TCF Bank 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 15 •

2010 Form 10-K

any event it has meritorious defenses to the claims brought

by the plaintiffs. At this stage of the litigation, it is not

possible for management of TCF to determine the probability

of a material adverse outcome or reasonably estimate the

amount of any potential loss.

From time to time, TCF is also a party to other legal

proceedings arising out of its lending, leasing and deposit

operations. TCF is, and expects to become, engaged in a

number of foreclosure proceedings and other collection

actions as part of its lending and leasing collections

activities. TCF may also be subject to enforcement action

by federal regulators, including the Securities and Exchange

Commission, the Federal Reserve and the OCC. From time to

time, borrowers and other customers, or employees or

former employees, have also brought actions against TCF,

in some cases claiming substantial damages. Financial

services companies are subject to the risk of class action

litigation, and TCF is subject to such actions brought

against it from time to time. Litigation is often

unpredictable and the actual results of litigation cannot

be determined with certainty, and therefore the ultimate

resolution of a matter and the possible range of loss

associated with certain potential outcomes cannot be

established with confidence. Based on our current

understanding of these pending legal proceedings,

management does not believe that judgments or

settlements arising from pending or threatened legal

matters, individually or in the aggregate, would have a

material adverse effect on the consolidated financial

position, operating results or cash flows of TCF.

Part II

Item 5. Market for Registrant’s

Common Equity, Related

Stockholder Matters and Issuer

Purchases of Equity Securities

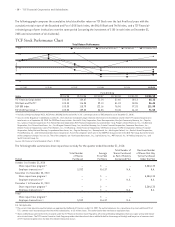

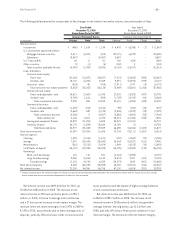

TCF’s common stock trades on the New York Stock Exchange

under the symbol “TCB”. The following table sets forth the

high and low prices and dividends declared for TCF’s com-

mon stock. The stock prices represent the high and low

sale prices for the common stock on the New York Stock

Exchange Composite Tape, as reported by Bloomberg.

As of January 31, 2011, there were 7,299 holders of

record of TCF’s common stock.

Dividends

High Low Declared

2010

Fourth Quarter $16.63 $12.90 $.05

Third Quarter 17.66 13.87 .05

Second Quarter 18.89 14.95 .05

First Quarter 16.83 13.40 .05

2009

Fourth Quarter $14.72 $11.36 $.05

Third Quarter 15.83 12.71 .05

Second Quarter 16.67 11.37 .05

First Quarter 14.31 8.74 .25

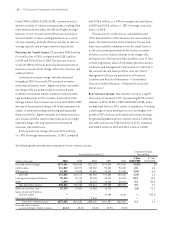

The Board of Directors of TCF Financial and TCF Bank

have adopted a Capital Plan and Dividend Policy. The

policies define how enterprise risk related to capital will be

managed, how the adequacy of capital will be measured

and the process by which capital strategy, capital manage-

ment and common stock dividend recommendations will be

presented to TCF’s Board of Directors. TCF’s management

is charged with ensuring that capital strategy actions,

including the declaration of common stock dividends, are

prudent, efficient and provide value to TCF’s shareholders,

while ensuring that past and prospective earnings retention

is consistent with TCF’s capital needs, asset quality and

overall financial condition. The Board of Directors intends

to continue its practice of paying quarterly cash dividends

on TCF’s common stock as justified by the financial condition

of TCF. The declaration and amount of future dividends will

depend on circumstances existing at the time, including

TCF’s earnings, level of internally generated common

capital excluding earnings, financial condition and capital

requirements, the cash available to pay such dividends

(derived mainly from dividends and distributions from TCF

Bank), as well as regulatory and contractual limitations

and such other factors as the Board of Directors may deem

relevant. In general, TCF Bank may not declare or pay a

dividend to TCF in excess of 100% of its net retained profits

for that year combined with its net retained profits for the

preceding two calendar years without prior approval of the

OCC. Restrictions on the ability of TCF Bank to pay cash

dividends or possible diminished earnings of TCF may limit

the ability of TCF Financial to pay dividends in the future to

holders of its common stock. In addition, the ability of TCF

Financial and TCF Bank to pay dividends is dependent on

regulatory policies and capital requirements and may be

subject to regulatory approval. See “Item 1. Business

— Regulation — Regulatory Capital Requirements”, “Item 1.

Business — Regulation — Restrictions on Distributions”

and Note 14 of Notes to Consolidated Financial Statements.