TCF Bank 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

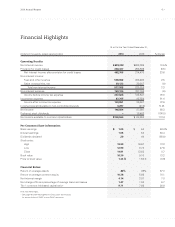

At December 31, 2010, TCF held

$337.4 million of modified consumer

real estate loans that are considered

troubled debt restructurings (TDRs) and

continue to accrue interest, up from

$252.5 million at December 31, 2009. In

these cases, we granted a concession

regarding the terms of the loan to help

homeowners with appropriate financial

means retain ownership of their house

and to improve the likelihood that we

will collect the principal owed. Reserves

for losses on accruing consumer real

estate TDRs were $37 million, or 11

percent of the outstanding balance. The

over 60-day delinquency rate on these

loans was 5.3 percent at December 31,

2010. To date, our loan modification

programs are performing very well.

TCF also saw some credit deterioration

within its Wholesale Banking business,

primarily in commercial real estate,

attributable to the recessionary state

of the economy. We did see credit

quality improvement in specialty

finance with delinquencies down for

six consecutive quarters and non-

accrual loans and leases down for three

consecutive quarters at year-end. We

continued to closely monitor our

wholesale customers, and in particular

those customers in distressed indus-

tries and geographies. Our relationship

banking strategy provided us the ability

to effectively work out many distressed

loans. Wholesale Banking continues

to be very profitable and is highly

diversified and well-managed.

Real estate owned properties and real

estate in judgment properties increased

over the past year as the length of time

in the foreclosure process continues to

expand. Delays in TCF’s foreclosure

process are not due to any failures in

our system to comply with regional

laws, like the robo-signer debacle at

other banks, but were affected by an

overwhelmed legal system in some

markets. The foreclosure crisis of 2010

involved misbehavior and documenta-

tion mistakes by some of our larger

competitors. TCF did not participate in

any of these practices and continues to

follow prudent policies and procedures

around the foreclosure process.

At December 31, 2010, TCF’s allowance

for loan and lease losses totaled

$265.8 million, or 1.80 percent of loans

and leases, an increase of $21.3 million

from $244.5 million, or 1.68 percent of

loans and leases, at December 31, 2009.

The increase in allowance for loan and

lease losses was primarily related

to increased reserve levels on loans

secured by real estate. The provision

for credit losses of $236.4 million,

however, decreased 9 percent from

last year mainly due to credit improve-

ments in the leasing and equipment

finance portfolio.

Overall, we have seen some improve-

ment in credit quality, most notably in

our leasing and equipment finance

portfolio. We have started to see early

signs of stabilization in our consumer

real estate portfolio, which gives us

some optimism about 2011, however,

it is still too early to claim victory. While

still challenging, our credit losses

remain less than most of our peers

and continue to be manageable.

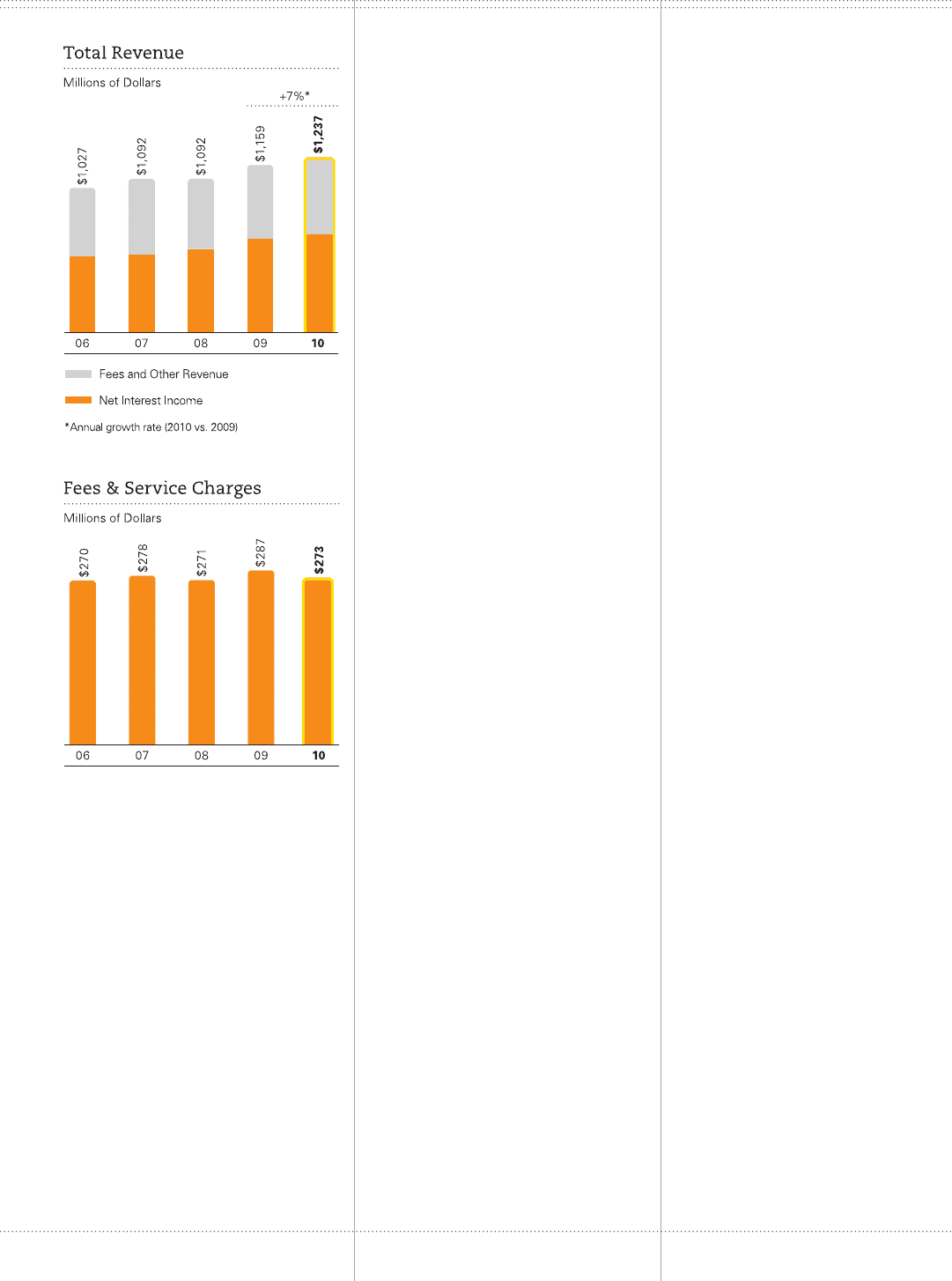

Revenue

TCF’s total revenue in 2010 was

$1.2 billion, up 7 percent from last year

with an increase of 10 percent in net

interest income and an increase of

2 percent in non-interest income. Our

aggressive deposit pricing strategy and

growth in our specialty finance portfolio

in 2010 contributed to the increase in

net interest income. Net interest

income, however, was pressured by

increased non-accrual loans and leases

and TDRs, as well as management’s

efforts to change the mix of assets by

replacing the run-off of higher-yielding

fixed-rate loans with lower-yielding

variable-rate loans in anticipation of

future interest rate increases.

Banking fees and service charges in

2010 decreased from last year primarily

due to the implementation of opt-in

• 8 • TCF Financial Corporation and Subsidiaries