TCF Bank 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• 67 •

2010 Form 10-K

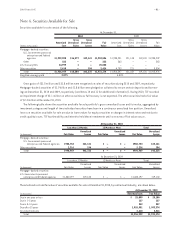

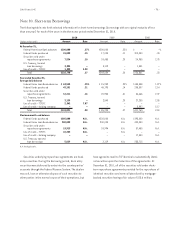

Loan Modifications for Borrowers with Financial

Difficulties Included within the loans and leases above

are certain loans that have been modified in order to

maximize collection of loan balances. If, for economic or

legal reasons related to the customer’s financial difficulties,

TCF grants a concession compared to the original terms

and conditions on the loan that it would not have otherwise

considered, the modified loan is classified as a TDR.

Concessions related to TDRs generally do not include

forgiveness of principal balances. All TDRs are considered

to be impaired. TCF held consumer real estate loan TDRs

of $367.9 million and $267.9 million at December 31, 2010

and December 31, 2009, respectively. Of these loans,

$337.4 million and $252.5 million were accruing at

December 31, 2010 and December 31, 2009, respectively.

TCF also held $66.3 million and $9.6 million of commercial

real estate loan TDRs at December 31, 2010 and December

31, 2009, respectively. Of these loans, $48.8 million were

accruing at December 31, 2010. There were no accruing

commercial loan TDRs at December 31, 2009. The amount

of additional funds committed to borrowers who are in TDR

status was $2.2 million at December 31, 2010 and $3 million

at December 31, 2009.

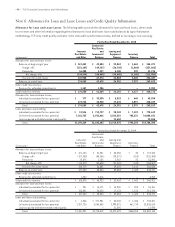

TDRs are evaluated separately in TCF’s allowance

methodology based on the expected cash flows for loans

in this status. Reserves for losses on accruing consumer

real estate loan TDRs were $36.8 million, or 10.9% of the

outstanding balance, at December 31, 2010 and $27 million,

or 10.7% of the outstanding balance at December 31, 2009.

TCF utilized its historical 16% re-default rate on consumer

real estate loan TDRs in determining its assumed 20% re-

default rate included in the estimated cash flows. Reserves

for losses on accruing commercial real estate loan TDRs were

$695 thousand, or 1.42% of the outstanding balance, at

December 31, 2010.

Consumer real estate loans that are less than 150 days

past due, or six payments owing, at the time of modifica-

tion remain on accrual status if there is demonstrated

performance under a reduced payment amount prior to the

actual legal modification and payment in full under the

modified loan is expected. Otherwise, the loans are placed

on non-accrual status and reported as non-accrual until

there is sustained repayment performance for six con-

secutive payments. An accruing modified loan is re-aged

to current delinquency status after the receipt of three

consecutive modified payments.

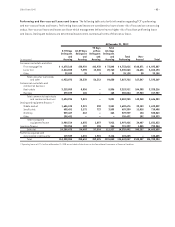

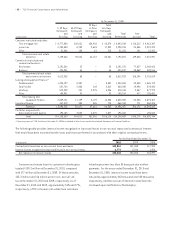

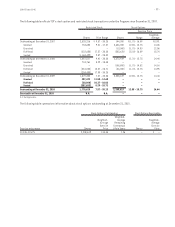

The following table provides interest income recognized

on TDRs and contractual interest that would have been

recorded had the loans performed in accordance with their

original contractual terms.

For the Year Ended December 31,

(In thousands) 2010 2009 2008

Contractual interest due on TDRs $21,297 $6,308 $1,331

Interest income recognized on TDRs 11,318 3,215 495

Net reduction in interest income $ 9,979 $3,093 $ 836

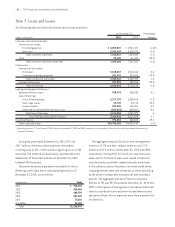

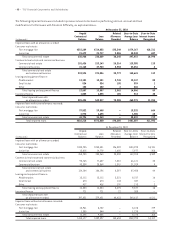

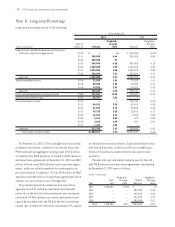

Impaired Loans TCF considers impaired loans to include

non-accrual commercial loans, equipment finance loans,

inventory finance loans and consumer real estate or

commercial TDRs. Non-accrual impaired loans are included

in the previous tables within the amounts disclosed as

non-accrual and the accruing consumer real estate and

commercial TDRs have been previously disclosed as

performing within the tables of performing and non-accrual

loans and leases. The loan balance of impaired loans

represents the amount recorded within loans and leases on the

Consolidated Statements of Financial Condition whereas the

unpaid contractual balance represents the balances legally

owed by the borrowers, excluding write-downs.