TCF Bank 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

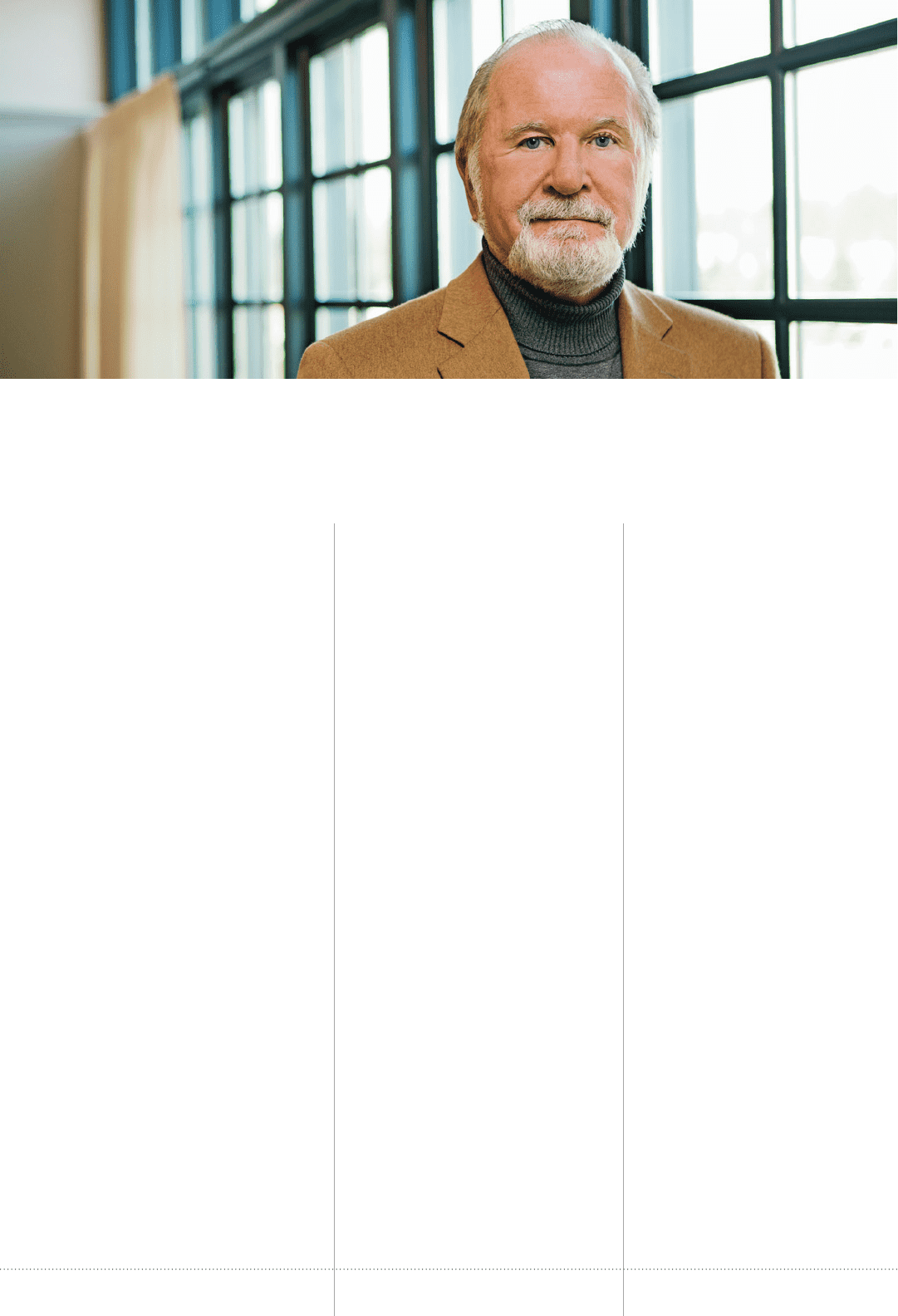

William A. Cooper,

Chairman of the Board & Chief Executive Officer

As I finish my 25th year as Chairman

of TCF, it is rewarding to see that we

have been able to create a successful

company with sustained profitability

through the various economic cycles.

I attribute our success to a conservative

philosophy of banking, which is

embedded in everything we do at

TCF. At year end, TCF reported its 63rd

consecutive quarter of profitability.

This is a noteworthy achievement few

of our competitors can match. At TCF,

we value a large and growing customer

base and deliver on our core conve-

nience promise; we believe in secured

and diversified lending to minimize

risk; we focus on prudent capital and

liquidity management to create a safe

and sound bank; and we manage our

expenses very well. We have a business

model that works, despite the economic

conditions we have faced.

As important as what we have done are

the things we have not done. TCF never

made any subprime loans. We never

securitized any loans. We did not

conduct business with Fannie Mae® or

Freddie Mac®. We don’t own any credit

default swaps. All of our assets are on

our balance sheet. Virtually all of our

loans are secured. We are largely

funded with low-cost retail deposits

and we don’t participate in nationally

syndicated credits.

2010 was yet another tumultuous year

in the financial services industry. Many

economists and bankers, including

myself, thought 2010 would be “The

Comeback Year” in which real signs of

economic improvement would be seen

throughout the country. Instead, we

continued to see elevated unemploy-

ment rates, depressed values on homes

and other assets, and businesses

postponing projects.

Change in 2010 came mainly from

expansion of government intervention

into the financial services industry.

Compliance with new legislation and

regulation for all financial institutions

has been significant in terms of both

time and cost, but more painful for

institutions like TCF that never partici-

pated in the various activities that

caused the financial crisis in the

first place. This level of government

oversight is unlike any I have seen

in my career. However, I can say with

certainty that banks, including TCF, will

find ways to continue to address these

issues going forward.

At December 31, 2010, TCF’s stock price

closed at $14.81 per share, up from

$13.62 per share on December 31,

2009 and a 52-week low of $12.90 on

November 1, 2010. We have seen

significant volatility in the stock price

over the past 52 weeks and increased

short-selling activity, but by year-end

the pressure on our stock price was

related mainly to the uncertainty

around the regulatory environment,

which I expect to settle somewhat

in 2011 when we know more where

these new regulations will land.

A Look At 2010

• TCF management and staff spent a

great deal of time and effort around

compliance with new and proposed

regulations in 2010, primarily around

the following items:

Opt-in Initiative On August 15, 2010,

new regulations on overdraft fees

specific to ATM transactions and

one-time debit card transactions became

fully effective. TCF was one of the first

banks in the country to proactively

implement a highly successful customer

education program around this issue

and the number of opt-ins has been a

true testament of how our customers

Dear Stockholders: