Wells Fargo 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

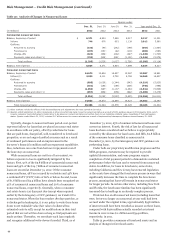

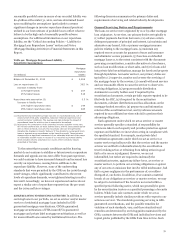

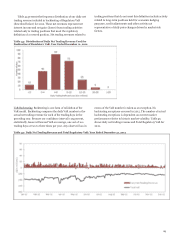

repurchase liability considers all vintages, however, repurchase

demands have predominantly related to 2006 through 2008

vintages and to GSE-guaranteed MBS.

During 2012, we continued to experience elevated levels of

repurchase activity measured by the number of investor

repurchase demands. We repurchased or reimbursed investors

for incurred losses on mortgage loans with original balances of

$2.5 billion in 2012, compared with $2.8 billion in 2011.

Additionally, we negotiated settlements on pools of mortgage

loans with original sold balances of $341 million in 2011, to

eliminate the risk of repurchase on these loans. We had no such

settlements in 2012. We incurred net losses on repurchased

loans and investor reimbursements totalling $1.1 billion in 2012,

compared with $1.2 billion in 2011.

Table 38 provides the number of unresolved repurchase

demands and mortgage insurance rescissions. We do not

typically receive repurchase requests from GNMA, FHA and the

Department of Housing and Urban Development (HUD) or VA.

As an originator of an FHA-insured or VA-guaranteed loan, we

are responsible for obtaining the insurance with FHA or the

guarantee with the VA. To the extent we are not able to obtain

the insurance or the guarantee we must request permission to

repurchase the loan from the GNMA pool. Such repurchases

from GNMA pools typically represent a self-initiated process

upon discovery of the uninsurable loan (usually within 180 days

from funding of the loan). Alternatively, in lieu of repurchasing

loans from GNMA pools, we may be asked by the FHA/HUD or

the VA to indemnify them (as applicable) for defects found in the

Post Endorsement Technical Review process or audits

performed by FHA/HUD or the VA. The Post Endorsement

Technical Review is a process whereby the HUD performs

underwriting audits of closed/insured FHA loans for potential

deficiencies. Our liability for mortgage loan repurchase losses

incorporates probable losses associated with such

indemnification.

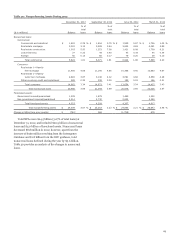

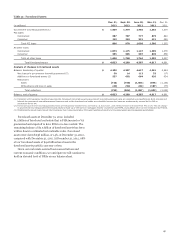

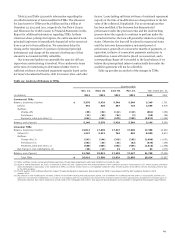

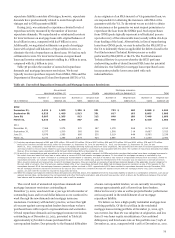

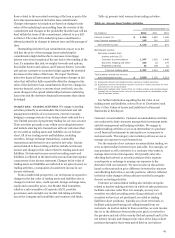

Table 38: Unresolved Repurchase Demands and Mortgage Insurance Rescissions

Government Mortgage insurance

sponsored entities (1) Private rescissions with no demand (2) Total

Number o

f

Original loan Number o

f

Original loan Number o

f

Original loan Number o

f

Original loan

($ in millions) loans balance (3) loans balance (3) loans balance (3) loans balance (3)

2012

December 31, 6,621 $ 1,503 1,306 $ 281 753 $ 160 8,680 $ 1,944

September 30, 6,525 1,489 1,513 331 817 183 8,855 2,003

June 30, 5,687 1,265 913 213 840 188 7,440 1,666

March 31, 6,333 1,398 857 241 970 217 8,160 1,856

2011

December 31, 7,066 1,575 470 167 1,178 268 8,714 2,010

September 30, 6,577 1,500 582 208 1,508 314 8,667 2,022

June 30, 6,876 1,565 695 230 2,019 444 9,590 2,239

March 31, 6,210 1,395 1,973 424 2,885 674 11,068 2,493

(1) Includes repurchase demands of 661 and $132 million, 534 and $111 million, 526 and $103 million, 694 and $131 million, 861 and $161 million, 878 and $173 million,

892 and $179 million and 685 and $132 million for December 31, September 30, June 30 and March 31, 2012, and December 31, September 30, June 30 and

March 31, 2011, respectively, received from investors on mortgage servicing rights acquired from other originators. We generally have the right of recourse against the seller

and may be able to recover losses related to such repurchase demands subject to counterparty risk associated with the seller. The number of repurchase demands from GSEs

that are from mortgage loans originated in 2006 through 2008 totaled 81% at December 31, 2012.

