Overstock.com 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

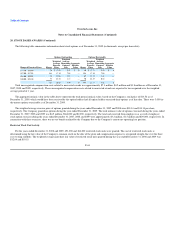

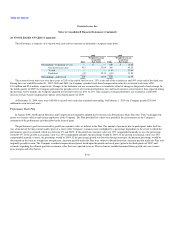

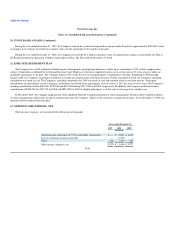

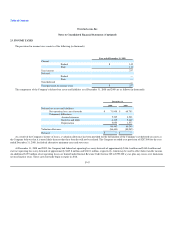

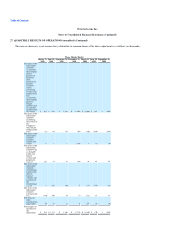

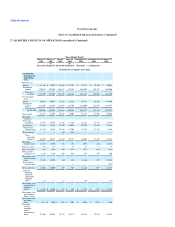

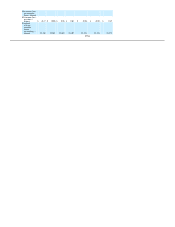

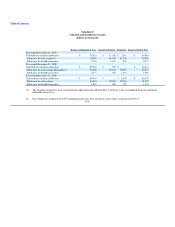

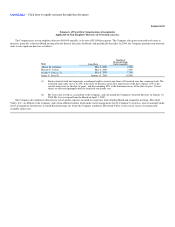

27. QUARTERLY RESULTS OF OPERATIONS (unaudited) (Continued)

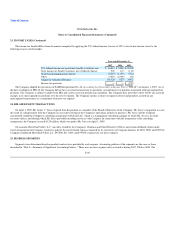

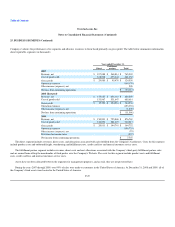

The following tables set forth the Company's unaudited quarterly results of operations data for the eight most recent quarters for the period ended

December 31, 2009. The Company has prepared this information on the same basis as the consolidated statements of operations and the information includes

all adjustments that it considers necessary for a fair statement of its financial position and operating results for the quarters presented.

Three Months Ended

March 31,

2008 March 31,

2008 June 30,

2008 June 30,

2008 September 30,

2008 September 30,

2008 December 31,

2008 December 31,

2008

(Restated)

(As

Reported)

(Restated)

(As

Reported)

(Restated)

(As Reported)

(Restated)

(As

Reported)

(in thousands, except per share data)

Consolidated

Statement of

Operations

Data:

Revenue, net

Direct $ 51,655 $ 51,764 $ 39,713 $ 39,832 $ 34,079 $ 34,176 $ 48,240 $ 48,431

Fulfillment

partner 150,145 151,050 148,489 149,004 151,928 152,679 205,601 207,431

Total net

revenue 201,800 202,814 188,202 188,836 186,007 186,855 253,841 255,862

Cost of goods

sold

Direct 44,697 44,803 34,756 34,871 30,541 30,633 43,973 44,194

Fulfillment

partner 122,491 124,040 119,212 120,756 122,053 124,103 167,891 168,058

Total cost of

goods sold 167,188 168,843 153,968 155,627 152,594 154,736 211,864 212,252

Gross profit 34,612 33,971 34,234 33,209 33,413 32,119 41,977 43,610

Operating

expenses:

Sales and

marketing 15,023 15,019 14,254 14,244 11,944 11,934 16,447 16,437

Technology 14,489 14,516 15,049 15,311 13,784 14,119 13,355 13,869

General and

administrative 9,392 9,563 11,068 10,867 10,691 10,321 8,197 7,622

Restructuring — — (299) — — — — —

Total

operating

expenses 38,904 39,098 40,072 40,422 36,419 36,374 37,999 37,928

Operating

income (loss) (4,292) (5,127) (5,838) (7,213) (3,006) (4,255) 3,978 5,682

Interest income 1,304 1,304 740 740 664 664 455 455

Interest expense (901) (901) (936) (888) (907) (847) (821) (826)

Other income

(expense), net — — 2 2 2,849 2,849 (4,297) (4,297)

Net income (loss)

before income

taxes (3,889) (4,724) (6,032) (7,359) (400) (1,589) (685) $ 1,014

Provision for

income taxes — — — — — — — —

Net income (loss) (3,889) (4,724) (6,032) (7,359) (400) (1,589) (685) 1,014

Deemed dividend

related to

redeemable

common stock (21) — (16) — (20) — (20) —

Net income (loss)

attributable to

common

shares $ (3,910) $ (4,724) $ (6,048) $ (7,359) $ (420) $ (1,589) $ (705) $ 1,014

Net income (loss)

per common

share—basic:

Net income (loss)

per share—

basic $ (0.17) $ (0.20) $ (0.27) $ (0.32) $ (0.02) $ (0.07) $ (0.03) $ 0.04

Weighted

average

common

shares

outstanding—

basic 23,345 23,345 22,750 22,750 22,768 22,768 22,745 22,745