TCF Bank 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 53 •

2010 Form 10-K

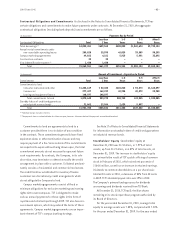

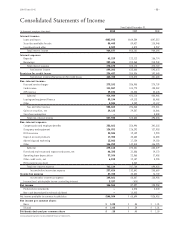

Consolidated Statements of Income

Year Ended December 31,

(In thousands, except per-share data) 2010 2009 2008

Interest income:

Loans and leases $883,923 $864,384 $847,512

Securities available for sale 80,445 89,427 110,946

Investments and other 5,509 4,370 5,937

Total interest income 969,877 958,181 964,395

Interest expense:

Deposits 61,229 122,112 156,774

Borrowings 209,446 203,063 213,948

Total interest expense 270,675 325,175 370,722

Net interest income 699,202 633,006 593,673

Provision for credit losses 236,437 258,536 192,045

Net interest income after provision for credit losses 462,765 374,470 401,628

Non-interest income:

Fees and service charges 273,181 286,908 270,739

Card revenue 111,067 104,770 103,082

ATM revenue 29,836 30,438 32,645

Subtotal 414,084 422,116 406,466

Leasing and equipment finance 89,194 69,113 55,488

Other 5,584 5,239 12,107

Fees and other revenue 508,862 496,468 474,061

Gains on securities, net 29,123 29,387 16,066

Visa share redemption – – 8,308

Total non-interest income 537,985 525,855 498,435

Non-interest expense:

Compensation and employee benefits 352,861 356,996 341,203

Occupancy and equipment 126,551 126,292 127,953

FDIC insurance 23,584 19,109 2,990

Deposit account premiums 17,304 30,682 16,888

Advertising and marketing 13,062 17,134 19,150

Other 146,253 142,818 146,295

Subtotal 679,615 693,031 654,479

Foreclosed real estate and repossessed assets, net 40,385 31,886 19,170

Operating lease depreciation 37,106 22,368 17,458

Other credit costs, net 6,018 12,137 3,296

FDIC special assessment – 8,362 –

Total non-interest expense 763,124 767,784 694,403

Income before income tax expense 237,626 132,541 205,660

Income tax expense 87,765 45,854 76,702

Income after income tax expense 149,861 86,687 128,958

Income (loss) attributable to non-controlling interest 3,297 (410) –

Net income 146,564 87,097 128,958

Preferred stock dividends – 6,378 2,540

Non-cash deemed preferred stock dividend – 12,025 –

Net income available to common stockholders $146,564 $ 68,694 $126,418

Net income per common share:

Basic $ 1.05 $ .54 $ 1.01

Diluted $ 1.05 $ .54 $ 1.01

Dividends declared per common share $ .20 $ .40 $ 1.00

See accompanying notes to consolidated financial statements.