TCF Bank 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 79 •

2010 Form 10-K

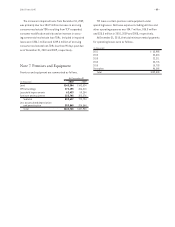

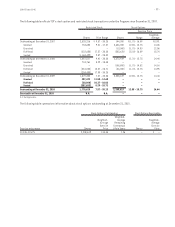

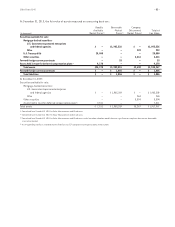

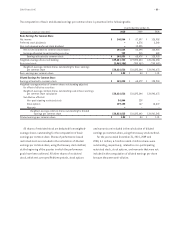

The following table sets forth the status of the Pension Plan and the Postretirement Plan at the dates indicated.

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2010 2009 2010 2009

Benefit obligation:

Accrued participant balance — vested $48,473 $50,933 N.A. N.A.

Present value of future service and benefits 443 (2,109) N.A. N.A.

Total projected benefit obligation $48,916 $48,824 N.A. N.A.

Accumulated benefit obligation $48,916 $48,824 N.A. N.A.

Change in benefit obligation:

Benefit obligation at beginning of year $48,824 $49,049 $ 9,166 $ 8,384

Service cost — benefits earned during the year – – 2 7

Interest cost on projected benefit obligation 2,554 2,918 455 495

Actuarial loss 1,726 935 460 892

Benefits paid (4,188) (4,078) (528) (612)

Projected benefit obligation at end of year 48,916 48,824 9,555 9,166

Change in fair value of plan assets:

Fair value of plan assets at beginning of year 50,605 38,624 – –

Actual return on plan assets 9,938 13,559 – –

Benefits paid (4,188) (4,078) (528) (612)

TCF contributions – 2,500 528 612

Fair value of plan assets at end of year 56,355 50,605 – –

Funded status of plans at end of year $ 7,439 $ 1,781 $(9,555) $(9,166)

Amounts recognized in the Statements of Financial Condition:

Prepaid (accrued) benefit cost at end of year $ 7,439 $ 1,781 $(9,555) $(9,166)

Amounts not yet recognized in net periodic benefit cost and included

in accumulated other comprehensive loss, before tax:

Transition obligation – – 7 11

Accumulated actuarial net loss 20,083 27,020 4,423 4,277

Accumulated other comprehensive loss, before tax 20,083 27,020 4,430 4,288

Total recognized asset (liability) $27,522 $28,801 $(5,125) $(4,878)

N.A. Not Applicable.