Overstock.com 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

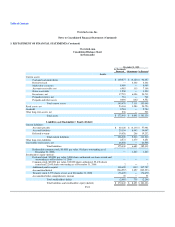

3. RESTATEMENT OF FINANCIAL STATEMENTS (Continued)

Change in the Company's accounting for external audit fees to the "as incurred" method instead of the "ratable" method.

Other miscellaneous adjustments, none of which were material either individually or in the aggregate. Certain of these adjustments were related

to a reduction in revenue and cost of goods sold in equal amounts for certain consideration the Company received from vendors, an increase in

inventory, accounts payable and accrued liabilities to record the Company's sales return allowance on a gross basis, an adjustment to the

Company's cash and restricted cash balances due to compensating balance arrangements and an adjustment to record redeemable common stock

for certain shares previously issued to employees.

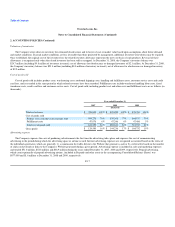

The effect of the adjustments on the consolidated statement of operations for the year ended December 31, 2008 is to decrease net loss attributable to

common shares by $1.6 million. The effect of the adjustments on net loss per common share from continuing operations for the year ended December 31,

2008 is to decrease net loss per common share by $0.07.

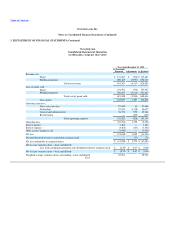

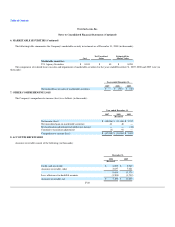

The (increase) decrease to net loss attributable to common shares of the above adjustments is as follows (in thousands):

Year ended

December 31,

2008

The effect of the adjustments related to (1) amounts the Company paid to partners or deducted from payments to

partners related to return processing services and product costs and (2) amounts the Company paid to a freight

vendor based on incorrect invoices from the vendor. $ 1,736

The effect of the adjustments related to accounting for certain of the Company's share-based compensation

plans. (350)

The effect of the adjustments related to customer refunds and credits. (186)

The effect of the adjustments related to the co-branded credit card bounty revenue and promotion expense. 298

The effect of the adjustments related to restructuring expense and interest expense related to the accretion of the

restructuring accrual. 196

The effect of the adjustments related to external audit fees. (190)

The effect of other miscellaneous adjustments 71

Total impact of the effect of the adjustments $ 1,575

F-22

•

•