Wells Fargo 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

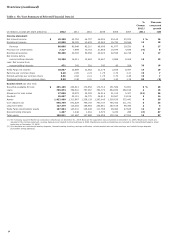

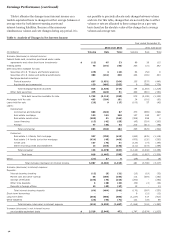

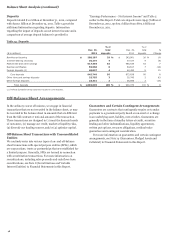

Earnings Performance (continued)

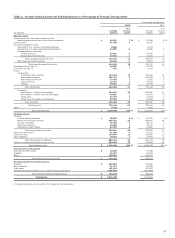

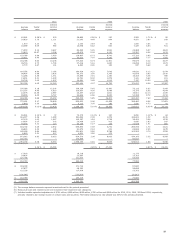

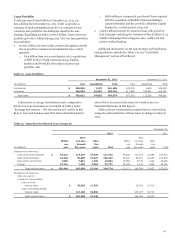

Table 5: Average Balances, Yields and Rates Paid (Taxable-Equivalent Basis) (1)(2)(3)

2012 2011

Interest Interest

Average Yields/ income/ Average Yields

/

income/

(in millions) balance rates expense balance rates expense

Earning assets

Federal funds sold, securities purchased under

resale agreements and other short-term investments $ 84,081 0.45 % $ 378 87,186 0.40 % $ 345

Trading assets (4) 41,950 3.29 1,380 39,737 3.68 1,463

Securities available for sale (5):

Securities of U.S. Treasury and federal agencies 3,604 1.31 47 5,503 1.25 69

Securities of U.S. states and political subdivisions 34,875 4.48 1,561 24,035 5.09 1,223

Mortgage-backed securities:

Federal agencies 92,887 3.12 2,893 74,665 4.36 3,257

Residential and commercial 33,545 6.75 2,264 31,902 8.20 2,617

Total mortgage-backed securities 126,432 4.08 5,157 106,567 5.51 5,874

Other debt and equity securities 49,245 4.04 1,992 38,625 5.03 1,941

Total securities available for sale 214,156 4.09 8,757 174,730 5.21 9,107

Mortgages held for sale (6) 48,955 3.73 1,825 37,232 4.42 1,644

Loans held for sale (6) 661 6.22 41 1,104 5.25 58

Loans:

Commercial:

Commercial and industrial 173,913 4.01 6,981 157,608 4.37 6,894

Real estate mortgage 105,437 4.18 4,411 102,236 4.07 4,163

Real estate construction 17,963 4.98 894 21,592 4.88 1,055

Lease financing 12,771 7.22 921 12,944 7.54 976

Foreign 39,852 2.47 984 36,768 2.56 941

Total commercial 349,936 4.06 14,191 331,148 4.24 14,029

Consumer:

Real estate 1-4 family first mortgage 234,619 4.55 10,671 226,980 4.89 11,090

Real estate 1-4 family junior lien mortgage 80,840 4.28 3,457 90,705 4.33 3,926

Credit card 22,772 12.67 2,885 21,463 13.02 2,794

Other revolving credit and installment 87,057 6.10 5,313 86,848 6.29 5,463

Total consumer 425,288 5.25 22,326 425,996 5.46 23,273

Total loans (6) 775,224 4.71 36,517 757,144 4.93 37,302

Other 4,438 4.70 209 4,929 4.12 203

Total earning assets $ 1,169,465 4.20 % $ 49,107 1,102,062 4.55 % $ 50,122

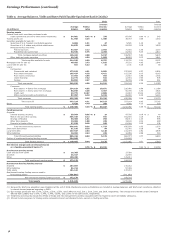

Funding sources

Deposits:

Interest-bearing checking $ 30,564 0.06 % $ 19 47,705 0.08 % $ 40

Market rate and other savings 505,310 0.12 592 464,450 0.18 836

Savings certificates 59,484 1.31 782 69,711 1.43 995

Other time deposits 13,363 1.68 225 13,126 2.04 268

Deposits in foreign offices 67,920 0.16 109 61,566 0.22 136

Total interest-bearing deposits 676,641 0.26 1,727 656,558 0.35 2,275

Short-term borrowings 51,196 0.18 94 51,781 0.18 94

Long-term debt 127,547 2.44 3,110 141,079 2.82 3,978

Other liabilities 10,032 2.44 245 10,955 2.88 316

Total interest-bearing liabilities 865,416 0.60 5,176 860,373 0.77 6,663

Portion of noninterest-bearing funding sources 304,049 - - 241,689 - -

Total funding sources $ 1,169,465 0.44 5,176 1,102,062 0.61 6,663

Net interest margin and net interest income

on a taxable-equivalent basis (7) 3.76 % $ 43,931 3.94 % $ 43,459

Noninterest-earning assets

Cash and due from banks $ 16,303 17,388

Goodwill 25,417 24,904

Other 130,450 125,911

Total noninterest-earning assets $ 172,170 168,203

Noninterest-bearing funding sources

Deposits $ 263,863 215,242

Other liabilities 61,214 57,399

Total equity 151,142 137,251

Noninterest-bearing funding sources used to

fund earning assets (304,049) (241,689)

Net noninterest-bearing funding sources $ 172,170 168,203

Total assets $ 1,341,635 1,270,265

(1) Because the Wachovia acquisition was completed at the end of 2008, Wachovia’s assets and liabilities are included in average balances, and Wachovia’s results are reflected

in interest income/expense beginning in 2009.

(2) Our average prime rate was 3.25%, 3.25%, 3.25%, 3.25%, and 5.09% for 2012, 2011, 2010, 2009, and 2008, respectively. The average three-month London Interbank

Offered Rate (LIBOR) was 0.43%, 0.34%, 0.34%, 0.69%, and 2.93% for the same years, respectively.

(3) Yield/rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(4) Interest income/expense for trading assets represents interest and dividend income earned on trading securities.

38