TCF Bank 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

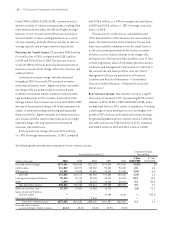

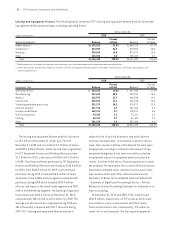

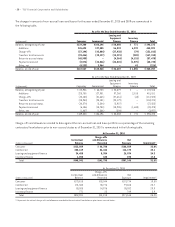

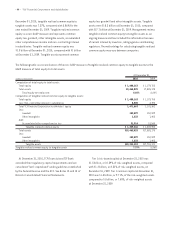

• 34 • TCF Financial Corporation and Subsidiaries

December 31, 2010

Performing Loans and Leases 60+ Days

Delinquent

and

Accruing(2) Accruing

TDRs

Non-accrual

Loans and

Leases Total Loans

and Leases(Dollars in thousands) Non-classified Classified(1) Total

Consumer real estate

and other $ 6,613,610 $ – $ 6,613,610 $76,711 $337,401 $167,547 $ 7,195,269

Commercial real estate

and commercial business 3,091,911 354,185 3,446,096 9,021 48,838 142,248 3,646,203

Leasing and equipment finance 3,073,347 35,695 3,109,042 11,029 – 34,407 3,154,478

Inventory finance 785,245 5,710 790,955 344 – 1,055 792,354

Total loans and leases $13,564,113 $395,590 $13,959,703 $97,105 $386,239 $345,257 $14,788,304

Percent of total loans and leases 91.7% 2.7% 94.4% .7% 2.6% 2.3% 100.0%

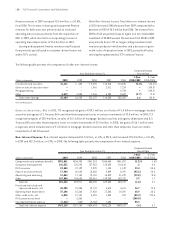

December 31, 2009

Performing Loans and Leases 60+ Days

Delinquent

and

Accruing(2) Accruing

TDRs

Non-accrual

Loans and

Leases Total Loans

and Leases(Dollars in thousands) Non-classified Classified(1) Total

Consumer real estate

and other $ 6,863,222 $ – $ 6,863,222 $76,959 $252,510 $139,300 $ 7,331,991

Commercial real estate

and commercial business 3,280,957 331,298 3,612,255 68 – 106,196 3,718,519

Leasing and equipment finance 2,967,540 31,767 2,999,307 22,114 – 50,008 3,071,429

Inventory finance 467,319 – 467,319 715 – 771 468,805

Total loans and leases $13,579,038 $363,065 $13,942,103 $99,856 $252,510 $296,275 $14,590,744

Percent of total loans and leases 93.1% 2.5% 95.6% .7% 1.7% 2.0% 100.0%

(1) Excludes classified loans and leases that are 60+ days delinquent or accruing TDRs.

(2) Excludes accruing TDRs that are 60+ days delinquent.

