TCF Bank 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 76 • TCF Financial Corporation and Subsidiaries

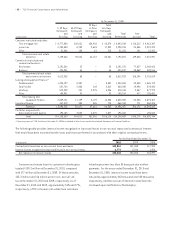

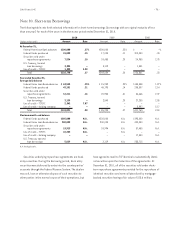

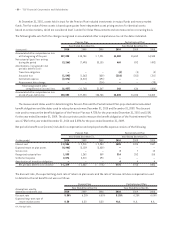

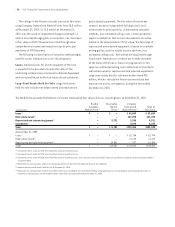

The following table sets forth TCF’s and TCF National Bank’s regulatory tier 1 leverage, tier 1 risk-based and total risk-based

capital levels, and applicable percentages of adjusted assets, together with the stated minimum and well-capitalized capital

ratio requirements.

Minimum Well-Capitalized

Actual Capital Requirement(1) Capital Requirement(1)

(Dollars in thousands) Amount Ratio Amount Ratio Amount Ratio

As of December 31, 2010:

Tier 1 leverage capital

TCF $1,475,525 8.00% $ 553,448 3.00% N.A. N.A.

TCF National Bank 1,519,201 8.24 553,146 3.00 $ 921,909 5.00%

Tier 1 risk-based capital

TCF 1,475,525 10.59 557,164 4.00 835,746 6.00

TCF National Bank 1,519,201 10.91 556,756 4.00 835,133 6.00

Total risk-based capital

TCF 1,808,412 12.98 1,114,328 8.00 1,392,910 10.00

TCF National Bank 1,851,962 13.31 1,113,511 8.00 1,391,889 10.00

As of December 31, 2009:

Tier 1 leverage capital

TCF $1,161,750 6.59% $ 528,681 3.00% N.A. N.A.

TCF National Bank 1,103,875 6.27 527,836 3.00 $ 879,727 5.00%

Tier 1 risk-based capital

TCF 1,161,750 8.52 545,115 4.00 817,672 6.00

TCF National Bank 1,103,875 8.11 544,648 4.00 816,972 6.00

Total risk-based capital

TCF 1,514,940 11.12 1,090,230 8.00 1,362,787 10.00

TCF National Bank 1,456,858 10.70 1,089,297 8.00 1,361,621 10.00

N.A. Not Applicable.

(1) The minimum and well capitalized requirements are determined by the Federal Reserve for TCF and by the OCC for TCF National Bank pursuant to the FDIC Improvement Act

of 1991. At December 31, 2010, TCF and TCF National Bank exceeded their regulatory capital requirements and are considered “well-capitalized”.

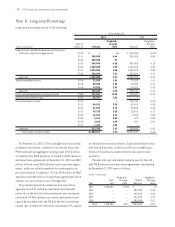

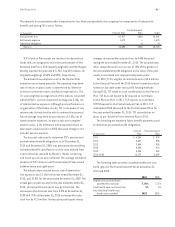

Note 15. Stock Compensation

The TCF Financial Incentive Stock Program (the “Program”)

was adopted to enable TCF to attract and retain key

personnel. At December 31, 2010, there were 4,760,019

shares reserved for issuance under the Program.

At December 31, 2010, there were 207,194 shares of

performance-based restricted stock that will vest only

if certain return on equity goals or service conditions, as

defined in the Program, are achieved. Failure to achieve

the goals and service conditions will result in all or a por-

tion of the shares being forfeited. Other restricted stock

grants vest over periods from one year to seven years. The

weighted-average grant date fair value of restricted stock

was $13.36, $10.33 and $12.50 for shares granted in 2010,

2009 and 2008, respectively. Compensation expense for

restricted stock and stock options totaled $9.1 million,

$7.9 million and $5.7 million in 2010, 2009 and 2008,

respectively. The recognized tax benefit for stock compen-

sation expense was $3.5 million, $3 million and $2 million

in 2010, 2009 and 2008, respectively. Unrecognized stock

compensation expense for restricted stock awards and

stock options were $12.4 million with a weighted-average

remaining amortization period of .9 years at December 31,

2010, compared with $17.3 million with a weighted-average

remaining amortization period of 1.6 years at December 31,

2009 and $20.8 million with a weighted-average remaining

amortization period of 2.4 years at December 31, 2008.

TCF has also issued stock options under the Program that

generally become exercisable over a period of one to ten

years from the date of the grant and expire after ten years.

All outstanding options have a fixed exercise price equal to

the market price of TCF common stock on the date of grant.