TCF Bank 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• 46 • TCF Financial Corporation and Subsidiaries

Recent Accounting Developments

On July 21, 2010, the Financial Accounting Standards Board

(“FASB”) issued Accounting Standards Update (“ASU”)

No. 2010-20, Disclosures about the Credit Quality of

Financing Receivables and the Allowance for Credit Losses,

which requires significant new disclosures about the

allowance for credit losses and the credit quality of

financing receivables. The FASB has elected to defer

the disclosures related to TDRs included within ASU No.

2010-20. The disclosures related to TDRs are expected to

be effective for the second quarter 2011. The remaining

disclosures under ASU No. 2010-20 were not deferred and

are included in Note 6 of Notes to Consolidated Financial

Statements, “Allowance for Loan and Lease Losses and

Credit Quality Information”.

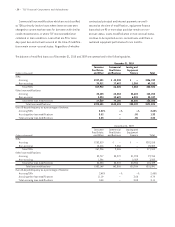

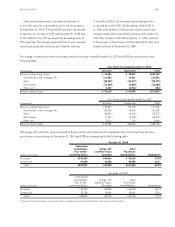

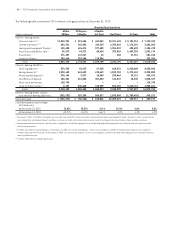

Fourth Quarter Summary

In the fourth quarter of 2010, TCF reported net income of

$30.7 million, compared with $19.5 million in the fourth

quarter of 2009. Diluted earnings per common share was

22 cents for the fourth quarter of 2010, compared with 15

cents for the same 2009 period.

Net interest income was $174.3 million for the quarter

ended December 31, 2010, up $4.6 million, or 2.7%, from

the quarter ended December 31, 2009. The increase in net

interest income was primarily due to decreased rates paid

on deposits and increases in Specialty Finance loans and

leases, partially offset by the impact of increased asset

liquidity and decreased income from consumer loans. The

net interest margin was 4.04% and 4.07% for the fourth

quarter of 2010 and 2009, respectively.

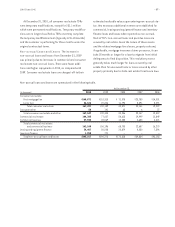

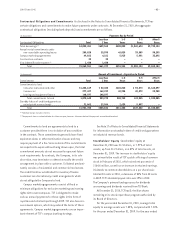

TCF provided $77.6 million for credit losses in the fourth

quarter of 2010, compared with $77.4 million in the fourth

quarter of 2009. The net increase was primarily due to

increased reserves and charge-offs in the commercial real

estate portfolio partially offset by decreased levels of

provision in excess of net charge-offs in the consumer real

estate portfolio. For the fourth quarter of 2010, net loan

and lease charge-offs were $64.9 million, or 1.75% of aver-

age loans and leases outstanding, compared with $48.7

million, or 1.35% of average loans and leases outstanding

during the same 2009 period. The increase was primarily

due to in commercial loan and consumer real estate net

charge-offs.

Total non-interest income in the fourth quarter of

2010 was $141.5 million, compared with $143.1 million in

the fourth quarter of 2009. The decrease in non-interest

income was primarily due to a decrease in leasing revenues

and fees and service charges. Fees and service charges were

$61.5 million, down 17.9% from the fourth quarter of 2009,

primarily due to a decrease in activity-based fee revenue

as a result of the implementation of recent overdraft fee

regulations, partially offset by increased monthly

maintenance fee income. Card revenues totaled $27.6

million for the fourth quarter of 2010, up 3% over the same

2009 period. Leasing and equipment finance revenues were

$23.4 million for the fourth quarter of 2010, down $1 million

from the fourth quarter of 2009 primarily due to decreased

operating lease revenue as a result of operating lease

runoff from the FNCI acquisition that occurred during 2009,

which was partially offset by a corresponding decrease in

operating lease depreciation.

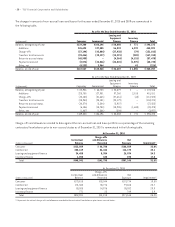

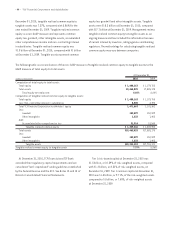

Non-interest expense totaled $190.5 million for the 2010

fourth quarter, a decrease of $16.3 million, or 7.9%, from

$206.8 million for the 2009 fourth quarter. Compensation

and employee benefits decreased $2 million, or 2.2%, from

the fourth quarter of 2009, primarily due to headcount

reductions and decreased employee medical plan expenses,

partially offset by increased costs in the Specialty Finance

businesses as a result of expansion and growth. Deposit

account premium expense decreased $7.7 million from the

fourth quarter of 2009, primarily due to revised marketing

strategies and lower checking account production. Other

expense in the fourth quarter of 2010 decreased $2.9 million,

or 7.2%, from the fourth quarter of 2009 primarily attribut-

able to a decrease in severance costs, as a result of the reor-

ganization of the company’s structure and business segments

in the fourth quarter of 2009. Other credit costs, net in the

fourth quarter of 2010 decreased $2.8 million, or 64.8%, from

the fourth quarter of 2009 primarily due to the reversal of

reserves on several unfunded commitments that were closed

and lower costs of consumer real estate loan pool insurance.

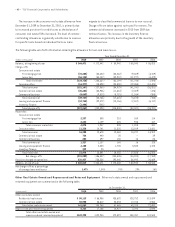

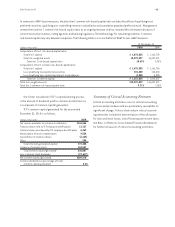

In the fourth quarter of 2010, the effective income tax

rate was 33.61% of income before tax expense, up from

32.77% for the fourth quarter of 2009. The effective tax rate

for the fourth quarter of both 2010 and 2009 included the

effects of year-to-date changes in the estimated annual

effective tax rate of approximately $1 million.