TCF Bank 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 95 •

2010 Form 10-K

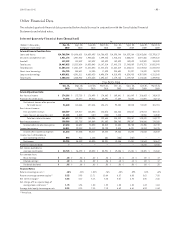

Other Financial Data

The selected quarterly financial data presented below should be read in conjunction with the Consolidated Financial

Statements and related notes.

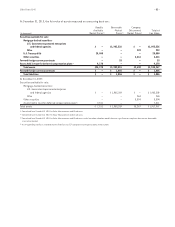

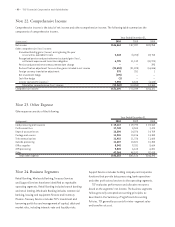

Selected Quarterly Financial Data (Unaudited)

At

(Dollars in thousands, Dec. 31, Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31,

except per-share data) 2010 2010 2010 2010 2009 2009 2009 2009

Selected Financial Condition Data:

Loans and leases $14,788,304 $14,896,601 $14,639,893 $14,706,423 $14,590,744 $14,329,264 $13,962,656 $13,795,617

Securities available for sale 1,931,174 1,947,462 1,940,331 1,899,825 1,910,476 2,060,227 2,087,406 2,098,628

Goodwill 152,599 152,599 152,599 152,599 152,599 152,599 152,599 152,599

Total assets 18,465,025 18,313,608 18,030,045 18,187,314 17,885,175 17,743,009 17,475,721 18,082,341

Total deposits 11,585,115 11,461,519 11,523,043 11,882,373 11,568,319 11,626,011 11,619,053 11,647,203

Short-term borrowings 126,790 344,681 14,805 17,590 244,604 21,397 25,829 26,299

Long-term borrowings 4,858,821 4,581,511 4,600,820 4,496,574 4,510,895 4,524,955 4,307,098 4,311,568

Total equity 1,480,163 1,505,962 1,474,536 1,393,617 1,179,755 1,179,839 1,142,535 1,499,956

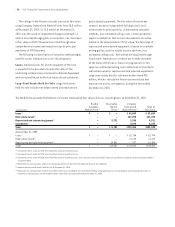

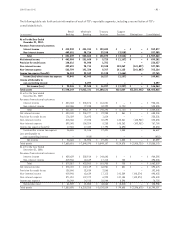

Three Months Ended

Dec. 31, Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31,

2010 2010 2010 2010 2009 2009 2009 2009

Selected Operations Data:

Net interest income $ 174,286 $ 173,755 $ 176,499 $ 174,662 $ 169,641 $ 161,489 $ 156,463 $ 145,413

Provision for credit losses 77,646 59,287 49,013 50,491 77,389 75,544 61,891 43,712

Net interest income after provision

for credit losses 96,640 114,468 127,486 124,171 92,252 85,945 94,572 101,701

Non-interest income:

Fees and other revenue 120,309 129,437 136,043 123,073 135,866 128,057 129,814 102,731

Gains (losses) on securities, net 21,185 8,505 (137) (430) 7,283 – 10,556 11,548

Total non-interest income 141,494 137,942 135,906 122,643 143,149 128,057 140,370 114,279

Non-interest expense 190,500 191,753 189,069 191,802 206,763 190,267 196,546 174,208

Income before income tax expense 47,634 60,657 74,323 55,012 28,638 23,735 38,396 41,772

Income tax expense 16,011 22,852 28,112 20,790 9,385 6,491 14,853 15,125

Income after income tax expense 31,623 37,805 46,211 34,222 19,253 17,244 23,543 26,647

Income (loss) attributable to

non-controlling interest 898 912 1,186 301 (203) (207) – –

Net income 30,725 36,893 45,025 33,921 19,456 17,451 23,543 26,647

Preferred stock dividends – – – – – – 13,218 5,185

Net income available to

common stockholders $ 30,725 $ 36,893 $ 45,025 $ 33,921 $ 19,456 $ 17,451 $ 10,325 $ 21,462

Per common share:

Basic earnings $ .22 $ .26 $ .32 $ .26 $ .15 $ .14 $ .08 $ .17

Diluted earnings $ .22 $ .26 $ .32 $ .26 $ .15 $ .14 $ .08 $ .17

Dividends declared $ .05 $ .05 $ .05 $ .05 $ .05 $ .05 $ .05 $ .25

Financial Ratios:

Return on average assets (1) .68% .84% 1.02% .76% .43% .39% .53% .62%

Return on average common equity (1) 8.25 9.95 12.71 10.68 6.57 6.03 3.61 7.58

Net interest margin (1) 4.04 4.12 4.18 4.20 4.07 3.92 3.80 3.66

Net charge-offs as a percentage of

average loans and leases (1) 1.75 1.58 1.30 1.22 1.35 1.52 1.43 1.04

Average total equity to average assets 8.05 8.28 7.88 7.10 6.69 6.61 6.94 8.64

(1) Annualized.