TCF Bank 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 69 •

2010 Form 10-K

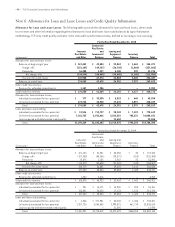

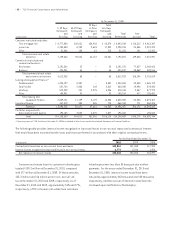

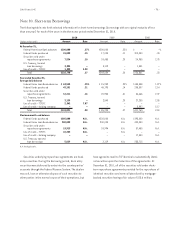

The increase in impaired loans from December 31, 2009,

was primarily due to a $84.9 million increase in accruing

consumer real estate TDRs resulting from TCF’s expanded

consumer modification activity and an increase in accru-

ing commercial real estate loan TDRs. Included in impaired

loans were $326.1 million and $249.6 million of accruing

consumer real estate loan TDRs less than 90 days past due

as of December 31, 2010 and 2009, respectively.

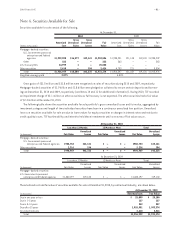

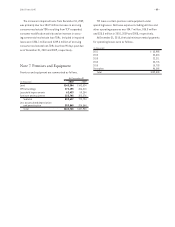

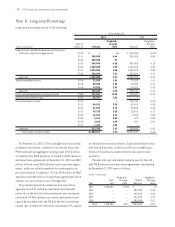

Note 7. Premises and Equipment

Premises and equipment are summarized as follows.

At December 31,

(In thousands) 2010 2009

Land $145,304 $142,024

Office buildings 272,155 266,210

Leasehold improvements 62,433 59,284

Furniture and equipment 323,745 305,276

Subtotal 803,637 772,794

Less accumulated depreciation

and amortization 359,869 324,864

Total $443,768 $447,930

TCF leases certain premises and equipment under

operating leases. Net lease expense including utilities and

other operating expenses was $34.7 million, $35.3 million

and $35.5 million in 2010, 2009 and 2008, respectively.

At December 31, 2010, the total minimum rental payments

for operating leases were as follows.

(In thousands)

2011 $ 25,995

2012 23,818

2013 22,211

2014 20,776

2015 18,733

Thereafter 98,295

Total $209,828