Overstock.com 2009 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Shelf Registration

In April 2005, we filed a registration statement with the Securities and Exchange Commission using a "shelf" registration or continuous offering process.

On May 1, 2006, we issued approximately 1,042,000 shares of common stock for net proceeds of approximately $25.0 million. Additionally, on

December 12, 2006, we issued approximately 2,734,000 shares for net proceeds of approximately $39.4 million. We did not issue any shares of common

stock under the shelf registration statement during the years ended December 31, 2007, 2008 or 2009. During 2008, we filed a new shelf registration statement

with the Securities and Exchange Commission, which was declared effective on December 5, 2008. The new shelf registration statement registers offerings of

our securities in an aggregate amount of up to $500.0 million. However, as a result of our inability to timely file a Quarterly Report on Form 10-Q for the

quarter ended September 30, 2009 containing financial statements reviewed by an independent registered public accounting firm in accordance with

applicable requirements, our shelf registration statement is currently unavailable to us.

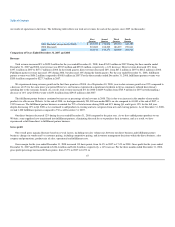

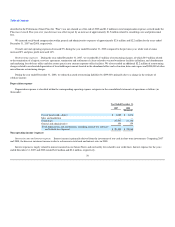

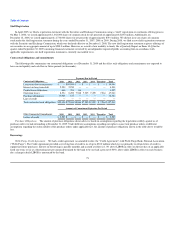

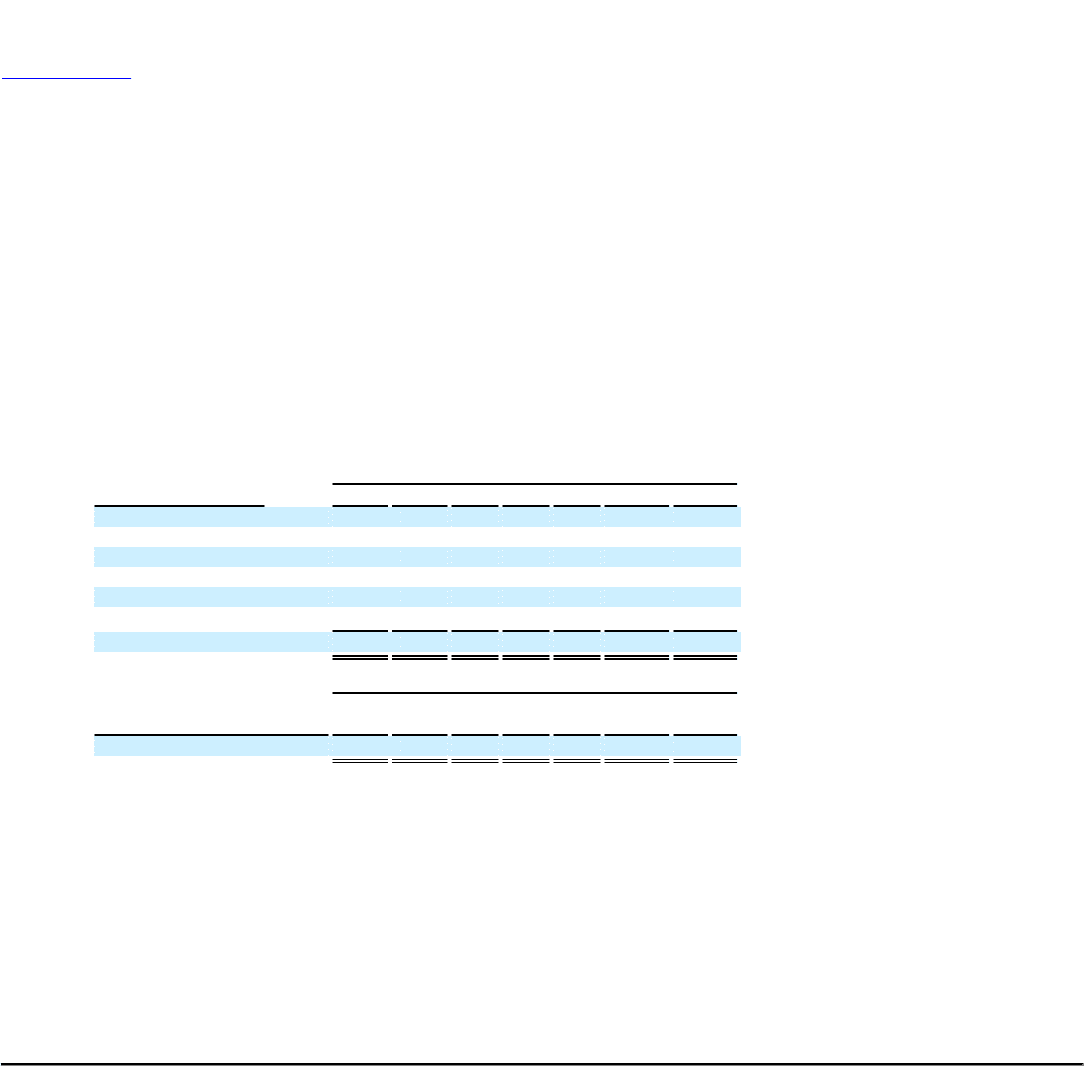

Contractual obligations and commitments

The following table summarizes our contractual obligations as of December 31, 2009 and the effect such obligations and commitments are expected to

have on our liquidity and cash flow in future periods (in thousands):

Payments Due by Period

Contractual Obligations 2010 2011 2012 2013 2014 Thereafter Total

Long-term debt arrangements $ — $59,994 $ — $ — $ — $ — $ 59,994

Interest on long-term debt 2,250 2,250 — — — — 4,500

Capital lease obligations 646 793 116 1,555

Operating leases 8,534 8,490 7,948 7,305 7,499 7,264 47,040

Purchase obligations 13,906 517 — — — — 14,423

Line of credit — — — — — — —

Toal contractual cash obligations $25,336 $72,044 $8,064 $7,305 $7,499 $ 7,264 $127,512

Amounts of Commitment Expiration Per Period

Other Commercial Commitments 2010 2011 2012 2012 2013 Thereafter Total

Letters of credit $ 2,580 $ — $ — $ — $ — $ — $ 2,580

Purchase Obligations. The amount of purchase obligations shown above is based on assumptions regarding the legal enforceability against us of

purchase orders we had outstanding at December 31, 2009. Under different assumptions regarding our rights to cancel our purchase orders or different

assumptions regarding the enforceability of the purchase orders under applicable law, the amount of purchase obligations shown in the table above would be

less.

Borrowings

Wells Fargo Credit Agreement. We had a credit agreement (as amended to date, the "Credit Agreement") with Wells Fargo Bank, National Association

("Wells Fargo"). The Credit Agreement provided a revolving line of credit to us of up to $30.0 million which we use primarily to obtain letters of credit to

support inventory purchases. Interest on borrowings is payable monthly and accrued at either (i) 1.0% above LIBOR in effect on the first day of an applicable

fixed rate term, or (ii) at a fluctuating rate per annum determined by the bank to be one half a percent (0.50%) above daily LIBOR in effect on each business

day a change in daily LIBOR is announced by the bank.

75