TCF Bank 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• 48 • TCF Financial Corporation and Subsidiaries

resulting from recently enacted Federal health care reform

legislation; adverse regulatory examinations and resulting

enforcement actions or other adverse consequences such as

increased capital requirements or higher deposit insurance

assessments; heightened regulatory practices, requirements

or expectations, including, but not limited to, requirements

related to the Bank Secrecy Act and anti-money laundering

compliance activity.

Other Risks Relating to Fee Income Uncertainties

relating to TCF’s implementation of new regulatory require-

ments that prohibit financial institutions from charging

NSF fees on point-of-sale and ATM transactions unless

customers opt-in, including customer opt-in preferences

which may have an adverse impact on TCF’s fee revenue;

and uncertainties relating to future retail deposit account

changes such as charging a daily negative balance fee

in lieu of per item NSF fees or other significant changes,

including limitations on TCF’s ability to predict customer

behavior and the impact on TCF’s fee revenues.

Litigation Risks Results of litigation, including class

action litigation concerning TCF’s lending or deposit

activities including account servicing processes or fees or

charges, or employment practices, and possible increases

in indemnification obligations for certain litigation against

Visa U.S.A. (“covered litigation”) and potential reductions

in card revenues resulting from covered litigation or other

litigation against Visa.

Competitive Conditions; Supermarket Branching Risk

Reduced demand for financial services and loan and lease

products; adverse developments affecting TCF’s supermar-

ket banking relationships or any of the supermarket chains

in which TCF maintains supermarket branches.

Accounting, Audit, Tax and Insurance Matters

Changes in accounting standards or interpretations of

existing standards; federal or state monetary, fiscal or

tax policies, including adoption of state legislation that

would increase state taxes; adverse state or Federal tax

assessments or findings in tax audits; lack of or inadequate

insurance coverage for claims against TCF.

Technological and Operational Matters Technological,

computer-related or operational difficulties or loss or theft

of information and the possibility that deposit account

losses (fraudulent checks, etc.) may increase.

Item 7A. Quantitative and

Qualitative Disclosures About

Market Risk

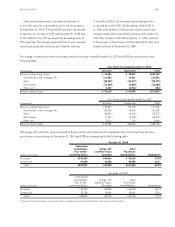

TCF’s results of operations are dependent to a large

degree on its net interest income and its ability to manage

interest-rate risk. Although TCF manages other risks, such

as credit risk, liquidity risk, operational and other risks, in

the normal course of its business, the Company considers

interest-rate risk to be one of its most significant market

risks. See “Item 1A. Risk Factors – Enterprise Risk

Management — Market Risk Management (Including

Interest-Rate and Liquidity Risk)” for further discussion.

Since TCF does not hold a trading portfolio, the Company

is not exposed to market risk from trading activities. A

mismatch between maturities, interest rate sensitivities

and prepayment characteristics of assets and liabilities

results in interest-rate risk. TCF, like most financial institu-

tions, has material interest-rate risk exposure to changes

in both short-term and long-term interest rates as well as

variable interest rate indices (e.g., the prime rate).

TCF’s Asset/Liability Management Committee (ALCO)

manages TCF’s interest-rate risk based on interest rate

expectations and other factors. The principal objective of

TCF’s asset/liability management activities is to provide

maximum levels of net interest income while maintaining

acceptable levels of interest-rate risk and liquidity risk

and facilitating the funding needs of the Company.

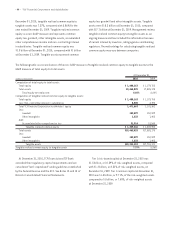

TCF utilizes net interest income simulation models to

estimate the near-term effects (next 1-2 years) of chang-

ing interest rates on its net interest income. Net interest

income simulation involves forecasting net interest income

under a variety of scenarios, including the level of interest

rates, the shape of the yield curve, and spreads between

market interest rates. At December 31, 2010, net interest

income is estimated to increase slightly by 1% compared

with the base case scenario, over the next 12 months if

short- and long-term interest rates were to sustain an

immediate increase of 100 basis points.

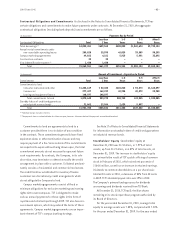

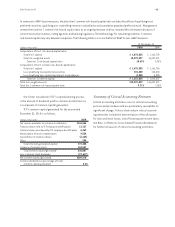

Management exercises its best judgment in making

assumptions regarding events that management can influ-

ence such as non-contractual deposit repricings and events

outside management’s control such as customer behavior

on loan and deposit activity, counterparty decisions on

callable borrowings and the effect that competition has

on both loan and deposit pricing. These assumptions are