TCF Bank 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• 28 • TCF Financial Corporation and Subsidiaries

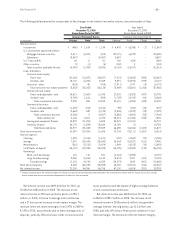

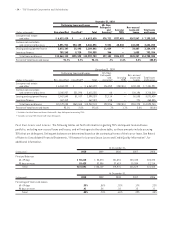

costs, net totaled $6 million for 2010, down from $12.1

million in 2009. The decrease for 2010 as compared to

2009 was primarily attributable to the reversal of reserves

on several unfunded commitments that were closed and

lower premium costs related to consumer real estate loan

pool insurance. Other credit costs, net totaled $12.1

million in 2009, up $8.8 million from 2008. The increase for

2009 as compared to 2008 was primarily attributable to

higher premium costs related to consumer real estate loan

pool insurance.

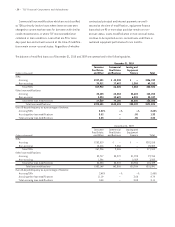

Visa Indemnification Expense TCF is a member of Visa

U.S.A. for issuance and processing of its card transactions.

As a member of Visa, TCF has an obligation to indemnify

Visa U.S.A. under its bylaws and Visa under a retrospective

responsibility plan, for contingent losses in connection

with certain covered litigation (“the Visa indemnification”)

disclosed in Visa’s public filings with the SEC based on its

membership proportion. TCF is not a party to the lawsuits

brought against Visa U.S.A. TCF’s membership proportion in

Visa U.S.A. is .16234% at December 31, 2010.

As of December 31, 2010, TCF held 308,219 Visa Inc.

Class B shares with no recorded value that are generally

restricted from sale, other than to other Class B share-

holders, and are subject to dilution as a result of TCF’s

indemnification obligation.

At December 31, 2010, TCF’s estimated remaining Visa

contingent indemnification obligation was $1.4 million.

During the fourth quarter of 2010, TCF, based on informa-

tion made public by Visa U.S.A., reduced the contingency

obligation related to the Visa indemnification for certain

covered litigation matters by $1 million. The remaining

covered litigation against Visa is primarily with card retailers

and merchants, mostly related to fees and interchange rates.

TCF’s remaining indemnification obligation for Visa’s covered

litigation is a highly judgmental estimate. TCF must rely on

Visa’s public disclosures about the covered litigation in mak-

ing estimates of this contingent indemnification obligation.

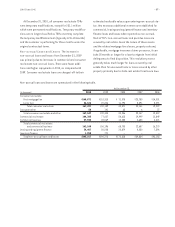

Income Taxes Income tax expense represented 36.93% of

income before income tax expense during 2010, compared

with 34.60% and 37.30% in 2009 and 2008, respectively. The

higher effective income tax rate for 2010 as compared with

2009 and the lower effective income tax rate for 2009 as

compared with 2008 are primarily due to significant favor-

able developments in uncertain tax positions in 2009.

The determination of current and deferred income taxes

is a critical accounting estimate which is based on com-

plex analyses of many factors including interpretation of

income tax laws, the evaluation of uncertain tax positions,

differences between the tax and financial reporting bases

of assets and liabilities (temporary differences), estimates

of amounts due or owed such as the timing of reversal of

temporary differences and current financial accounting

standards. Additionally, there can be no assurance that

estimates and interpretations used in determining income

tax liabilities may not be challenged by taxing authorities.

Actual results could differ significantly from the estimates

and tax law interpretations used in determining the current

and deferred income tax liabilities.

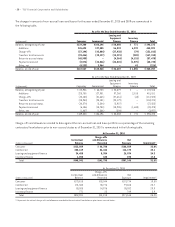

In addition, under generally accepted accounting

principles, deferred income tax assets and liabilities are

recorded at the income tax rates expected to apply to

taxable income in the periods in which the deferred income

tax assets or liabilities are expected to be realized. If such

rates change, deferred income tax assets and liabilities

must be adjusted in the period of change through a charge

or credit to the Consolidated Statements of Income. Also, if

current period income tax rates change, the impact on the

annual effective income tax rate is applied year-to-date in

the period of enactment.

As discussed under “Item 1A. Risk Factors — Other Risks

— Income Taxes”, TCF uses a REIT and related companies in

the management of qualified real estate secured assets. In

the third quarter of 2009, TCF received notice from a state

taxing authority challenging use of the REIT and related

companies based on a recent court decision unrelated to

TCF and unrelated to the laws in place for the years in the

notice. In May 2010, the state’s Supreme Court unanimously

overturned the lower court’s decision on which the state

taxing authority relied. In September 2010, the state

taxing authority informed TCF it was conceding its position

and withdrawing its notice. This closure had no effect on

TCF’s liability for uncertain tax positions.