TCF Bank 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 73 •

2010 Form 10-K

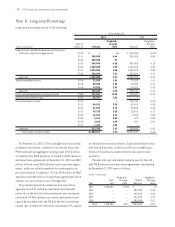

The $71 million of subordinated notes due 2014 will

reprice quarterly at the three-month LIBOR rate plus 1.63%.

These subordinated notes may be redeemed by TCF Bank at

par once a quarter at TCF’s discretion. The $50 million of

subordinated notes due 2015 will reprice quarterly at the

three-month LIBOR rate plus 1.56%. These subordinated

notes may be redeemed by TCF Bank at par once a quarter at

TCF’s discretion. The $74.6 million of subordinated notes due

2016 have a fixed-rate coupon of 5.5% until February 1, 2016.

All of these subordinated notes qualify as Tier 2 or supple-

mentary capital for regulatory purposes, subject to certain

limitations.

TCF’s trust preferred securities are callable, with Federal

Reserve approval, at par beginning August 15, 2013 or within

90 days of the occurrence of a Capital Treatment Event, as

defined by TCF’s trust preferred securities Supplemental

Indenture dated August 19, 2008.

During the second quarter of 2010, TCF entered into a $90

million senior unsecured variable-rate term note maturing in

July 2012. The loan is prepayable and contains certain cov-

enants common to such agreements. TCF was not in default

with respect to any covenants at December 31, 2010.

For certain equipment leases, TCF sells its minimum

lease rentals to other financial institutions at fixed rates

on a non-recourse basis with its underlying equipment as

collateral as a credit risk reduction tool and such transaction

did not qualify as sales. In the event of a default by customer

on these leases, the other financial institution has a first lien

on the underlying leased equipment and TCF is only entitled

to residual proceeds in excess of the outstanding borrowing

balance. In these non-recourse financings, the other financial

institution has no further recourse against TCF.

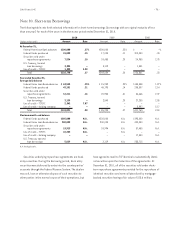

Note 12. Income Taxes

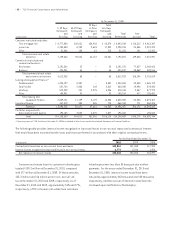

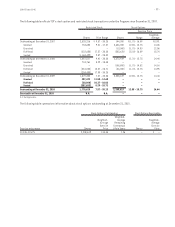

(In thousands) Current Deferred Total

Year ended December 31, 2010:

Federal $49,462 $24,740 $74,202

State 11,695 1,868 13,563

Total $61,157 $26,608 $87,765

Year ended December 31, 2009:

Federal $ 4,311 $33,775 $38,086

State 6,285 1,483 7,768

Total $10,596 $35,258 $ 45,854

Year ended December 31, 2008:

Federal $46,627 $24,191 $70,818

State 1,715 4,169 5,884

Total $48,342 $28,360 $ 76,702

The effective income tax rate differs from the federal

income tax rate of 35% as a result of the following.

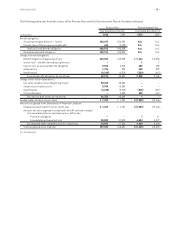

Year Ended December 31,

2010 2009 2008

Federal income tax rate 35.00% 35.00% 35.00%

Increase (decrease) in income

tax expense resulting from:

State income tax,net

of federal income

tax benefit 3.71 3.81 1.86

Investments in

affordable housing (.78) (1.42) (.77)

Deductible stock dividends (.25) (.85) (1.60)

Changes in uncertain

tax positions (.15) (3.42) .57

Compensation deduction

limitations .18 .75 .77

Deferred tax adjustments

due to law changes – .35 1.40

Non-controlling interest

tax effect (.49) .11 –

Other, net (.29) .27 .07

Effective income tax rate 36.93% 34.60% 37.30%

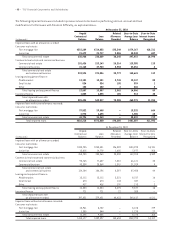

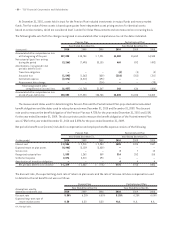

A reconciliation of the change in the gross amount,

before related tax effects, of unrecognized tax benefits

from January 1, 2010 to December 31, 2010 is as follows:

(In thousands)

Balance at January 1, 2010 $2,857

Increases for tax positions related to the current year 562

Decreases for tax positions related to prior years (251)

Decreases related to lapses of applicable statutes

of limitation (704)

Balance at December 31, 2010 $2,464

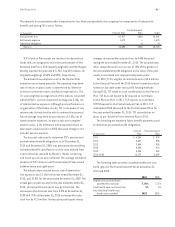

The total amount of unrecognized tax benefits that,

if recognized, would affect the tax provision and the

effective income tax rate is $1 million, net of related

tax benefit effects. The gross amount of accrued interest

on unrecognized tax benefits was $218 thousand at

December 31, 2010. TCF recorded a reduction of accrued

interest of $154 thousand and $419 thousand during 2010

and 2009, respectively.