Overstock.com 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

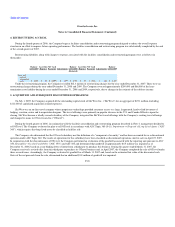

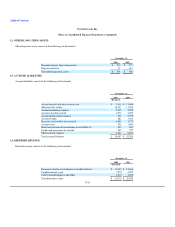

15. BORROWINGS (Continued)

$10 million for advances supported by the Company's non-cash collateral. The maximum credit potentially available under the revolving facility is

$20 million. The Company's obligations under the Financing Agreement and all related agreements are secured by all or substantially all of the Company's

assets, excluding its interest in certain litigation. Subject to certain exceptions, the full amount of the revolving facility is expected to be available to the

Company as long as $20 million is maintained on deposit with U.S. Bank. The obligation of U.S. Bank to make advances under the Financing Agreement is

subject to the conditions set forth in the Financing Agreement.

The Company's failure to keep at least $20 million on deposit in certain accounts with U.S. Bank would constitute a "triggering event" under the

Financing Agreement. If a triggering event occurs, the Company would become subject to financial covenants (i) limiting the Company's capital expenditures

to $20 million annually, and (ii) requiring the Company to maintain a fixed charges coverage ratio of at least 1.10 to 1.00 as of the end of any fiscal quarter for

the period of the prior four quarters. The occurrence of a triggering event could also result in a decrease in the amount available to the Company under the non

cash-collateralized portion of the facility, as availability would then depend, in part, on the Borrowing Base (as defined in the Financing Agreement). The

Financing Agreement and the credit facility terminate on October 2, 2011. As of December 31, 2009, the Company had $20.0 million in compensating cash

balances held at U.S. Bank.

Subject to certain interest rate floors and other exceptions, advances under the Financing Agreement bear interest at either (a) Libor plus 1% for cash-

collateralized financing, including letters of credit, or (b) Libor plus 2.5% for non cash- collateralized advances. The default rate of interest is 2.0% per annum

over the otherwise applicable interest rate. An unused line fee of 0.375% is payable annually on the unused portion of the $10 million portion of the facility

available for non cash-collateralized advances.

The Financing Agreement includes affirmative covenants as well as negative covenants that prohibit a variety of actions without the approval of U.S.

Bank, including, without limitation, covenants that (subject to certain exceptions) limit the Company's ability to (a) incur or guarantee debt or enter into

indemnity agreements, (b) create or permit liens, (c) enter into any merger or consolidation or purchase or otherwise acquire all or substantially all of the

assets of another person or the assets comprising any line of business or business unit of another person, (d) except for permitted acquisitions, purchase the

securities of, create, invest in, or form any subsidiary or other entity, (e) make loans or advances, (f) purchase, acquire or redeem shares of its capital stock or

other securities, (g) change its capital structure or issue any new class of capital stock, (h) change its business objectives, purposes or operations in a manner

which could reasonably be expected to have a material adverse effect, (i) change its fiscal year, (j) enter into transactions with affiliates, (k) sell assets except

for the sale of inventory in the ordinary course of business, (l) make payments except regularly scheduled interest payments on its convertible debt or, after

the occurrence of a triggering event, repurchase, redeem, defease, or acquire its convertible debt, (m) permit judgments to be rendered against it in excess of

certain limits or having specified effects, depending in part on whether a triggering event has occurred or would occur, (n) take certain actions regarding its

receivables, and (o) take certain actions regarding its inventory.

With certain exceptions, a termination fee of up to 1.0% of the non cash-collateralized portion of the facility is payable by the Company if the Company

terminates the facility prior to its stated termination date.

F-32