TCF Bank 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 50 • TCF Financial Corporation and Subsidiaries

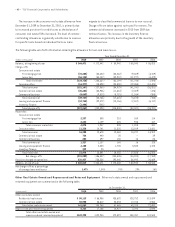

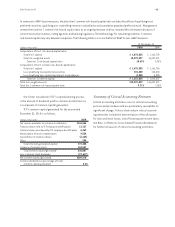

The following table summarizes TCF’s interest-rate gap position at December 31, 2010.

Maturity/Rate Sensitivity

Within 30 Days to 6 Months

(Dollars in thousands) 30 Days 6 Months to 1 Year 1 to 3 Years 3+ Years Total

Interest-earning assets:

Consumer loans (1) (2) $1,022,951 $ 391,684 $ 441,042 $2,157,678 $ 3,181,914 $ 7,195,269

Commercial loans (1) (2) 452,911 301,442 324,193 1,395,466 1,172,191 3,646,203

Leasing and equipment finance (2) 155,630 626,474 577,485 1,356,257 438,632 3,154,478

Securities available for sale (2) 38,273 64,272 88,414 333,026 1,407,189 1,931,174

Investments 371,407 141,567 62 368 37,761 551,165

Inventory finance 360,646 253,204 178,504 – – 792,354

Total 2,401,818 1,778,643 1,609,700 5,242,795 6,237,687 17,270,643

Interest-bearing liabilities:

Checking deposits (3) 575,930 62,673 67,230 860,831 2,963,400 4,530,064

Savings deposits (3) 1,592,682 462,632 470,622 1,589,703 1,275,163 5,390,802

Money market deposits (3) 330,149 9,837 10,349 250,466 35,121 635,922

Certificates of deposit 100,451 412,856 357,483 146,837 10,700 1,028,327

Short-term borrowings 126,790 – – – – 126,790

Long-term borrowings (4) 8,107 548,460 138,389 501,152 3,662,713 4,858,821

Total 2,734,109 1,496,458 1,044,073 3,348,989 7,947,097 16,570,726

Interest-earning assets (under)

over interest-bearing liabilities (332,291) 282,185 565,627 1,893,806 (1,709,410) 699,917

Cumulative gap $ (332,291) $ (50,106) $ 515,521 $2,409,327 $ 699,917 $ 699,917

Cumulative gap as a percentage

of total assets:

At December 31, 2010 (1.8)% (0.3)% 2.8 % 13.0% 3.8% 3.8%

At December 31, 2009 (12.9)% (8.9)% (6.6)% 4.2% 1.9% 1.9%

(1) At January 1, 2011, $1.4 billion of variable-rate consumer loans and $397 million of variable-rate commercial loans were modeled as fixed-rate loans as their current interest

rate is below their contractual interest rate floor. An increase in short-term interest rates may not result in a change in the interest rate on these variable-rate loans.

(2) Based upon contractual maturity, repricing date, if applicable, scheduled repayments of principal and projected prepayments of principal based upon experience and

third-party projections.

(3) Includes non-interest bearing deposits. At December 31, 2010, 16% of checking deposits, 47% of savings deposits, and 55% of money market deposits are included in

amounts repricing within one year. At December 31, 2009, 18% of checking deposits, 51% of savings deposits, and 54% of money market deposits are included in amounts

repricing within one year.

(4) Includes $700 million of callable borrowings.