Wells Fargo 2012 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2012 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

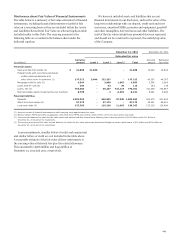

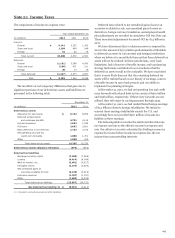

Note 19: Common Stock and Stock Plans (continued)

Stock Options

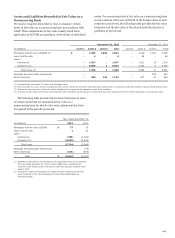

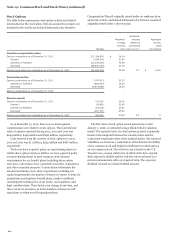

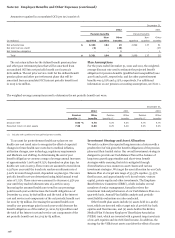

The table below summarizes stock option activity and related

information for the stock plans. Options assumed in mergers are

included in the activity and related information for Incentive

Compensation Plans if originally issued under an employee plan,

and in the activity and related information for Director Awards if

originally issued under a director plan.

Weighted-

Weighted- average Aggregate

average remaining intrinsic

exercise contractual value

Number price term (in yrs.) (in millions)

Incentive compensation plans

Options outstanding as of December 31, 2011 271,298,603 $ 38.14

Granted 1,828,758 31.82

Canceled or forfeited (11,376,806) 73.59

Exercised (58,824,163) 21.78

Options exercisable and outstanding as of December 31, 2012 202,926,392 40.84 3.7 $ 1,119

PartnerShares Plan

Options outstanding as of December 31, 2011 7,477,472 25.25

Canceled or forfeited (606,614) 25.25

Exercised (6,870,858) 25.25

Options outstanding as of December 31, 2012 - - - -

Director awards

Options outstanding as of December 31, 2011 721,432 29.56

Granted 82,893 33.82

Canceled or forfeited (19,232) 33.41

Exercised (197,071) 25.45

Options exercisable and outstanding as of December 31, 2012 588,022 31.42 3.2 2

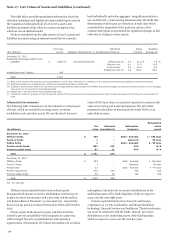

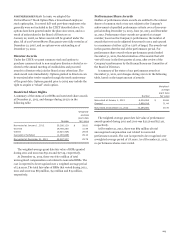

As of December 31, 2012, there was no unrecognized

compensation cost related to stock options. The total intrinsic

value of options exercised during 2012, 2011 and 2010 was

$694 million, $246 million and $298 million, respectively.

Cash received from the exercise of stock options for 2012,

2011 and 2010 was $1.5 billion, $554 million and $687 million,

respectively.

We do not have a specific policy on repurchasing shares to

satisfy share option exercises. Rather, we have a general policy

on repurchasing shares to meet common stock issuance

requirements for our benefit plans (including share option

exercises), conversion of our convertible securities, acquisitions

and other corporate purposes. Various factors determine the

amount and timing of our share repurchases, including our

capital requirements, the number of shares we expect to issue for

acquisitions and employee benefit plans, market conditions

(including the trading price of our stock), and regulatory and

legal considerations. These factors can change at any time, and

there can be no assurance as to the number of shares we will

repurchase or when we will repurchase them.

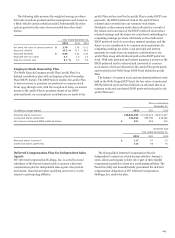

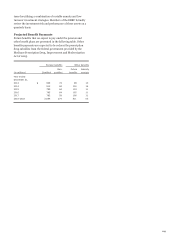

The fair value of each option award granted on or after

January 1, 2006, is estimated using a Black-Scholes valuation

model. The expected term of reload options granted is generally

based on the midpoint between the valuation date and the

contractual termination date of the original option. Our expected

volatilities are based on a combination of the historical volatility

of our common stock and implied volatilities for traded options

on our common stock. The risk-free rate is based on the U.S.

Treasury zero-coupon yield curve in effect at the time of grant.

Both expected volatility and the risk-free rates are based on a

period commensurate with our expected term. The expected

dividend is based on a fixed dividend amount.

224