Overstock.com 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

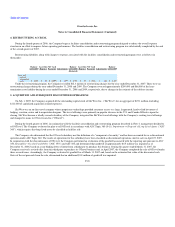

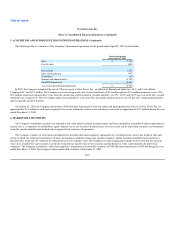

15. BORROWINGS

Wells Fargo Credit Agreement

The Company's credit agreement (as amended, the "Credit Agreement") with Wells Fargo Bank, National Association ("Wells Fargo"). The Credit

Agreement provided a revolving line of credit to the Company of up to $30.0 million which the Company used primarily to obtain letters of credit to support

inventory purchases. Interest on borrowings was payable monthly and accrued at either (i) 1.0% above LIBOR in effect on the first day of an applicable fixed

rate term, or (ii) at a fluctuating rate per annum determined by the bank to be one half a percent (0.50%) above daily LIBOR in effect on each business day a

change in daily LIBOR is announced by the bank.

Borrowings and outstanding letters of credit under the Credit Agreement were required to be completely collateralized by cash balances held at Wells

Fargo Bank, N.A, and therefore the facility did not provide additional liquidity to the Company.

On December 23, 2009, the Company terminated its credit facility with Wells Fargo Bank, National Association, subject to provisions relating to

outstanding letters of credit issued by Wells Fargo for its account and other transitional provisions. On December 31, 2009, per the provisions relating to the

outstanding letters of credit, the letters of credit issued by Wells Fargo expired on December 31, 2009, and were replaced by $2.6 million of letters of credit

issued by U.S. Bank National Association ("U.S. Bank") on behalf of the Company.

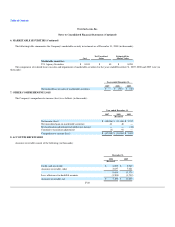

Wells Fargo Retail Finance Agreement

On January 6, 2009, the Company entered into an Amended and Restated Loan and Security Agreement (the "Agreement") with Wells Fargo Retail

Finance, LLC ("WFRF"). The Agreement replaced the Company's Loan and Security Agreement dated December 12, 2005 with WFRF, which had previously

been amended and had terminated in accordance with its terms.

On August 3, 2009, the Company terminated the WFRF Agreement.

Wells Fargo Commercial Purchasing Card Agreement

The Company had a commercial purchasing card agreement (the "Purchasing Card") with Wells Fargo Bank, National Association ("Wells Fargo"). The

Company used the Purchasing Card for business purpose purchasing and was required to pay it in full each month. The Company was required to maintain a

cash balance of $1.4 million at Wells Fargo Bank, N.A. as collateral for the Purchasing Card, and these amounts are included in Restricted cash in the

accompanying consolidated balance sheets, and therefore the facility did not provide additional liquidity to the Company. At December 31, 2008 and 2009,

$436,000 and $1.0 million, respectively, was outstanding. No further amounts were available under the Purchasing Card as of December 31, 2009.

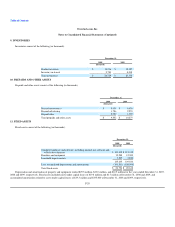

U.S. Bank Financing Agreement

On December 23, 2009, the Company entered into a Financing and Security Agreement dated December 22, 2009 (the "Financing Agreement") with

U.S. Bank. The Financing Agreement replaces the credit agreement with Wells Fargo.

The Financing Agreement provides for revolving loans and other financial accommodations to or for the benefit of the Company of (i) up to $10 million

for cash-collateralized advances, and (ii) up to

F-31