TCF Bank 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 37 •

2010 Form 10-K

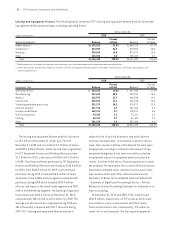

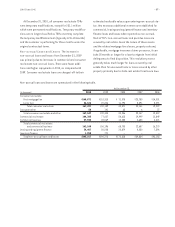

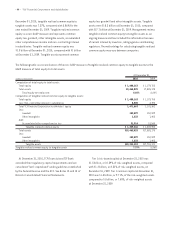

At December 31, 2010, all consumer real estate TDRs

were temporary modifications, except for $31.1 million

which were permanent modifications. Temporary modifica-

tions are no longer classified as TDRs once they complete

the temporary modification term (typically 12 to 18 months)

and the customer is performing for three months under the

original contractual terms.

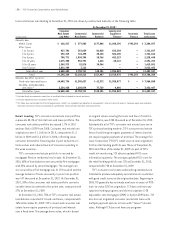

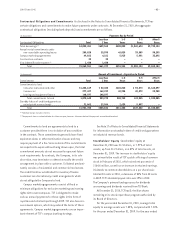

Non-accrual Loans and Leases The increase in

non-accrual loans and leases from December 31, 2009

was primarily due to increases in commercial and consumer

real estate non-accrual loans. There were fewer addi-

tions and higher repayments in 2010, as compared with

2009. Consumer real estate loans are charged-off to their

estimated realizable values upon entering non-accrual sta-

tus. Any necessary additional reserves are established for

commercial, leasing and equipment finance and inventory

finance loans and leases when reported as non-accrual.

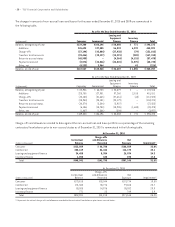

Most of TCF’s non-accrual loans and past due loans are

secured by real estate. Given the nature of these assets

and the related mortgage foreclosure, property sale and,

if applicable, mortgage insurance claims processes, it can

take 18 months or longer for a loan to migrate from initial

delinquency to final disposition. This resolution process

generally takes much longer for loans secured by real

estate than for unsecured loans or loans secured by other

property primarily due to state real estate foreclosure laws.

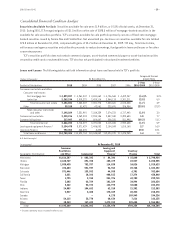

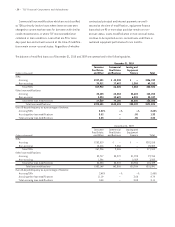

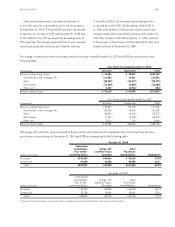

Non-accrual loans and leases are summarized in the following table.

At December 31,

(In thousands) 2010 2009 2008 2007 2006

Consumer real estate

First mortgage lien $140,871 $118,313 $ 71,078 $23,750 $14,001

Junior lien 26,626 20,846 11,793 5,391 5,291

Total consumer real estate 167,497 139,159 82,871 29,141 19,292

Consumer other 50 141 65 6 27

Total consumer real estate and other 167,547 139,300 82,936 29,147 19,319

Commercial real estate 104,305 77,627 54,615 19,999 12,849

Commercial business 37,943 28,569 14,088 2,658 3,421

Total commercial real estate

and commercial business 142,248 106,196 68,703 22,657 16,270

Leasing and equipment finance 34,407 50,008 20,879 8,050 7,596

Inventory finance 1,055 771 – – –

Total non-accrual loans and leases $345,257 $296,275 $172,518 $59,854 $43,185