Wells Fargo 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

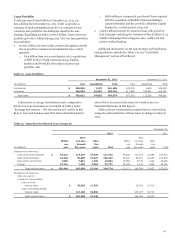

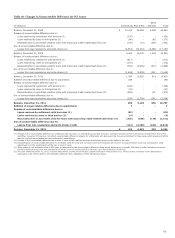

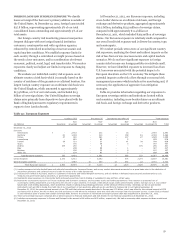

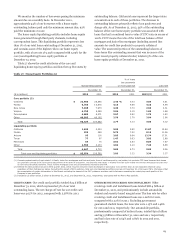

Table 20: Commercial and Industrial Loans and Lease

Financing by Industry

December 31, 2012

% of

Nonaccrual Total total

(in millions) loans portfolio (1) loans

PCI loans (1):

Healthcare $ - 48 * %

Technology - 39 *

Aerospace and defense - 37 *

Home furnishings - 23 *

Steel and metal products - 22 *

Leisure - 17 *

Other - 73 (2) *

Total PCI loans $ - 259 * %

All other loans:

Oil and gas $ 36 13,634 2 %

Investors 2 13,570 2

Cyclical retailers 30 12,459 2

Financial institutions 76 12,228 2

Food and beverage 42 11,804 1

Healthcare 39 10,044 1

Industrial equipment 50 9,941 1

Real estate lessor 32 9,370

1

Technology 20 6,767

*

Transportation 12 6,597

*

Business services 30 5,754

*

Securities firms 65 5,534

*

Other 1,015 82,222 (3) 10

Total all other loans $ 1,449 199,924 25 %

Total $ 1,449 200,183 25 %

* Less than 1%.

(1) For PCI loans, amounts represent carrying value. PCI loans are considered to be

accruing due to the existence of the accretable yield and not based on

consideration given to contractual interest payments.

(2) No other single category had loans in excess of $11.4 million.

(3) No other single category had loans in excess of $4.7 billion.

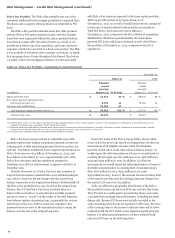

During the current credit cycle, we have experienced an

increase in loans requiring risk mitigation activities including

the restructuring of loan terms and requests for extensions of

commercial and industrial and CRE loans. All actions are based

on a re-underwriting of the loan and our assessment of the

borrower’s ability to perform under the agreed-upon terms.

Extension terms generally range from six to thirty-six months

and may require that the borrower provide additional economic

support in the form of partial repayment, or additional collateral

or guarantees. In cases where the value of collateral or financial

condition of the borrower is insufficient to repay our loan, we

may rely upon the support of an outside repayment guarantee in

providing the extension.

Our ability to seek performance under a guarantee is directly

related to the guarantor’s creditworthiness, capacity and

willingness to perform, which is evaluated on an annual basis, or

more frequently as warranted. Our evaluation is based on the

most current financial information available and is focused on

various key financial metrics, including net worth, leverage, and

current and future liquidity. We consider the guarantor’s

reputation, creditworthiness, and willingness to work with us

based on our analysis as well as other lenders’ experience with

the guarantor. Our assessment of the guarantor’s credit strength

is reflected in our loan risk ratings for such loans. The loan risk

rating and accruing status are important factors in our allowance

methodology for commercial and industrial and CRE loans.

In considering the accrual status of the loan, we evaluate the

collateral and future cash flows as well as the anticipated support

of any repayment guarantor. In many cases the strength of the

guarantor provides sufficient assurance that full repayment of

the loan is expected. When full and timely collection of the loan

becomes uncertain, including the performance of the guarantor,

we place the loan on nonaccrual status. As appropriate, we also

charge the loan down in accordance with our charge-off policies,

generally to the net realizable value of the collateral securing the

loan, if any.

At the time of restructuring, we evaluate whether the loan

should be classified as a TDR, and account for it accordingly. For

more information on TDRs, see “Troubled Debt Restructurings”

later in this section and Note 6 (Loans and Allowance for Credit

Losses) to Financial Statements in this Report.

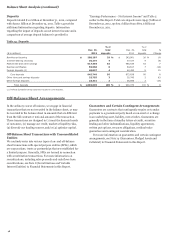

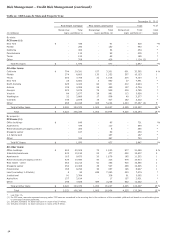

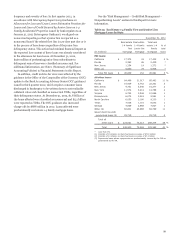

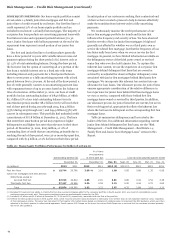

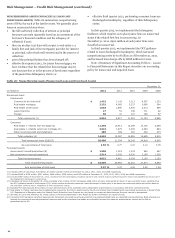

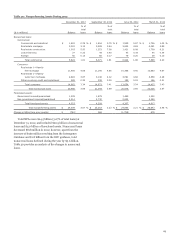

COMMERCIAL REAL ESTATE (CRE) The CRE portfolio, consisting

of both CRE mortgage loans and CRE construction loans, totaled

$123.2 billion, or 15%, of total loans at December 31, 2012. CRE

construction loans totaled $16.9 billion and CRE mortgage loans

totaled $106.3 billion at December 31, 2012. Table 21

summarizes CRE loans by state and property type with the

related nonaccrual totals. CRE nonaccrual loans totaled 4% of

the non-PCI CRE outstanding balance at December 31, 2012

compared with 5% at December 31, 2011. The portfolio is

diversified both geographically and by property type. The largest

geographic concentrations of combined CRE loans are in

California and Florida, which represented 27% and 9% of the

total CRE portfolio, respectively. By property type, the largest

concentrations are office buildings at 26% and

industrial/warehouse at 10% of the portfolio. At

December 31, 2012, we had $17.2 billion of criticized non-PCI

CRE mortgage loans, a decrease of 24% from December 31, 2011,

and $3.8 billion of criticized non-PCI CRE construction loans, a

decrease of 44% from December 31, 2011. See Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report for additional information on criticized loans.

At December 31, 2012, the recorded investment in PCI CRE

loans totaled $2.8 billion, down from $12.3 billion when

acquired at December 31, 2008, reflecting the reduction

resulting from principal payments, loan resolutions and write-

downs.

55