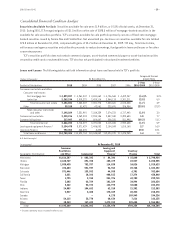

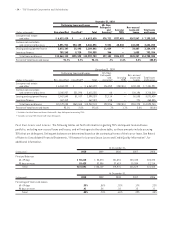

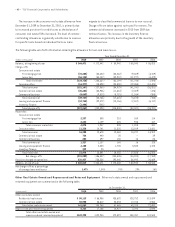

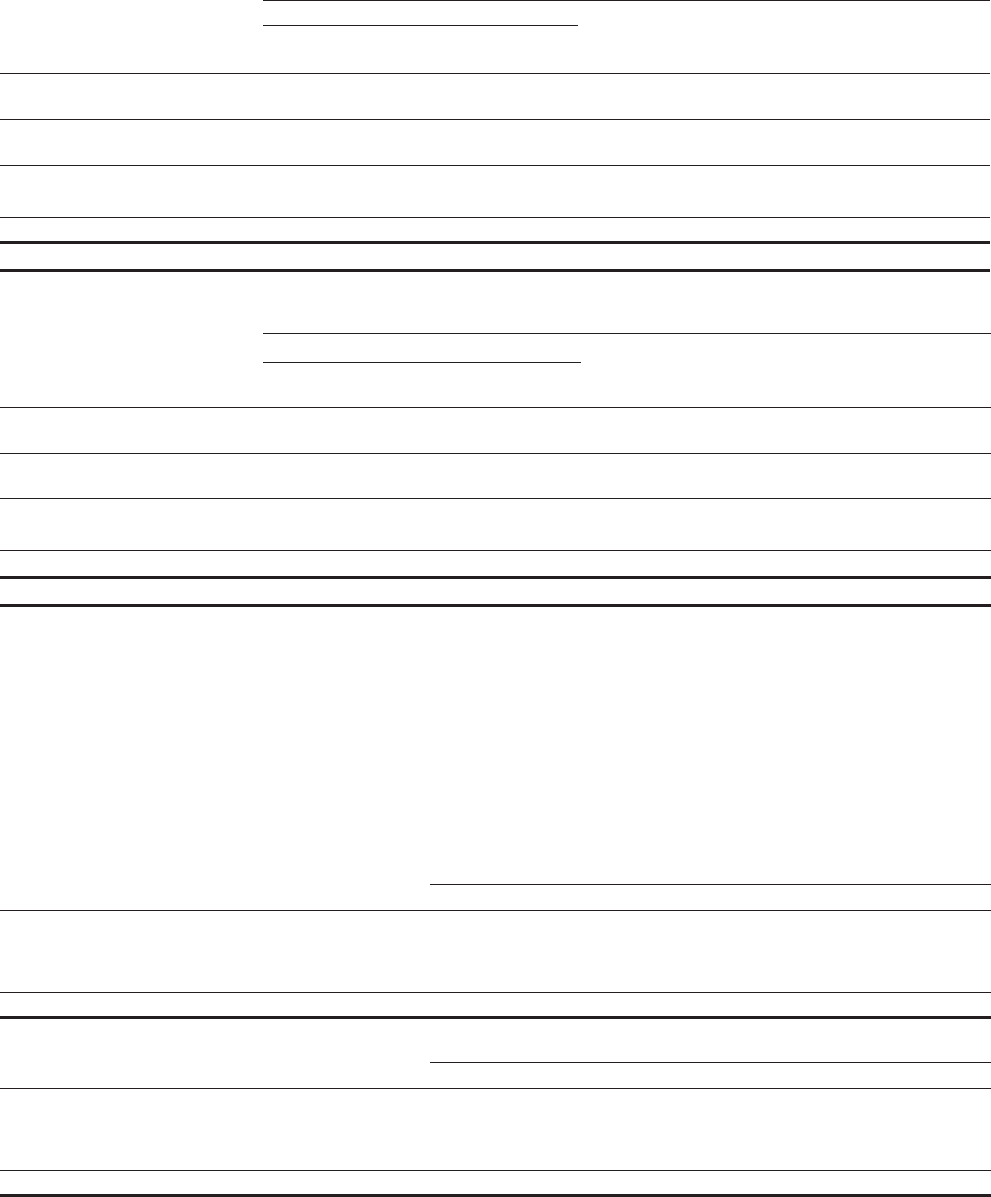

Past Due Loans and Leases The following tables set forth information regarding TCF’s delinquent loan and lease

portfolio, excluding non-accrual loans and leases, and will not agree to the above table, as these amounts include accruing

TDRs that are delinquent. Delinquent balances are determined based on the contractual terms of the loan or lease. See Note 6

of Notes to Consolidated Financial Statements, “Allowance for Loan and Lease Losses and Credit Quality Information”, for

additional information.

At December 31,

(In thousands) 2010 2009 2008 2007 2006

Principal Balances

60-89 days $ 55,618 $ 54,073 $41,851 $20,445 $24,872

90 days or more 59,425 52,056 37,619 15,384 12,214

Total $115,043 $106,129 $79,470 $35,829 $37,086

At December 31,

(In thousands) 2010 2009 2008 2007 2006

Percentage of Loans and Leases

60-89 days .39% .38% .32% .17% .22%

90 days or more .41 .36 .28 .12 .11

Total .80% .74% .60% .29% .33%