Overstock.com 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Overstock.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Overstock.com, Inc.

Notes to Consolidated Financial Statements (Continued)

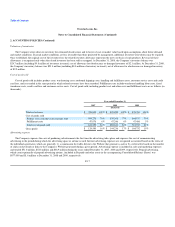

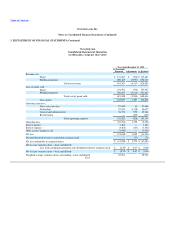

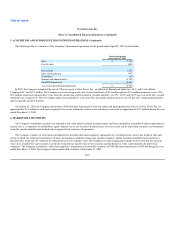

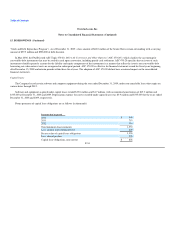

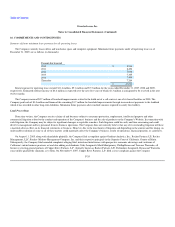

4. RESTRUCTURING ACCRUAL

During the fourth quarter of 2006, the Company began a facilities consolidation and restructuring program designed to reduce the overall expense

structure in an effort to improve future operating performance. The facilities consolidation and restructuring program was substantially completed by the end

of the second quarter of 2007.

Restructuring liabilities along with charges to expense associated with the facilities consolidation and restructuring program were as follows (in

thousands):

Balance

12/31/2007 Accretion

Expense Net Cash

Payments Adjustments Balance

12/31/2008 Accretion

Expense Net Cash

Payments Adjustments Balance

12/31/2009

(Restated)

Lease and

contract

termination

costs $ 4,035 $ 351 $ (1,099) $ (299) $ 2,988 $ 285 $ (522) $ (66) $ 2,685

Under the restructuring program, the Company recorded $12.3 million of restructuring charges for the year ended December 31, 2007. There were no

restructuring charges during the year ended December 31, 2008 and 2009. The Company reversed approximately $299,000 and $66,000 of the lease

termination costs liability during the years ended December 31, 2008 and 2009, respectively, due to changes in the estimate of the sublease income.

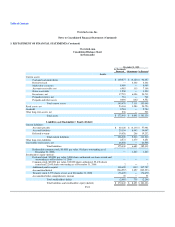

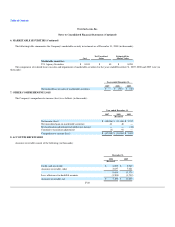

5. ACQUISITION AND SUBSEQUENT DISCONTINUED OPERATIONS

On July 1, 2005, the Company acquired all the outstanding capital stock of Ski West, Inc. ("Ski West") for an aggregate of $25.1 million (including

$111,000 of capitalized acquisition related expenses).

Ski West was an on-line travel company whose proprietary technology provided consumer access to a large, fragmented, hard-to-find inventory of

lodging, vacation, cruise and transportation bargains. The travel offerings were primarily in popular ski areas in the U.S. and Canada. Effective upon the

closing, Ski West became a wholly-owned subsidiary of the Company, integrated the Ski West travel offerings with the Company's existing travel offerings

and changed its name to OTravel.com, Inc ("OTravel").

During the fourth quarter of 2006, in conjunction with the facilities consolidation and restructuring program described in Note 4, management decided to

sell OTravel. The Company evaluated its plan to sell OTravel in accordance with ASC Topic 360-10-15, Impairment or Disposal of Long-Lived Assets ("ASC

360"), which requires that long-lived assets be classified as held for sale.

The Company also determined that the OTravel subsidiary met the definition of a "component of an entity" and has been accounted for as a discontinued

operation under ASC Topic 360. The results of operations for this subsidiary have been classified as discontinued operations until its sale on April 25, 2007.

In conjunction with the discontinuance of OTravel, the Company performed an evaluation of the goodwill associated with the reporting unit pursuant to ASC

350, Intangibles—Goodwill and Other ("ASC 350") and ASC 360 and determined that goodwill of approximately $4.5 million was impaired as of

December 31, 2006, based on a non-binding letter of intent from a third party to purchase this business. During the quarter ended March 31, 2007, the

Company received a revised offer from this third party to purchase its OTravel business and, in April 2007, the Company completed the sale of OTravel under

these revised terms. Accordingly, the Company evaluated its goodwill as of March 31, 2007 and, based on the estimated fair value of the discounted cash

flows of the net proceeds from the sale, determined that an additional $3.8 million of goodwill was impaired.

F-26