TCF Bank 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 93 •

2010 Form 10-K

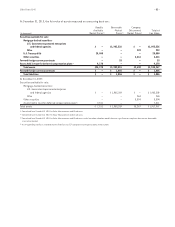

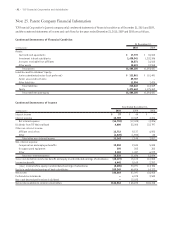

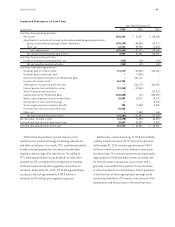

Condensed Statements of Cash Flows

Year Ended December 31,

(In thousands) 2010 2009 2008

Cash flows from operating activities:

Net income $146,564 $ 87,097 $ 128,958

Adjustments to reconcile net income to net cash provided by operating activities:

Equity in undistributed earnings of bank subsidiaries (155,249) (66,806) (14,172)

Other, net 16,743 29,795 (6,394)

Total adjustments (138,506) (37,011) (20,566)

Net cash provided by operating activities 8,058 50,086 108,392

Cash flows from investing activities:

Purchases of premises and equipment, net (142) (40) (40)

Net cash used by investing activities (142) (40) (40)

Cash flows from financing activities:

Dividends paid on common stock (27,617) (50,828) (126,447)

Dividends paid on preferred stock – (7,926) –

Recission of capital contribution to TCF National Bank – 361,172 –

Issuance of common stock 164,748 – –

(Redemption)/Issuance of preferred stock – (361,172) 361,004

Interest paid on trust preferred securities (12,364) (12,364) –

Sale of trust preferred securities – – 111,378

Capital infusions to TCF National Bank (255,000) (50) (434,092)

Shares sold to Employees Stock Purchase Plans 18,089 19,147 10,178

Net decrease in short-term borrowings – – (9,500)

Stock compensation tax (expense) benefits 298 (1,058) 9,638

Proceeds from senior unsecured term note 89,640 – –

Other, net – 1,538 163

Net cash used by financing activities (22,206) (51,541) (77,678)

Net (decrease) increase in cash (14,290) (1,495) 30,674

Cash and cash equivalents at beginning of year 32,062 33,557 2,883

Cash and cash equivalents at end of year $17,772 $ 32,062 $ 33,557

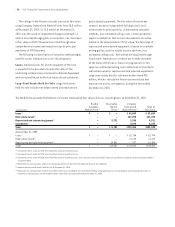

TCF Financial Corporation’s (parent company only)

operations are conducted through its banking subsidiaries

and other subsidiaries. As a result, TCF’s cash flow and ability

to make dividend payments to its common stockholders

depend on the earnings of its subsidiaries. The ability of

TCF’s banking subsidiaries to pay dividends or make other

payments to TCF is limited by their obligations to maintain

sufficient capital and by other regulatory restrictions on

dividends. At December 31, 2010, TCF’s banking subsidiaries

could pay a total of approximately $239.9 million in

dividends to TCF without prior regulatory approval.

Additionally, retained earnings at TCF National Bank,

a wholly owned subsidiary of TCF Financial Corporation,

at December 31, 2010 includes approximately $134.4

million for which no provision for federal income taxes

has been made. This amount represents earnings legally

appropriated to thrift bad debt reserves and deducted

for federal income tax purposes in prior years and is

generally not available for payment of cash dividends

or other distributions to shareholders. Future payments

or distributions of these appropriated earnings could

invoke a tax liability for TCF based on the amount of the

distributions and the tax rates in effect at that time.