4.61 228

Lease financing 12,461 6.43 201 12,893 7.41 239

Foreign 39,665 2.32 231 38,740 2.39 233

Total commercial 354,228 3.87 3,447 343,396 4.10 3,543

Consumer:

Real estate 1-4 family first mortgage 244,634 4.39 2,686 229,746 4.74 2,727

Real estate 1-4 family junior lien mortgage 76,908 4.28 826 87,212 4.34 953

Credit card 23,839 12.43 745 21,933 12.96 711

Other revolving credit and installment 87,601 6.05 1,333 86,276 6.23 1,356

Total consumer 432,982 5.15 5,590 425,167 5.39 5,747

Total loans (4) 787,210 4.58 9,037 768,563 4.81 9,290

Other 4,280 5.21 56 4,671 4.32 50

Total earning assets $ 1,213,182 3.96 % $ 12,059 1,135,733 4.41 % $ 12,572

Funding sources

Deposits:

Interest-bearing checking $ 30,858 0.06 % $ 5 35,285 0.06 % $ 6

Market rate and other savings 518,593 0.10 135 485,127 0.14 175

Savings certificates 56,743 1.27 181 64,868 1.43 233

Other time deposits 13,612 1.51 51 12,868 1.85 60

Deposits in foreign offices 69,398 0.15 27 67,213 0.20 33

Total interest-bearing deposits 689,204 0.23 399 665,361 0.30 507

Short-term borrowings 52,820 0.21 28 48,742 0.14 17

Long-term debt 127,505 2.30 735 129,445 2.73 885

Other liabilities 9,975 2.27 56 12,166 2.60 80

Total interest-bearing liabilities 879,504 0.55 1,218 855,714 0.69 1,489

Portion of noninterest-bearing funding sources 333,678 - - 280,019 - -

Total funding sources $ 1,213,182 0.40 1,218 1,135,733 0.52 1,489

Net interest margin and net interest income on

a taxable-equivalent basis (5) 3.56 % $ 10,841 3.89 % $ 11,083

Noninterest-earning assets

Cash and due from banks $ 16,361 17,718

Goodwill 25,637 25,057

Other 131,876 128,220

Total noninterest-earning assets $ 173,874 170,995

Noninterest-bearing funding sources

Deposits $ 286,924 246,692

Other liabilities 63,025 63,556

Total equity 157,603 140,766

Noninterest-bearing funding sources used to

fund earning assets (333,678) (280,019)

Net noninterest-bearing funding sources $ 173,874 170,995

Total assets $ 1,387,056 1,306,728

(1) Our average prime rate was 3.25% for the quarters ended December 31, 2012 and 2011. The average three-month London Interbank Offered Rate (LIBOR) was 0.32%

and 0.48% for the same quarters, respectively.

(2) Yields/rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(3) Yields and rates are based on interest income/expense amounts for the period, annualized based on the accrual basis for the respective accounts. The average balance

amounts represent amortized cost for the periods presented.

(4) Nonaccrual loans and related income are included in their respective loan categories.

(5) Includes taxable-equivalent adjustments of $198 million and $191 million for the quarters ended December 31, 2012 and 2011, respectively primarily related to tax-

exempt income on certain loans and securities. The federal statutory tax rate was 35% for the periods presented.

245