TCF Bank 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 63 •

2010 Form 10-K

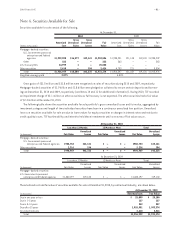

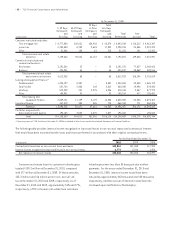

Acquired Loans and Leases During the year ended 2010,

TCF paid $186.8 million to acquire leasing and equipment

finance loans and leases having remaining contractual

principal cash flows including residual on leases of $186.8

million and paid $168.6 million to acquire inventory finance

loans having remaining contractual principal cash flows

of $168.6 million. In total, TCF paid $355.4 million during

the year ended 2010 to acquire loans and leases having

remaining contractual principal cash flows including residual

on leases of $355.4 million. At the time of acquisition,

the expected principal cash flows including residual on

leases to be collected over the life of the contracts was

$355.2 million. As of December 31, 2010, it was probable

that TCF would not collect all contractual principal remain-

ing cash flows, but it was probable that TCF would collect

more than the expected principal cash flows including

residual on leases.

During the year ended 2009, TCF paid $339.9 million to

acquire leasing and equipment finance loans and leases

having remaining contractual principal cash flows including

residual on leases of $353.9 million and paid $274.7 million

to acquire inventory finance loans having remaining

contractual principal cash flows of $277.7 million. In

total, TCF paid $614.6 million during the year ended 2009

to acquire loans and leases having remaining contractual

principal cash flows including residual on leases of $631.6

million. At the time of acquisition, the expected principal

cash flows including residual on leases to be collected over

the life of the contracts was $615.2 million. For these loans

and leases, it was probable that TCF would not collect all of

the contractual principal amounts due, but was probable

that TCF would collect more than the expected principal

cash flows including residual on leases.

These loans and leases were initially recorded at fair

value and a non-accretable discount was established for

the difference between the contractual principal cash flows

and the expected principal cash flows determined at the

time of acquisition.

Non-accretable discounts of $4.2 million and $10.2

million remained on these portfolios at December 31, 2010,

and December 31, 2009, respectively. In the future, if TCF

is unable to collect the expected cash flows or revises its

expectations below the current level, an allowance for credit

losses will be established on these acquired portfolios.

The excess of expected principal cash flows to be col-

lected over the initial fair value of the acquired portfolios

is referred to as the accretable yield and is accreted into

interest income over the estimated life of the acquired

portfolios using the effective yield method. The accretable

yield is affected by changes in interest rate indices for

variable-rate acquired portfolios, changes in prepayment

assumptions and changes in the expected principal and

interest payments over the estimated life of the loan. These

loans and leases are classified as accruing and interest

income continues to be recognized unless expected losses

exceed the non-accretable discount.

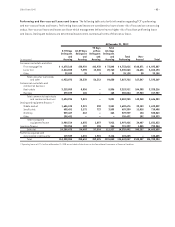

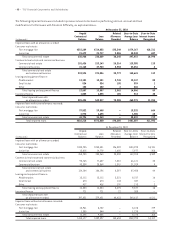

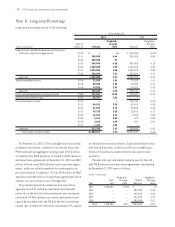

The following table provides a rollforward of unamortized

accretable yield for all acquired loan and lease portfolios

during the years ended December 31, 2010 and 2009.

Year Ended

December 31,

(In thousands) 2010 2009

Balance, at beginning of year $ (13) $ –

Portfolio acquisitions (214) 833

Reclassification from non-accretable

discount for loans with improving

cash flows 221 –

Accretion (183) (846)

Balance, at end of year $(189) $ (13)

Within the loan and lease portfolios acquired in 2009,

there were certain loans which had experienced deterioration

in credit quality at the time of acquisition. These loans

had outstanding principal balances of $13.7 million and

$21.6 million at December 31, 2010 and 2009, respectively.

The non-accretable discount on loans acquired with

deteriorated credit quality was $769 thousand and $1

million at December 31, 2010 and 2009, respectively. The

remaining accretion to be recognized in expense for these

loans was $207 thousand at December 31, 2010, and $376

thousand at December 31, 2009. Accretion of $169 thousand

and $149 thousand was recorded during the years ended

December 31, 2010 and 2009, respectively.