Overstock.com 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

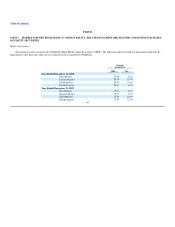

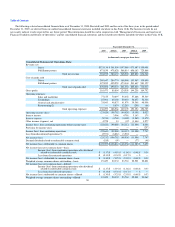

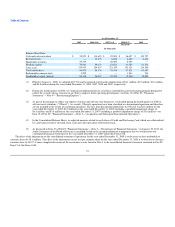

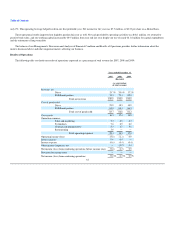

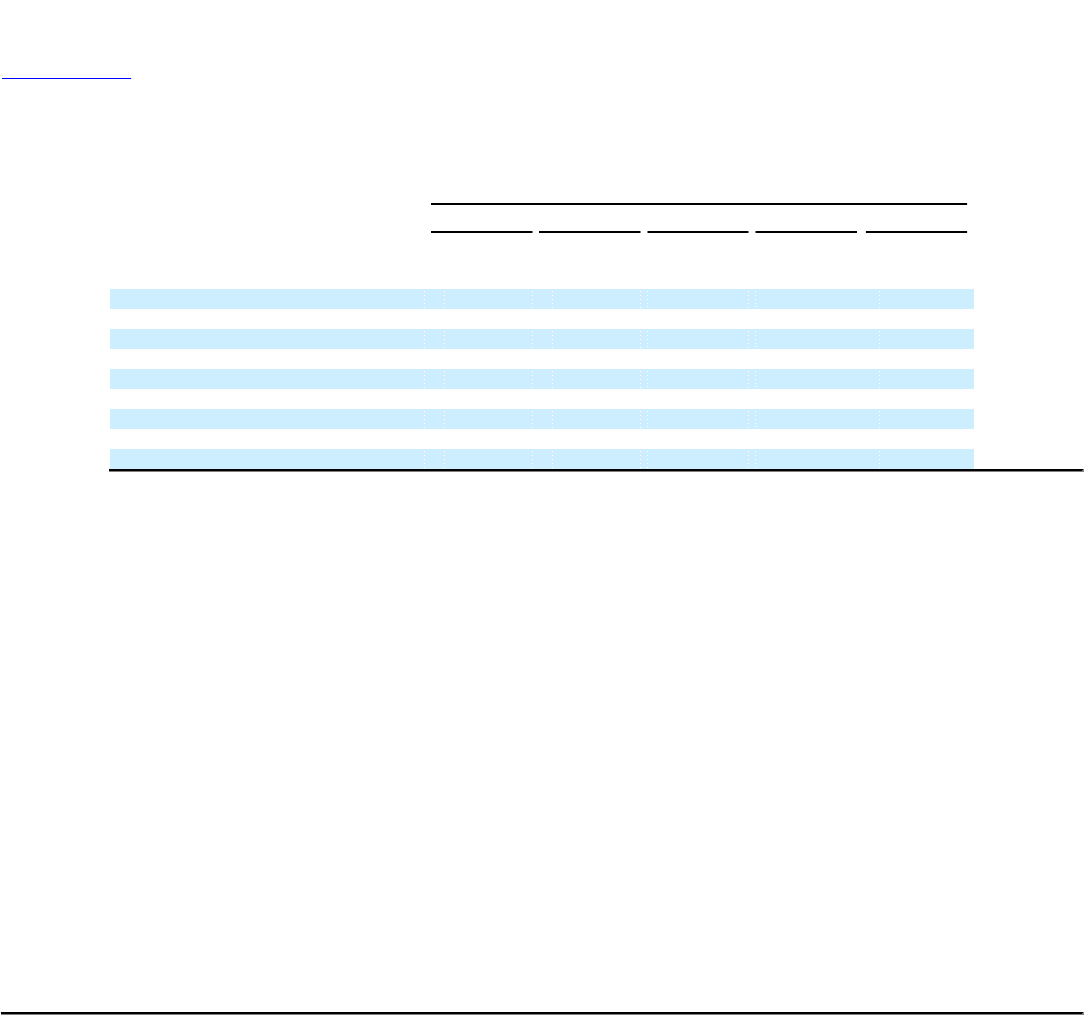

As of December 31,

2005 2006(2)(4) 2007(3)(4) 2008(4)(5) 2009

(Restated)

(in thousands)

Balance Sheet Data:

Cash and cash equivalents $ 55,875 $ 114,695 $ 92,809 $ 96,457 $ 139,757

Restricted cash — 12,270 8,634 4,262 4,414

Marketable securities 55,799 — 46,000 8,989 —

Working capital 79,561 59,475 62,621 41,780 51,236

Total assets 335,953 264,453 231,143 181,136 216,500

Total indebtedness 84,676 84,336 78,418 67,821 61,687

Redeemable common stock 3,205 — — 1,263 744

Stockholders' equity (deficit) 89,148 56,367 18,212 (2,246) 10,800

Effective January 1, 2006, we adopted ASC 718 and recognized stock-based compensation of $4.1 million, $4.5 million, $3.6 million,

and $4.8 million during the years ended December 31, 2006, 2007, 2008 and 2009, respectively.

During the fourth quarter of 2006, we commenced implementation of a facilities consolidation and restructuring program designed to

reduce the overall expense structure in an effort to improve future operating performance (see Item 15 of Part IV, "Financial

Statements"—Note 4—"Restructuring Expense").

As part of the program to reduce our expense structure and sell non-core businesses, we decided during the fourth quarter of 2006 to

sell our travel subsidiary ("OTravel"). As a result, OTravel's operations have been classified as a discontinued operation and therefore

are not included in the results of continuing operations. The loss from discontinued operations for OTravel was $2.6 million for the

year ended December 31, 2005, $6.9 million for the year ended December 31, 2006 (including a goodwill impairment charge of

$4.5 million) and $3.9 million for the year ended December 31, 2007 (including a goodwill impairment charge of $3.8 million—see

Item 15 of Part IV, "Financial Statements"—Note 5—"Acquisition and Subsequent Discontinued Operations").

In the Consolidated Balance Sheets we adjusted amounts related to our Letters of Credit and Purchasing Card, which are collateralized

by cash balances held at our bank, from Cash and cash equivalents to Restricted cash.

As discussed in Item 15 of Part IV "Financial Statements"—Note 3—"Restatement of Financial Statements," on January 29, 2010, the

Audit Committee of the Board of Directors concluded, based on the recommendation of management that we would restate our

consolidated financial statements for the year ended December 31, 2008 within this Form 10-K.

(1)

(2)

(3)

(4)

(5)

The effect of the adjustments on the consolidated statement of operations for the year ended December 31, 2008 is to decrease net loss attributable to

common shares by $1.6 million. The effect of the adjustments on net loss per common share for the year ended December 31, 2008 is to decrease net loss per

common share by $0.07. A more complete discussion of the restatement can be found in Note 3 to the consolidated financial statements contained in Part IV,

Item 15 of this Form 10-K.

51