TCF Bank 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

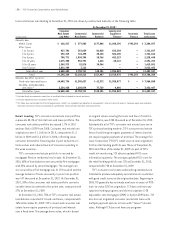

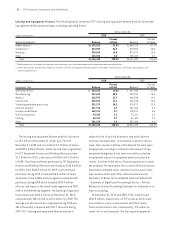

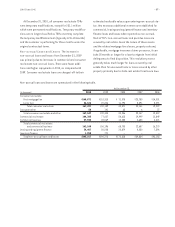

• 36 • TCF Financial Corporation and Subsidiaries

Commercial loan modifications which are not classified

as TDRs primarily involve loans where interest rates were

changed to current market rates for borrowers with similar

credit characteristics or where TCF received additional

collateral or loan conditions. Loans that are 90 or more

days past due and not well secured at the time of modifica-

tion remain on non-accrual status. Regardless of whether

contractual principal and interest payments are well-

secured at the time of modification, equipment finance

loans that are 90 or more days past due remain on non-

accrual status. Loans modified when on non-accrual status

continue to be reported as non-accrual loans until there is

sustained repayment performance for six months.

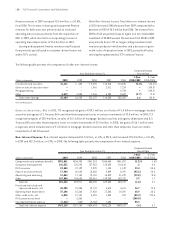

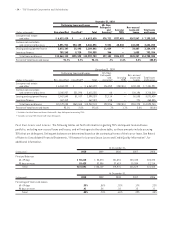

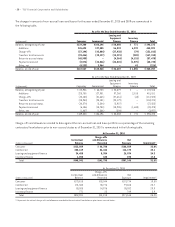

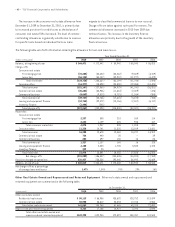

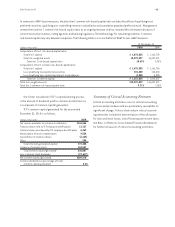

The balance of modified loans as of December 31, 2010 and 2009 are summarized in the following tables.

December 31, 2010

Consumer Commercial Leasing and

Real Estate Real Estate Equipment

(Dollars in thousands) and Other and Business Finance Total

TDRs:

Accruing $337,401 $ 48,838 $ – $386,239

Non-accruing 30,511 17,487 1,284 49,282

Total TDRs 367,912 66,325 1,284 435,521

Other loan modifications:

Accruing 24,145 68,484 22,624 115,253

Non-accruing 3,394 10,622 6,231 20,247

Total other loan modifications 27,539 79,106 28,855 135,500

Total loan modifications $395,451 $145,431 $30,139 $571,021

Over 60-day delinquency as a percentage of balance:

Accruing TDRs 5.32% –% –% 4.64%

Accruing other loan modifications 5.82 – .55 1.33

Total accruing loan modifications 5.35 – .55 3.88

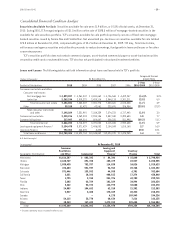

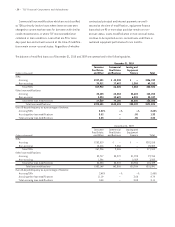

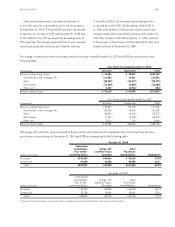

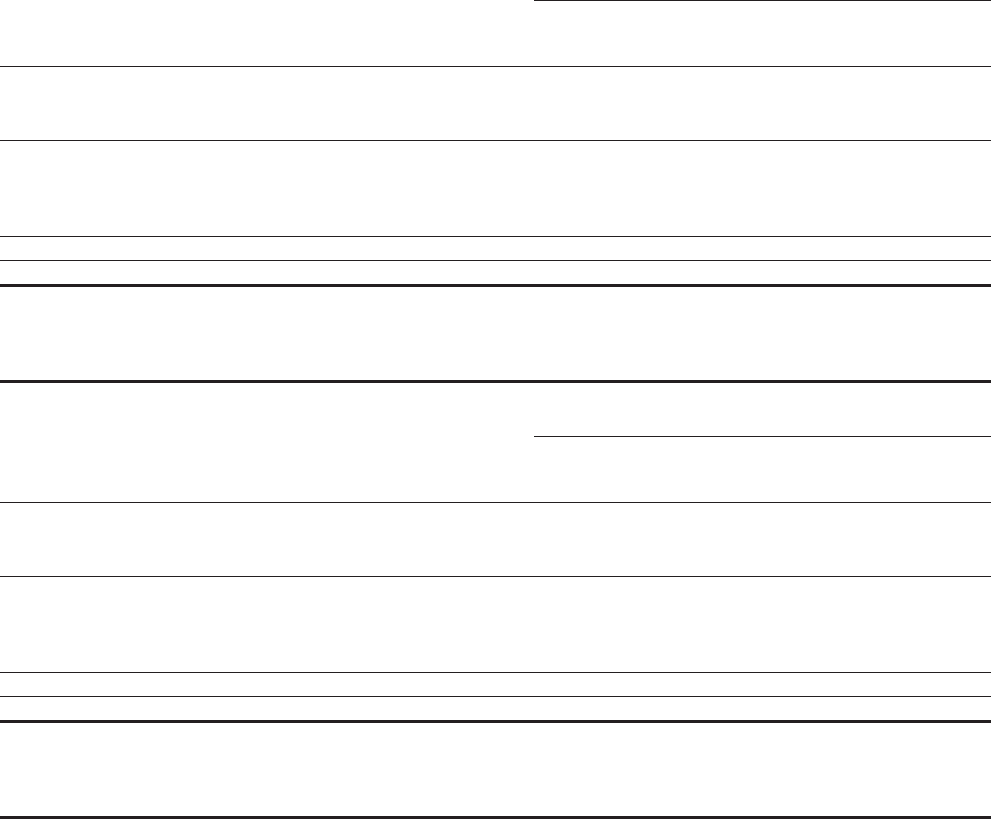

December 31, 2009

Consumer Commercial Leasing and

Real Estate Real Estate Equipment

(Dollars in thousands) and Other and Business Finance Total

TDRs:

Accruing $252,510 $ – $ – $252,510

Non-accruing 15,416 9,586 – 25,002

Total TDRs 267,926 9,586 – 277,512

Other loan modifications:

Accruing 32,717 33,272 31,925 97,914

Non-accruing 1,506 – 2,059 3,565

Total other loan modifications 34,223 33,272 33,984 101,479

Total loan modifications $302,149 $42,858 $33,984 $378,991

Over 60-day delinquency as a percentage of balance:

Accruing TDRs 2.48% –% –% 2.48%

Accruing other loan modifications 11.19 – 3.08 4.74

Total accruing loan modifications 3.48 – 3.08 3.11