TCF Bank 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 78 • TCF Financial Corporation and Subsidiaries

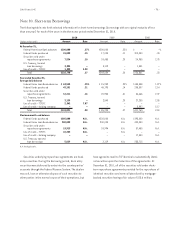

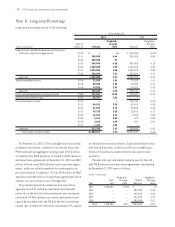

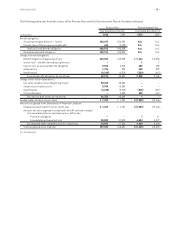

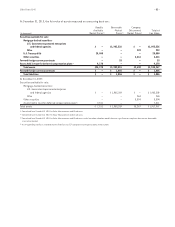

Additional valuation and related assumption informa-

tion for TCF’s stock option plans related to options issued

in 2008 is presented below. No stock options were issued in

2009 or 2010.

Expected volatility 28.5%

Weighted-average volatility 28.5%

Expected dividend yield 3.5%

Expected term (in years) 6.25 – 6.75

Risk-free interest rate 2.58 – 2.91%

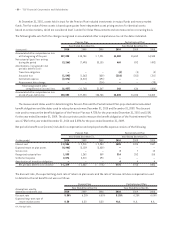

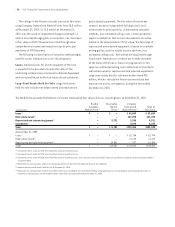

Note 16. Employee Benefit Plans

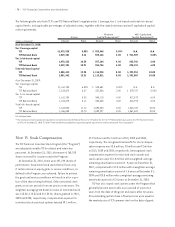

Employees Stock Purchase Plan The TCF Employees

Stock Purchase Plan, a qualified 401(K) and employee

stock ownership plan, generally allows participants to make

contributions of up to 50% of their covered compensation

on a tax-deferred basis, subject to the annual covered

compensation limitation imposed by the Internal Revenue

Service (“IRS”). TCF matches the contributions of all

participants with TCF common stock at the rate of 50 cents

per dollar for employees with one through four years of

service, up to a maximum company contribution of 3% of

the employee’s covered compensation, 75 cents per dollar

for employees with five through nine years of service, up to

a maximum company contribution of 4.5% of the employ-

ee’s covered compensation, and $1 per dollar for employees

with 10 or more years of service, up to a maximum company

contribution of 6% of the employee’s covered compensation,

subject to the annual covered compensation limitation

imposed by the IRS. Employee contributions vest immediately

while the Company’s matching contributions are subject to

a graduated vesting schedule based on an employee’s years

of service with full vesting after five years. Employees have

the opportunity to diversify and invest their account

balance, including matching contributions, in various

mutual funds or TCF common stock. At December 31, 2010,

the fair value of the assets in the plan totaled $163.4

million and included $116 million invested in TCF common

stock. The Company’s matching contributions are expensed

when made. TCF’s contributions to the plan were $6.9

million in 2010, 2009 and 2008, respectively.

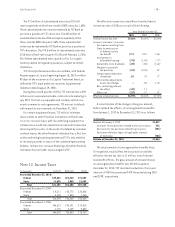

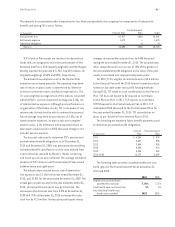

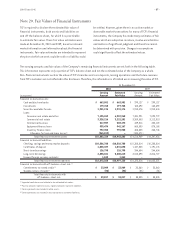

Pension Plan The TCF Cash Balance Pension Plan (the

“Pension Plan”) is a qualified defined benefit plan covering

eligible employees who are at least 21 years old and have

completed a year of eligibility service with TCF. Employees

hired after June 30, 2004 are not eligible to participate in

the Pension Plan. Effective March 31, 2006, TCF amended

the Pension Plan to discontinue compensation credits

for all participants. Interest credits will continue to be

paid until participants’ accounts are distributed from the

Pension Plan. Each month TCF credits participant accounts

with interest on the account balance based on the five-

year Treasury rate plus 25 basis points determined at the

beginning of each year. All participant accounts are vested.

The measurement of the projected benefit obligation,

prepaid pension asset, pension liability and annual pension

expense involves complex actuarial valuation methods and

the use of actuarial and economic assumptions. Due to the

long-term nature of the pension plan obligation, actual

results may differ significantly from the actuarial-based

estimates. Differences between estimates and actual

experience are required to be deferred and under certain

circumstances amortized over the future expected working

lifetime of plan participants. As a result, these differences

are not recognized when they occur. TCF closely monitors

all assumptions and updates them annually. The Company

does not consolidate the assets and liabilities associated

with the Pension Plan.

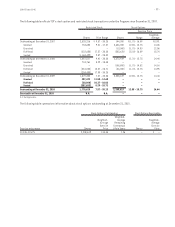

Postretirement Plan TCF provides health care benefits

for eligible retired employees (the “Postretirement Plan”).

Effective January 1, 2000, TCF modified the Postretirement

Plan for employees not yet eligible for benefits under the

Postretirement Plan by eliminating the Company subsidy.

The plan provisions for full-time and retired employees then

eligible for these benefits were not changed. Employees

retiring after December 31, 2009 are no longer eligible to

participate in the Postretirement Plan. The Postretirement

Plan is not funded.