(2) As part of our representations and warranties in our loan sales contracts, we typically represent to GSEs and private investors that certain loans have mortgage insurance to

the extent there are loans that have loan to value ratios in excess of 80% that require mortgage insurance. To the extent the mortgage insurance is rescinded by the

mortgage insurer due to a claim of breach of a contractual representation or warranty, the lack of insurance may result in a repurchase demand from an investor. Similar to

repurchase demands, we evaluate mortgage insurance rescission notices for validity and appeal for reinstatement if the rescission was not based on a contractual breach.

When investor demands are received due to lack of mortgage insurance, they are reported as unresolved repurchase demands based on the applicable investor category for

the loan (GSE or private). Over the last year, approximately 20% of our repurchase demands from GSEs had mortgage insurance rescission as one of the reasons for the

repurchase demand. Of all the mortgage insurance rescission notices received in 2011, approximately 80% have resulted in repurchase demands through December 2012.

Not all mortgage insurance rescissions received as far back as 2011 have been completed through the appeals process with the mortgage insurer and, upon successful

appeal, we work with the investor to rescind the repurchase demand.

(3) While the original loan balances related to these demands are presented above, the establishment of the repurchase liability is based on a combination of factors, such as our

appeals success rates, reimbursement by correspondent and other third party originators, and projected loss severity, which is driven by the difference between the current

loan balance and the estimated collateral value less costs to sell the property.

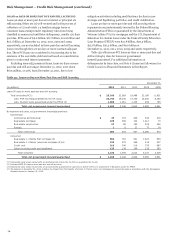

The overall level of unresolved repurchase demands and

mortgage insurance rescissions outstanding at

December 31, 2012, was down from a year ago in both number of

outstanding loans and in total dollar balances as we continued to

work through the new demands and mortgage insurance

rescissions. Customary with industry practice, we have the right

of recourse against correspondent lenders from whom we have

purchased loans with respect to representations and warranties.

Of total repurchase demands and mortgage insurance recissions

outstanding as of December 31, 2012, presented in Table 38,

approximately 25% relate to loans purchased from

correspondent lenders. Due primarily to the financial difficulties

of some correspondent lenders, we are currently recovering on

average approximately 45% of losses from these lenders.

Historical recovery rates as well as projected lender performance

are incorporated in the establishment of our mortgage

repurchase liability.

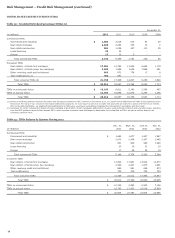

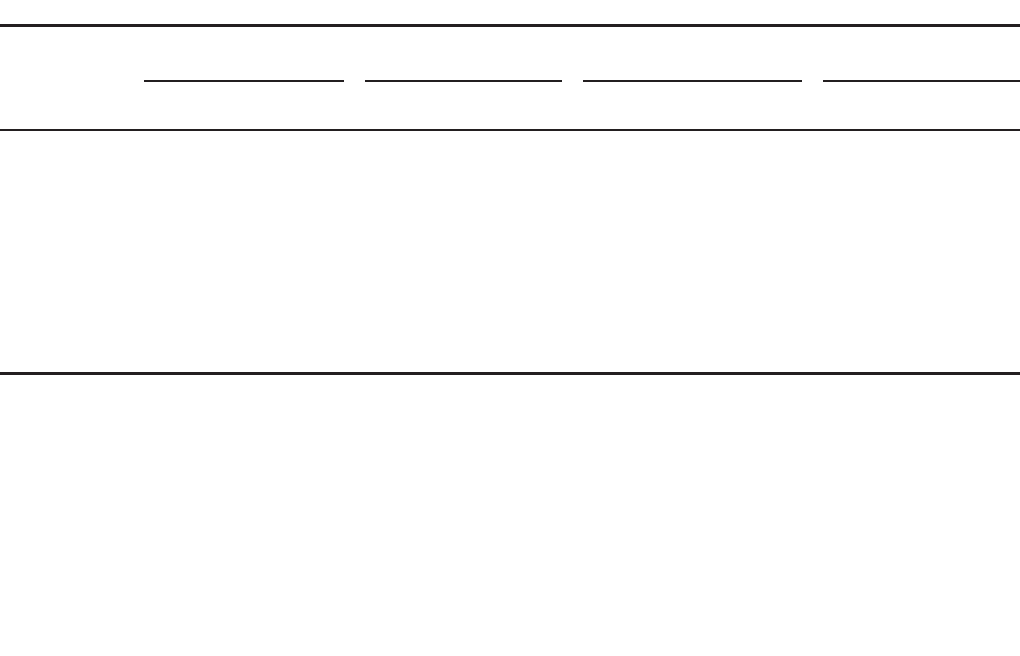

We believe we have a high quality residential mortgage loan

servicing portfolio. Of the $1.9 trillion in the residential

mortgage loan servicing portfolio at December 31, 2012, 93%

was current, less than 2% was subprime at origination, and less

than 1% was home equity securitizations. Our combined

delinquency and foreclosure rate on this portfolio was 7.04% at

December 31, 2012, compared with 7.96% at December 31, 2011.

75