TCF Bank 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• 18 • TCF Financial Corporation and Subsidiaries

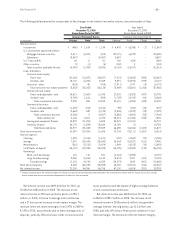

Item 7. Management’s Discussion

and Analysis of Financial Condition

and Results of Operations

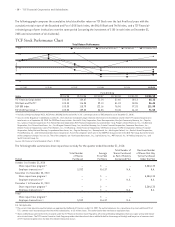

Table of Contents Page

Overview 18

Results of Operations 20

Performance Summary 20

Operating Segment Results 20

Consolidated Income Statement Analysis 20

Net Interest Income 20

Provision for Credit Losses 24

Non-Interest Income 24

Non-Interest Expense 26

Income Taxes 28

Consolidated Financial Condition Analysis 29

Securities Available for Sale 29

Loans and Leases 29

Allowance for Loan and Lease Losses 39

Other Real Estate Owned and Repossessed

and Returned Equipment 40

Liquidity Management 42

Deposits 42

Borrowings 42

Contractual Obligations and Commitments 43

Stockholders’ Equity 43

Summary of Critical Accounting Estimates 45

Recent Accounting Developments 46

Fourth Quarter Summary 46

Legislative, Legal and Regulatory Developments 47

Forward-Looking Information 47

Management’s discussion and analysis of the consolidated

financial condition and results of operations of TCF Financial

Corporation should be read in conjunction with the

consolidated financial statements in Item 8 and selected

financial data in Item 6.

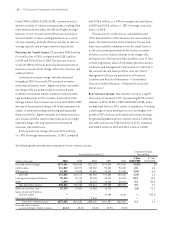

Overview

TCF Financial Corporation, a Delaware corporation, is

a national bank holding company based in Wayzata,

Minnesota. Its principal subsidiary, TCF National Bank, is

headquartered in South Dakota. TCF had 442 branches in

Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana,

Arizona and South Dakota (TCF’s primary banking markets)

at December 31, 2010.

TCF provides convenient financial services through

multiple channels in its primary banking markets. TCF has

developed products and services designed to meet the

needs of all consumers. The Company focuses on attracting

and retaining customers through service and convenience,

including branches that are open seven days a week and

on most holidays, extensive full-service supermarket

branches, automated teller machine (“ATM”) networks

and internet, mobile and telephone banking. TCF’s philoso-

phy is to generate interest income, fees and other revenue

growth through business lines that emphasize higher

yielding assets and low or no interest-cost deposits. The

Company’s growth strategies include the development

of new products and services, new branch expansion and

acquisitions. New products and services are designed to

build on existing businesses and expand into complemen-

tary products and services through strategic initiatives.

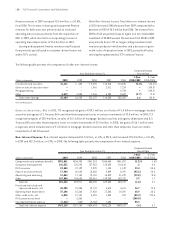

TCF’s core businesses include Retail Banking, Wholesale

Banking and Treasury Services. Retail Banking includes

branch banking and retail lending. Wholesale Banking

includes commercial banking, leasing and equipment

finance and inventory finance. TCF refers to its combined

leasing and equipment finance and inventory finance

businesses as Specialty Finance. Treasury Services includes

the Company’s investment and borrowing portfolios and

management of capital, debt and market risks, including

interest-rate and liquidity risks.

TCF’s lending strategy is to originate high credit quality

and primarily secured loans and leases. TCF’s retail lending

operation offers fixed- and variable-rate loans and lines

of credit secured by residential real estate properties.

Commercial loans are generally made on properties or to

customers located within TCF’s primary banking markets.

The leasing and equipment finance businesses consist of

TCF Equipment Finance, a company that delivers equipment

finance solutions to businesses in select markets, and

Winthrop Resources, a company that primarily leases

technology and data processing equipment. TCF’s leasing

and equipment finance businesses have equipment

installations in all 50 states and, to a limited extent, in

foreign countries. In December 2008, TCF Inventory Finance

commenced lending operations to originate commercial

variable-rate loans which are secured by equipment under

a floorplan arrangement and supported by repurchase

agreements from original equipment manufacturers to

businesses in the United States and Canada.