Overstock.com 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

described in the Performance Share Plan (the "Plan") was not attained as of the end of 2008 and $1.0 million in total compensation expense accrued under the

Plan was reversed. This year over year decrease was offset in part by an increase of approximately $1.5 million related to consulting costs and professional

fees.

We incurred stock-based compensation within general and administrative expenses of approximately $2.6 million and $2.2 million for the years ended

December 31, 2007 and 2008, respectively.

Overall, our total operating expenses decreased 9% during the year ended December 31, 2008 compared to the previous year, while total revenues

increased 8% and gross profit increased 16%.

Restructuring expenses. During the year ended December 31, 2007, we recorded $12.3 million of restructuring charges, of which $9.9 million related

to the termination of a logistics services agreement, termination and settlement of a lease related to vacated warehouse facilities in Indiana, and abandonment

and marketing for sub-lease office and data center space in our current corporate office facilities. We also recorded an additional $2.2 million of restructuring

charges related to accelerated depreciation of leasehold improvements located in the abandoned office and co-location data center space and $200,000 of other

miscellaneous restructuring charges.

During the year ended December 31, 2008, we reduced accrued restructuring liabilities by $299,000, primarily due to a change in the estimate of

sublease income.

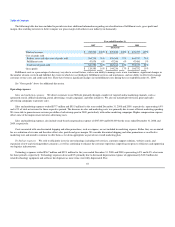

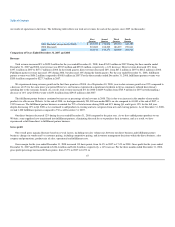

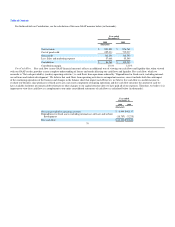

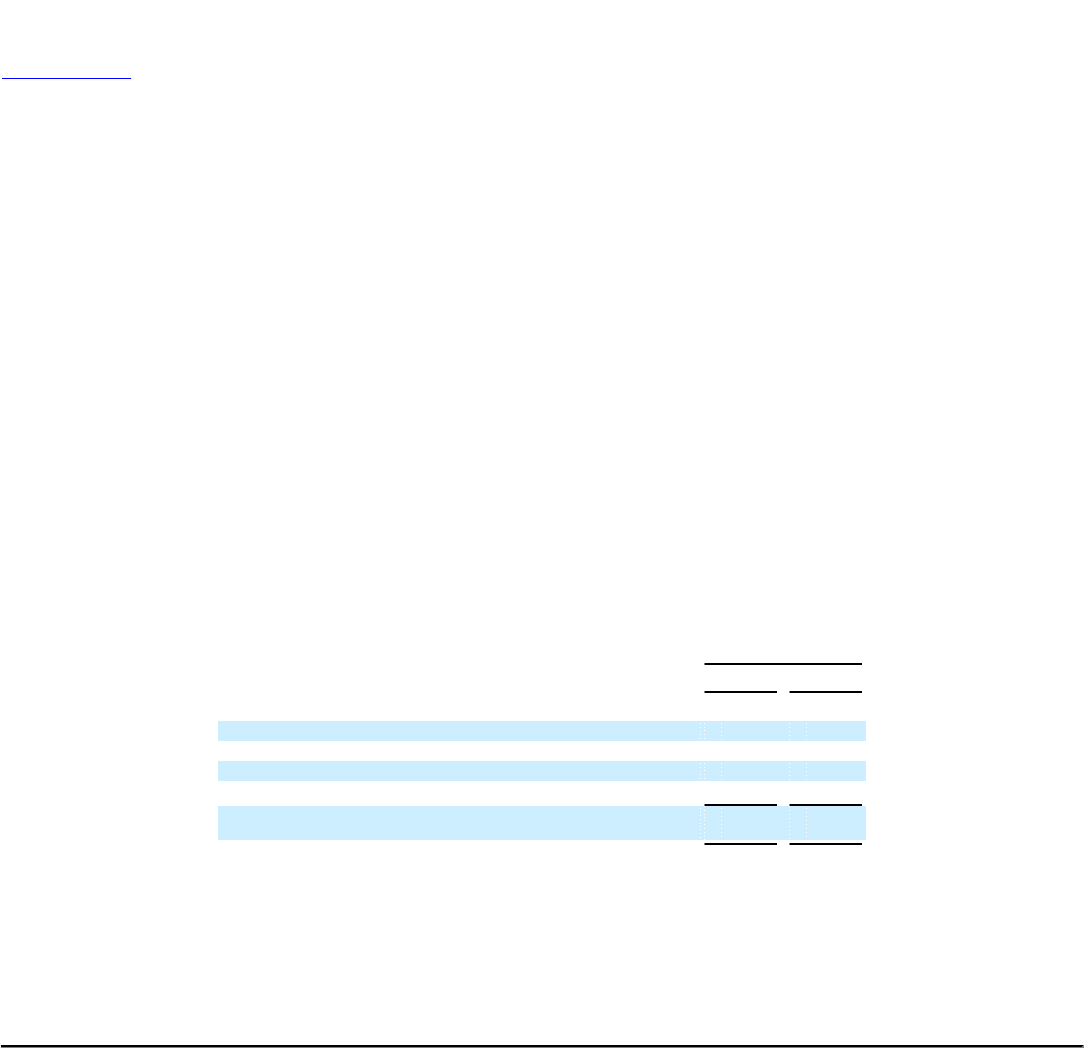

Depreciation expense

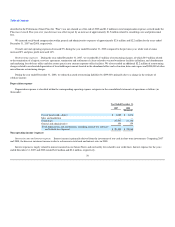

Depreciation expense is classified within the corresponding operating expense categories in the consolidated statements of operations as follows (in

thousands):

Year Ended December 31,

2007 2008

(Restated)

Cost of goods sold—direct $ 1,882 $ 1,674

Sales and marketing — —

Technology 27,507 21,140

General and administrative 106 154

Total depreciation and amortization, including internal-use software

and website development $ 29,495 $ 22,968

Non-operating income (expense)

Interest income and interest expense. Interest income is primarily derived from the investment of our cash in short-term investments. Comparing 2007

and 2008, the decrease in interest income is due to a decrease in total cash and interest rates in 2008.

Interest expense is largely related to interest incurred on our Senior Notes and our facility fees related to our credit lines. Interest expense for the years

ended December 31, 2007 and 2008 totaled $4.2 million and $3.6 million, respectively.

70