TCF Bank 2010 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We continue to be innovative and look for opportunities to create

and deliver value to our stockholders.

• Potential reductions in our borrowing

capacity because of restrictions put on

the Federal Home Loan Banks or the

Federal Reserve Discount Window could

reduce our liquidity and inhibit growth

or force higher deposit costs. Growing

core deposits reduces this risk.

• Changes in customer behavior from

the slowing economy and advances in

technology could further impact fee

revenue. In addition, further changes

to our product and service offerings in

response to legislative changes could

impact customer banking preferences

in the future.

• Growth expectations of our new

inventory finance business may not be

achieved. This new line of business has

been very successful for TCF, however,

the ability to retain existing business

relationships and attract new custom-

ers has become more challenging as

we find ourselves repeatedly compet-

ing with the nation’s largest inventory

finance provider.

• A further deterioration of the public’s

perception of banks. When public

perception sours as a result of bad

behavior from some of the largest

players, smaller community banks

like TCF suffer the most. Therefore, it

is important we continue to stick to

our knitting and provide products

and services that appeal to all people.

TCF has prudently managed these types

of risks in the past and we believe we

are adequately prepared to manage

them in the future.

In Closing

TCF remains a safe and sound financial

institution. Our capital position is

strong and we have ample liquidity to

conduct business. I am proud we have

held tight to our conservative banking

principles and, as a result, TCF has

remained profitable for an astounding

63 consecutive quarters. We continue

to be innovative and look for opportuni-

ties to create and deliver value to

our stockholders despite the recession-

ary environment and government’s

overreach into the banking industry.

We have also demonstrated an ability

to meet our regulatory challenges

head-on. This proactive approach has

proven to be the right thing to do for

our customers and stockholders.

We continue to have a mutuality of

interest with our stockholders. Our

senior management and board of

directors own over 6.2 million shares,

or 4 percent of TCF stock. Eighty-two

percent of our match-eligible employees

participate in TCF’s Employees Stock

Purchase Plan, which at year-end held

over 7.8 million shares.

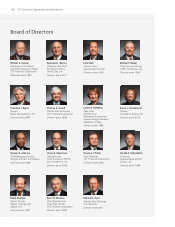

I would like to take this opportunity to

thank the board of directors for their

continued dedication, wise counsel

and support of TCF. It was very much

appreciated in 2010. During the past

year, we welcomed Karen Grandstrand,

Ray Barton and Rick Zona to TCF board

membership. Karen has a wealth of

knowledge and experience in law and

in the banking industry; Ray brings an

entrepreneurial background and insight

into the retail franchise business; and

Rick provides us with his knowledge

and experience in the financial services

industry. We welcome their insights

to assist TCF in our continued growth

and success.

I would also like to give a special

thanks to our employees for their hard

work and efforts during another very

challenging year. Their exceptional

abilities, commitment and energy

make everything happen at TCF.

I am proud of the TCF Team and our

accomplishments.

Thank you for your continued support

and investment in TCF.

William A. Cooper

Chairman and Chief Executive Officer

• 11 •

2010 Annual Report