TCF Bank 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

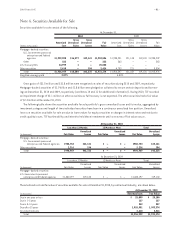

• 70 • TCF Financial Corporation and Subsidiaries

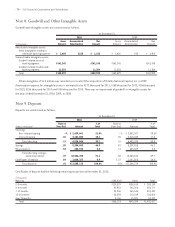

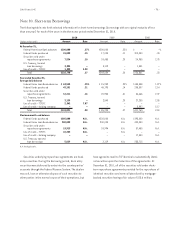

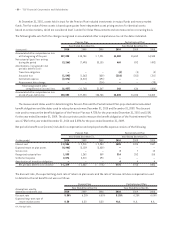

Note 8. Goodwill and Other Intangible Assets

Goodwill and intangible assets are summarized as follows.

At December 31,

2010 2009

Gross Accumulated Net Gross Accumulated Net

(In thousands) Amount Amortization Amount Amount Amortization Amount

Amortizable intangible assets:

Other intangibles related to

wholesale banking segment $ 1,450 $218 $ 1,232 $ 1,450 $45 $ 1,405

Unamortizable intangible assets:

Goodwill related to retail

banking segment $141,245 $141,245 $141,245 $141,245

Goodwill related to wholesale

banking segment 11,354 11,354 11,354 11,354

Total $152,599 $152,599 $152,599 $152,599

Other intangibles of $1.5 million was recorded as a result of the acquisition of Fidelity National Capital, Inc. in 2009.

Amortization expense for intangible assets is estimated to be $172 thousand for 2011, $168 thousand for 2012, $156 thousand

for 2013, $156 thousand for 2014 and $156 thousand for 2015. There was no impairment of goodwill or intangible assets for

the years ended December 31, 2010, 2009, or 2008.

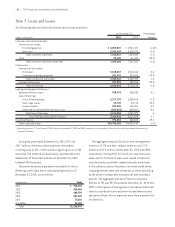

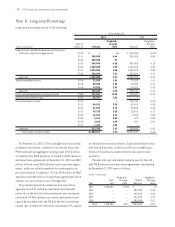

Note 9. Deposits

Deposits are summarized as follows.

At December 31,

2010 2009

Rate at % of Rate at % of

(Dollars in thousands) Year-End Amount Total Year-End Amount Total

Checking:

Non-interest bearing –% $ 2,429,061 21.0% –% $ 2,382,007 20.6%

Interest bearing .26 2,101,003 18.1 .35 2,018,283 17.4

Total checking .12 4,530,064 39.1 .16 4,400,290 38.0

Savings .55 5,390,802 46.5 .92 5,339,955 46.2

Money market .54 635,922 5.5 .71 640,569 5.5

Total checking, savings,

and money market .37 10,556,788 91.1 .58 10,380,814 89.7

Certificates of deposit .84 1,028,327 8.9 1.22 1,187,505 10.3

Total deposits .41 $11,585,115 100.0% .65% $11,568,319 100.0%

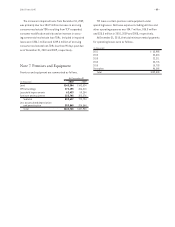

Certificates of deposit had the following remaining maturities at December 31, 2010.

(In thousands)

Maturity $100,000+ Other Total

0-3 months $120,529 $138,610 $ 259,139

4-6 months 91,963 162,208 254,171

7-12 months 93,936 263,546 357,482

13-24 months 28,559 110,249 138,808

Over 24 months 3,136 15,591 18,727

Total $338,123 $690,204 $1,028,327