TCF Bank 2010 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• 10 • TCF Financial Corporation and Subsidiaries

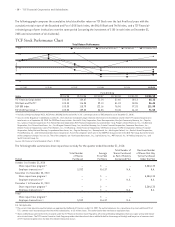

In addition to valuation analyses, management utilizes

an interest rate gap measure (difference between interest-

earning assets and interest-bearing liabilities repricing within

a given period). While the interest rate gap measurement has

some limitations, including no assumptions regarding future

asset or liability production and a static interest rate

assumption, the interest rate gap represents the net asset

or liability sensitivity at a point in time. An interest rate gap

measure could be significantly affected by external factors

such as loan prepayments, early withdrawals of deposits,

changes in the correlation of various interest-bearing

instruments, competition or a rise or decline in interest rates.

See “Item 7A. Quantitative and Qualitative Disclosures About

Market Risk” for further information about TCF’s interest-

rate risk, gap analysis and simulation analyses.

Management also uses valuation analyses to measure

risk in the balance sheet that might not be taken into

account in the net interest income simulation analyses.

Net interest income simulation highlights exposure over a

relatively short time period (12 or 24 months), and valua-

tion analysis incorporates all cash flows over the estimated

remaining life of all balance sheet positions. The valuation

of the balance sheet, at a point in time, is defined as the

discounted present value of asset cash flows minus the

discounted value of liability cash flows. Valuation analysis

addresses only the current balance sheet and does not

incorporate the growth assumptions that are used in the

net interest income simulation model. As with the net

interest income simulation model, valuation analysis is

based on key assumptions about the timing and variability

of balance sheet cash flows and does not take into account

actions management may undertake in response to antici-

pated changes in interest rates.

ALCO meets regularly and is responsible for reviewing the

Company’s interest rate sensitivity position and establishing

policies to monitor and limit exposure to interest-rate risk.

Liquidity Risk Liquidity risk is defined as the risk to

earnings or capital arising from the Company’s inability to

meet its obligations when they come due without incurring

unacceptable losses.

ALCO and the Board of Directors have adopted a

Liquidity Management Policy to direct management of

the Company’s liquidity risk. The objective of the liquidity

management policy is to ensure that TCF meets its cash and

collateral obligations promptly, in a cost-effective manner

and with the highest degree of reliability. The maintenance

of adequate levels of asset and liability liquidity will

provide TCF with the ability to meet both expected and

unexpected cash flows and collateral needs. Key liquidity

ratios, level of asset liquidity, and the amount available

from available funding sources are reported to ALCO on a

monthly basis. At year end, TCF’s Liquidity Management

Policy and current operating practices established a

minimum on-balance sheet asset liquidity target of $350

million, a maximum unsecured short-term daily borrowing

limit of $225 million, and collateral pledged at the Federal

Reserve Discount Window having a borrowing capacity of

$500 million.

TCF’s asset liquidity may be held in the form of

on-balance sheet cash invested with the Federal Reserve

or the use of overnight Federal Funds Sold to highly rated

counterparties or short-term U.S. Treasury Bills or Notes.

Other asset liquidity can be provided by unpledged, AAA

rated securities which could be sold or pledged to various

counterparties under established TCF lines. At December 31,

2010, TCF had asset liquidity of $507 million.

Deposits are TCF’s primary source of funding. In addition,

TCF maintains secured sources of funding, which include

$1.7 billion in secured borrowing capacity at the FHLB of Des

Moines and $529 million of secured borrowing capacity at the

Federal Reserve Discount Window. TCF’s secured borrowing

capacity with the FHLB is dependent upon the maintenance by

TCF of a Borrowing Base Certificate which pledges consumer

and commercial real estate loans to the FHLB under a blanket

lien. In addition, the FHLB relies upon its own internal credit

analysis of TCF’s financial results when determining TCF’s

secured borrowing capacity. Should the FHLB lower its internal

issuer credit rating on TCF, TCF’s secured borrowing capacity

could be reduced, TCF could be required to change collateral

from a blanket lien to physically delivering loan files which

would be held at the FHLB, or both.

Additionally, diminished borrowing capacity could

result from TCF credit rating downgrades and unfavorable

conditions in the credit markets that restrict or limit

various funding sources.

TCF has developed and maintains a contingency funding

plan should certain liquidity needs arise.

Other Market Risks The Company is also exposed to

foreign currency risk as changes in foreign exchange rates

may impact the Company’s investment in TCF Commercial

Finance Canada, Inc. (“TCFCFC”) or results of other

transactions in countries outside of the United States.

During 2010, TCF entered into forward foreign exchange

contracts in order to minimize the risk of changes in foreign

exchange rates on its investment in and loans to TCFCFC and

on certain other foreign lease transactions. The value of