TCF Bank 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 84 • TCF Financial Corporation and Subsidiaries

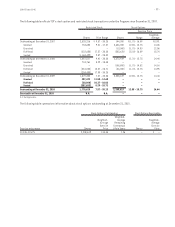

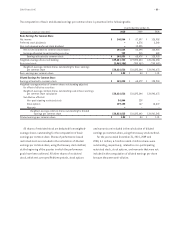

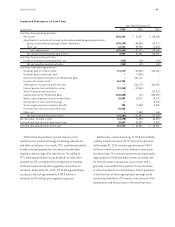

The following table summarizes the pre-tax impact

of foreign exchange activity on other non-interest

expense within the Consolidated Statements of Income

and Consolidated Statements of Financial Condition, by

accounting designation.

Year Ended

(In thousands) December 31, 2010

Foreign exchange gains $ 1,720

Forward foreign exchange contract losses:

Net investment hedge –

Cash flow hedge –

Not designated as hedges (1,976)

Total (1,976)

Accumulated other comprehensive income (loss):

Foreign currency translation adjustment 575

Net investment hedge (195)

Cash flow hedge (1)

Total $ 379

TCF executes all of its foreign exchange contracts in

the over-the-counter market with large, international

financial institutions. These contracts also include credit

risk-related contingent features, primarily in the form

of International Swaps and Derivatives Association, Inc.

(“ISDA”) master agreements that enhance the credit-

worthiness of these instruments as compared to other

obligations of the respective counterparty with whom TCF

has transacted. These contingent features may be for the

benefit of TCF, as well as its counterparties with respect to

changes in TCF’s creditworthiness. At December 31, 2010,

TCF had posted $854 thousand of U.S. Treasury securities

as collateral in the normal course of business under such

agreements. The amount of collateral required depends on

the contract and is determined daily based on market and

currency exchange rate conditions.

In connection with certain over-the-counter forward

foreign exchange contracts, TCF could be required to provide

additional collateral or to terminate transactions with

certain counterparties in the event that, among other

things, TCF National Bank’s long-term debt is rated less than

BB- by Standard and Poor’s ratings group. At December 31,

2010, approximately $1.3 million of additional collateral

would be required if the credit risk-related contingent

features were triggered, which would bring the total

collateral required to $2.1 million at December 31, 2010.

There were $349 thousand of forward foreign exchange

contracts containing credit risk related features in a net

liability position at December 31, 2010.

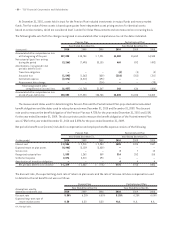

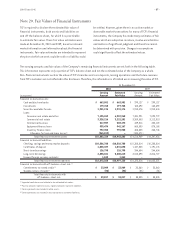

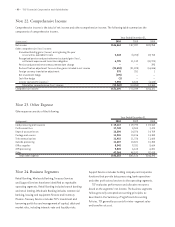

Note 19. Fair Value Measurement

Fair values represent the estimated price that would

be received from selling an asset or paid to transfer a

liability, otherwise known as an “exit price”. The following

is a description of valuation methodologies used for

assets recorded at fair value on a recurring basis at

December 31, 2010.

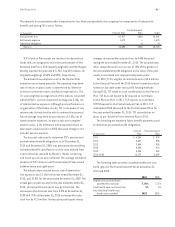

Securities Available for Sale Securities available

for sale consist primarily of U.S. Government sponsored

enterprise securities and U.S. Treasury bills. The fair

value of U.S. Government sponsored enterprise securities

is recorded using prices obtained from independent

asset pricing services that are based on observable

transactions, but not quoted markets, and are classified

as Level 2 assets. The fair value of U.S. Treasury bills is

recorded using prices obtained from independent asset

pricing services that obtain prices from brokers and active

market participants, and are classified as Level 1 assets.

Management reviews the prices obtained from independent

asset pricing services for unusual fluctuations and

comparisons to current market trading activity. However,

management does not adjust these prices.

Other securities, for which there is little or no market

activity, are categorized as Level 3 assets. Other securities

classified as Level 3 assets include equity investments

in other thinly traded financial institutions and foreign

debt securities. The fair value of these assets is determined

by using quoted prices, when available, and incorporating

results of internal pricing techniques and observable

market information, which is adjusted for security

specific information, such as financial statement strength,

earnings history, disclosed fair value measurements,

recorded impairments and key financial ratios, to

determine fair value.

Assets Held in Trust for Deferred Compensation

Assets held in trust for deferred compensation plans

included investments in publicly traded stocks, excluding

TCF common stock reported in treasury and other in equity,

and mutual funds. The fair value of these assets is based

upon prices obtained from independent asset pricing

services based on active markets.