Wells Fargo 2012 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

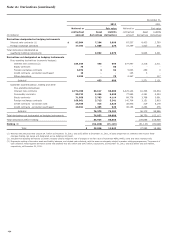

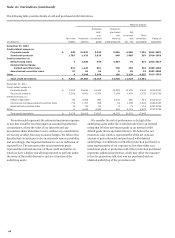

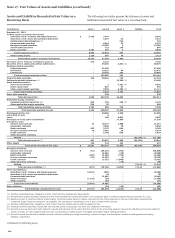

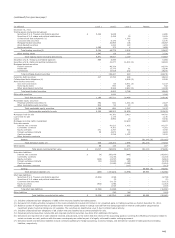

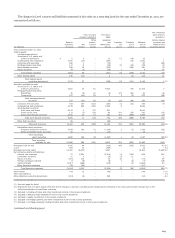

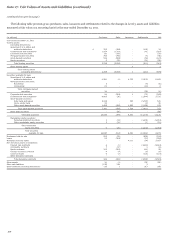

Note 17: Fair Values of Assets and Liabilities

We use fair value measurements to record fair value adjustments

to certain assets and liabilities and to determine fair value

disclosures. Trading assets (excluding derivatives), securities

available for sale, derivatives, substantially all residential MHFS,

certain commercial LHFS, certain loans held for investment, fair

value MSRs and securities sold but not yet purchased (short sale

liabilities) are recorded at fair value on a recurring basis.

Additionally, from time to time, we may be required to record at

fair value other assets on a nonrecurring basis, such as certain

residential and commercial MHFS, certain LHFS, loans held for

investment and certain other assets. These nonrecurring fair

value adjustments typically involve application of lower-of-cost-

or-market accounting or write-downs of individual assets.

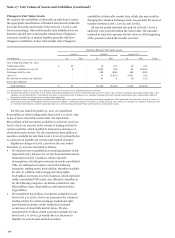

Following are descriptions of the valuation methodologies

used for assets and liabilities recorded at fair value on a

recurring or nonrecurring basis and for estimating fair value for

financial instruments not recorded at fair value.

Assets

SHORT-TERM FINANCIAL ASSETS

Short-term financial assets

include cash and due from banks, federal funds sold and

securities purchased under resale agreements and due from

customers on acceptances. These assets are carried at historical

cost. The carrying amount is a reasonable estimate of fair value

because of the relatively short time between the origination of

the instrument and its expected realization.

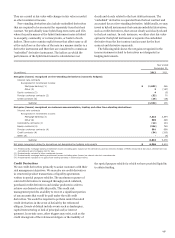

TRADING ASSETS (EXCLUDING DERIVATIVES) AND

SECURITIES AVAILABLE FOR SALE Trading assets and

securities available for sale are recorded at fair value on a

recurring basis. Fair value measurement is based upon various

sources of market pricing. We use quoted prices in active

markets, where available and classify such instruments within

Level 1 of the fair value hierarchy. Examples include exchange-

traded equity securities and some highly liquid government

securities such as U.S. Treasuries. When instruments are traded

in secondary markets and quoted market prices do not exist for

such securities, we generally rely on internal valuation

techniques or on prices obtained from third-party pricing

services or brokers (collectively, vendors) or combination

thereof, and accordingly, we classify these instruments as Level 2

or 3.

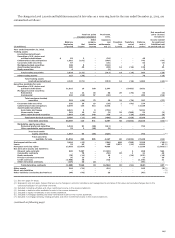

Trading securities are mostly valued using internal trader

prices that are subject to price verification procedures performed

by separate internal personnel. The majority of fair values

derived using internal valuation techniques are verified against

multiple pricing sources, including prices obtained from third-

party vendors. Vendors compile prices from various sources and

often apply matrix pricing for similar securities when no price is

observable. We review pricing methodologies provided by the

vendors in order to determine if observable market information

is being used, versus unobservable inputs. When evaluating the

appropriateness of an internal trader price compared with

vendor prices, considerations include the range and quality of

vendor prices. Vendor prices are used to ensure the

reasonableness of a trader price; however valuing financial

instruments involves judgments acquired from knowledge of a

particular market. If a trader asserts that a vendor price is not

reflective of market value, justification for using the trader price,

including recent sales activity where possible, must be provided

to and approved by the appropriate levels of management.

Similarly, while securities available for sale traded in

secondary markets are typically valued using unadjusted vendor

prices or vendor prices adjusted by weighting them with internal

discounted cash flow techniques, these prices are reviewed and,

if deemed inappropriate by a trader who has the most knowledge

of a particular market, can be adjusted. Securities measured with

these internal valuation techniques are generally classified as

Level 2 of the hierarchy and often involve using quoted market

prices for similar securities, pricing models, discounted cash

flow analyses using significant inputs observable in the market

where available or combination of multiple valuation techniques.

Examples include certain residential and commercial MBS,

municipal bonds, U.S. government and agency MBS, and

corporate debt securities.

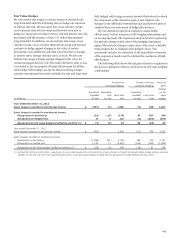

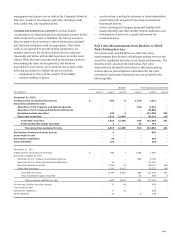

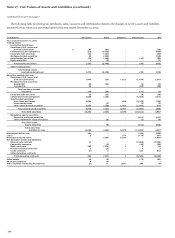

Security fair value measurements using significant inputs

that are unobservable in the market due to limited activity or a

less liquid market are classified as Level 3 in the fair value

hierarchy. Such measurements include securities valued using

internal models or a combination of multiple valuation

techniques such as weighting of internal models and vendor or

broker pricing, where the unobservable inputs are significant to

the overall fair value measurement. Securities classified as Level

3 include certain residential and commercial MBS, asset-backed

securities collateralized by auto leases or loans and cash

reserves, CDOs and CLOs, and certain residual and retained

interests in residential mortgage loan securitizations. We value

CDOs using the prices of similar instruments, the pricing of

completed or pending third party transactions or the pricing of

the underlying collateral within the CDO. Where vendor or

broker prices are not readily available, we use management's

best estimate.

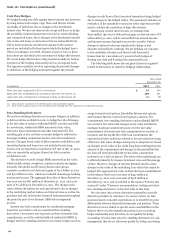

MORTGAGES HELD FOR SALE (MHFS) We carry substantially all

of our residential MHFS portfolio at fair value. Fair value is

based on quoted market prices, where available, or the prices for

other mortgage whole loans with similar characteristics. As

necessary, these prices are adjusted for typical securitization

activities, including servicing value, portfolio composition,

market conditions and liquidity. Most of our MHFS are classified

as Level 2. For the portion where market pricing data is not

available, we use a discounted cash flow model to estimate fair

value and, accordingly, classify as Level 3.

LOANS HELD FOR SALE (LHFS) LHFS are carried at the lower of

cost or market value, or at fair value. The fair value of LHFS is

based on what secondary markets are currently offering for loans

with similar characteristics. As such, we classify those loans

subjected to nonrecurring fair value adjustments as Level 2.

LOANS For information on how we report the carrying value of

loans, including PCI loans, see Note 1. Although most loans are

200