TCF Bank 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 33 •

2010 Form 10-K

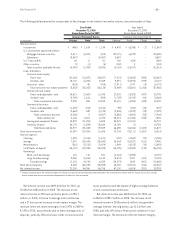

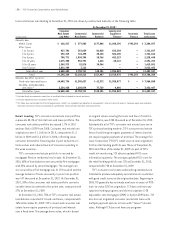

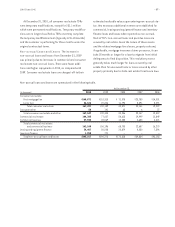

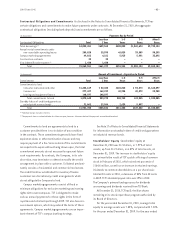

TCF Inventory Finance The following table summarizes the TCF Inventory Finance portfolio by marketing segment.

At December 31,

(Dollars in thousands) 2010 2009

Percent Percent

Equipment Type Balance of Total Balance of Total

Lawn and garden $441,691 55.8% $346,509 73.9%

Power sports and other 220,472 27.8 – –

Electronics and appliances 130,191 16.4 122,296 26.1

Total $792,354 100.0% $468,805 100.0%

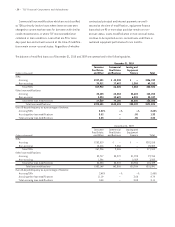

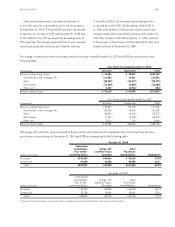

finance portfolio tables above include lease residuals.

Lease residuals represent the estimated fair value of the

leased equipment at the expiration of the initial term of

the transaction and are reviewed on an ongoing basis. Any

downward revisions in estimated fair value are recorded in

the periods in which they become known. At December 31,

2010, lease residuals totaled $109.6 million, or 10.1% of

original equipment value, compared with $106.3 million,

or 8.7% of original equipment value, at December 31, 2009.

In the third quarter of 2010, TCF expanded into the power

sports industry by entering into an agreement with Arctic

Cat Sales Inc. to become the exclusive inventory finance

source for Arctic Cat’s Canadian dealers. This agreement

led to the acquisition of $125.8 million in loans towards

the end of the third quarter of 2010.

In the third quarter of 2009, TCF formed a joint

venture with The Toro Company (“Toro”) called Red Iron

Acceptance, LLC (“Red Iron”). Red Iron provides U.S.

distributors and dealers and select Canadian distributors

of the Toro and Exmark brands with reliable, cost-effective

sources of financing. TCF and Toro maintain a 55% and 45%

ownership interest, respectively, in Red Iron. As TCF has

a controlling financial interest in Red Iron, its financial

results are consolidated in TCF’s financial statements.

Toro’s interest is reported as a non-controlling interest

within equity and qualifies as tier 1 regulatory capital.

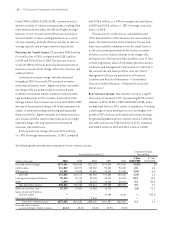

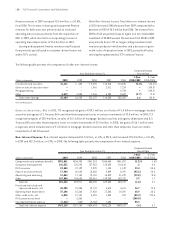

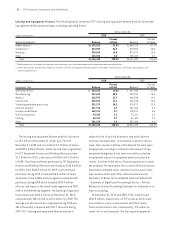

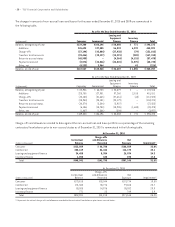

Credit Quality The following tables summarize TCF’s loan

and lease portfolio based on the most important credit

quality data that should be used to understand the overall

condition of the portfolio.

• Within the performing loans and leases, TCF classifies

customers within regulatory classification guidelines.

Loans and leases that are “classified” mean that

management has concerns regarding the ability of the

borrowers to meet existing loan or lease terms and

conditions but may never become non-performing

or result in a loss.

• Performing loans that are 60+ days delinquent

have a higher potential to become non-performing

and generally are a leading indicator for future

charge-off trends.

• Accruing troubled debt restructurings (“TDRs”) are

loans to borrowers that have been modified such

that TCF has granted a concession in terms to improve

the likelihood of collection of all principal and

interest owed.

• Non-accrual loans and leases generally have been

charged down to the estimated fair value of the

collateral less selling costs or reserved for expected

loss upon workout.

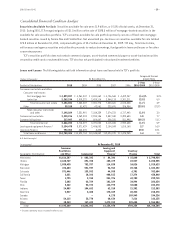

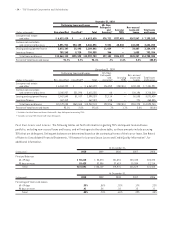

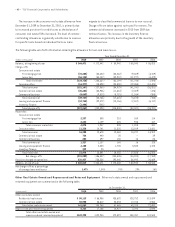

Included in Note 6 of Notes to Consolidated Financial

Statements, “Allowance for Loan and Lease Losses and Credit

Quality Information”, are disclosures of loans considered

to be “impaired” for accounting purposes. Impaired loans

comprise a portion of non-accrual loans and accruing TDRs

and therefore are not additive to the information in the

table below. Impaired loan accounting policies prescribe

specific methodologies for determining a portion of the

allowance for loan and lease losses. In addition, TCF has

modified certain loans and leases to troubled borrowers

where a concession was not granted and thus are not

considered TDRs. These other modified loans and leases

totaled $135.5 million and $101.5 million at December 31,

2010 and 2009, respectively, and are further discussed on

page 35 under “Loan Modifications”.