TCF Bank 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

inventory finance portfolio balances

increased $406.6 million, or 11 percent,

during 2010. Growth momentum in

specialty finance stemmed from portfolio

purchases and program acquisitions

as well as organic growth. Our highest

yielding loans and leases reside in

specialty finance, yet we are able to

minimize concentration risk by diversify-

ing these businesses by industry,

geography, product and collateral type.

TCF’s leasing and equipment finance

business grew 3 percent in 2010. This

$3.2 billion portfolio is well-diversified

by equipment type and by geography.

Our leasing and equipment finance

operation, which is comprised of TCF

Equipment Finance and Winthrop

Resources Corporation, is now the

29th largest in the United States, and is

the 13th largest bank-affiliated leasing

company in the United States.

In 2010, TCF Equipment Finance, Inc.

(TCFEF) expanded its capital markets

division, which focuses on portfolio and

company acquisition activities as well

as individual transactions on both the

buy and sell side. Expansion of the

capital markets activities has increased

our ability to acquire assets at a time

when the industry has been looking

for new sources of liquidity. TCFEF

completed a portfolio acquisition of

middle market leases toward the end

of the third quarter, which contributed

to increased leasing and equipment

finance balances at the end of the year.

TCFEF employs 322 people and was

recognized as one of the Minneapolis

Star Tribune’s Top 100 Workplaces in

the Twin Cities metro area in 2010.

Winthrop Resources Corporation is our

technology-oriented leasing company.

Its acquisition of Fidelity National

Capital, Inc. late in 2009 has yielded

solid returns for us as we integrated

the business and the new team of

employees into the Winthrop culture.

In 2010, Winthrop was recognized by

the Equipment Leasing and Finance

Association (ELFA) as recipient of

the ELFA Operations and Technology

Award for its successful implementa-

tion of a lease accounting and

management system.

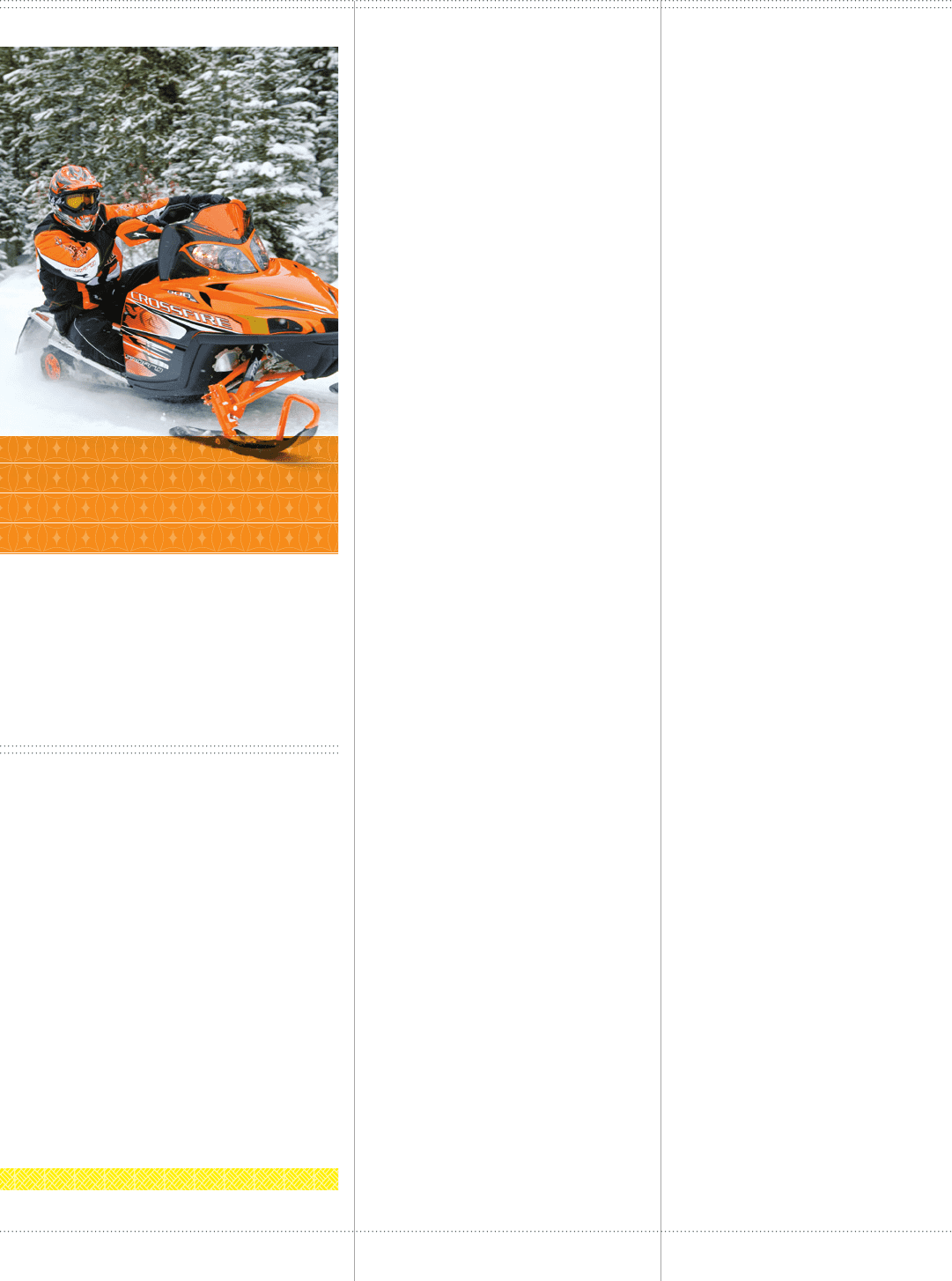

TCF’s newest specialty finance business

is TCF Inventory Finance, Inc. (TCFIF).

TCFIF provides floorplan financing

principally for dealers of consumer

products in the United States and

Canada. We started the business in late

2008 by entering into the consumer

electronics and household appliances

industries, expanded into the lawn and

garden industry in 2009, and further

expanded in 2010 into the power

sports industry with the assumption of

floorplan financing programs in Canada

for Arctic Cat Sales, Inc. We also entered

a relationship in the United States with

E-Z-GO®

, a Textron, Inc. Company. It is

clear that TCFIF is focused on estab-

lishing relationships with suppliers,

dealer buying groups and manufacturers

that are leaders in the industries we

serve. Our joint venture established in

2009 with The Toro Company, a leader

in the lawn and garden industry based

in Minneapolis, Minnesota, continues

to be very strong and productive.

At year-end, the TCFIF portfolio balance

was $792.4 million with indirect credit

lines to 169 manufacturers and buying

groups and direct credit lines with

8,866 dealers in the United States

and Canada. This management team

continues to work hard to position the

We focus on diversifying

our assets by business line

and geography to minimize

concentration risk. An

example is the growth

of our specialty nance

businesses through portfolio

acquisitions

—

like TCF

Inventory Finance’s acquisition

of Arctic Cat® Canadian

power sports equipment

oorplan programs.

Asset

Diversication

• 6 • TCF Financial Corporation and Subsidiaries